Xtrackers, the exchange-traded arm of European asset manager DWS, has entered the Brazilian exchange-traded fund market and US issuer Horizon Kinetics has listed a European equivalent of an active US ETF strategy as the buy side expects ETF assets to continue to grow.

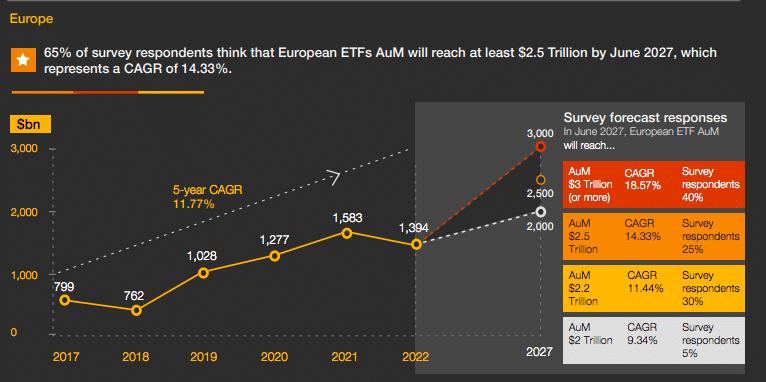

‘ETFs 2027: A world of new possibilities’, a survey from PwC found that the majority of respondents, 70%, anticipate that global ETF assets under management will increase to at least $15 trillion by 2027. Almost one third, 29%, also expect ETF assets to more than double to $18 trillion or higher under the same timeframe. PwC surveyed more than 70 executives globally in 2022, during a time of mounting financial market uncertainty. ETF managers or sponsors were more than three-quarters, 76%, of participants.

“Reaching $15 trillion in June 2027 would require a compound annual growth rate of 11.77%,” said PwC. “This is lower than the 13.69% CAGR achieved during the five years ended 2022.”

Global ETF assets under management were $9.2 trillion at the end of last year following the second highest net inflow on record of $779.4bn according to PwC. In contrast, most of the rest of the asset management sector experienced significant fund withdrawals in 2022, including $1.4 trillion of net outflows from mutual funds globally.

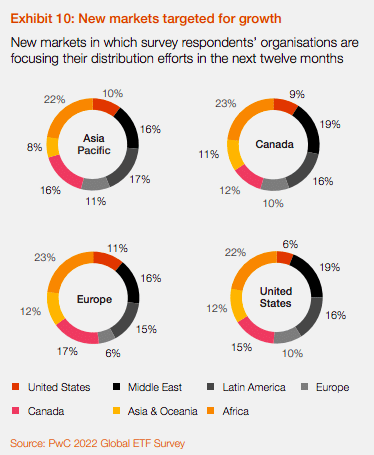

The survey said a growing number of ETF managers are targeting the underpenetrated markets of Africa, Latin America and the Middle East.

DWS’s Xtrackers

In April this year Xtrackers entered the Brazilian ETF market with the listing of 10 UCITS funds on B3 (Brasil, Bolsa, Balcão). The new listings includes Xtrackers Core ETFs, which are designed to provide exposure to the most widely used investment benchmarks at competitive fee levels. For example, the Xtrackers MSCI USA UCITS ETF, provides exposure to large and mid-cap companies listed in the US, and the other new listings provide exposure to global emerging markets and China.

The debut of Xtrackers in the Brazilian market followed the launch of the Brazilian Depository Receipts (BDR) programme which enabled overseas issuers to list ETFs.

Salvador Gómez, head of Xtrackers sales Latin America & US offshore at DWS, told Markets Media that the firm was the first to list UCITS ETFs on the Brazilian market using the BDR programme.

“One of the reasons we’ve chosen to lead with our UCITS ETFs is due to the lack of potential automatic withholding tax for Brazilian investors, relative to US-domiciled ETFs,” he added.

Gómez continued that the change in the macroeconomic environment has also led to Brazilian institutions wanting to diversify their portfolios, which is provided by UCITS ETFs. DWS also wanted to list in Brazil to improve the ETF ecosystem in the country and he said other overseas issuers had since followed their example by launching ETFs in Brazil.

After listing Xtrackers’ Core ETFs in Brazil, the manager intends to expand its suite of products with, for example, introducing factors or ESG funds. This will be similar to Mexico where DWS’s Xtrackers have been listed on the Mexico Stock Exchange since 2014 and the firm now has more that 90 products listed in the country. Gómez said Mexico is a priority and the asset manager will continue to expand its suite of ETFs.

“Our strategy is to go deeper into local markets in partnership with local distributors,” he added. “That allows us to bring the most efficient solutions but also help those partners by supporting their growth.”

Horizon Kinetics

In March this year Horizon Kinetics re-entered the European ETF market with the launch of the Inflation Beneficiaries UCITS ETF, an actively managed fund, which began trading on the Euronext Amsterdam and Dublin stock exchanges.

James Davolos, portfolio manager at Horizon Kinetics told Markets Media: “We differentiate ourselves by being truly active. Our active share is well upwards of 95% relative to the MSCI ACWI Index [the provider’s flagship global equity index].”

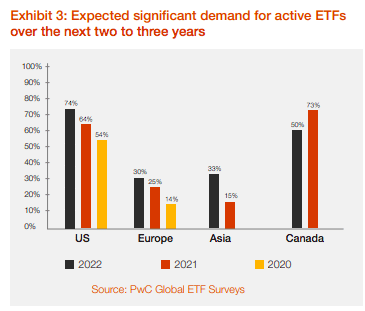

Active ETFs are tipped to be the fastest growing product according to the PwC survey. Active ETFs are well established in the US and form around 5% of overall ETF assets, compared to 1.5% in Europe.

Net inflows into active ETFs were $102bn in 2022, while active mutual funds had net outflows of around $1.5 trillion according to the report.

“This contrast in flows has encouraged a number of active fund managers to begin offering ETFs by converting or cloning existing mutual fund strategies,” said PwC. “The big challenge for traditional managers is to sustain margins in the face of lower fees than they are generally accustomed to. This calls for a clear focus on scale, operating costs and digital distribution.”

Horizon Kinetics said the Inflation Beneficiaries UCITS ETF seeks to address one of the most important economic and investment drivers by identifying unique, scalable businesses that have the potential to thrive in an inflationary environment.

“The old era of buying an index and forgetting about it is quickly shifting to one where you need to be far more discerning about your investment decisions,” said Davolos. “We obviously think that plays very well to our strategy.”

A US version of the ETF listed on the New York Stock Exchange in January 2021. Davolos said there had been tremendous demand in the US for the ETF in its first two years and European clients wanted a similar strategy.

“One of our largest clients is a multinational, global bank and many of their clients outside the US wanted exposure,” Davolos added. “We worked with them to find the best wrapper for the strategy and it was evident that this would be an ETF.”

The strategy emphasizes companies that have exposure to inflationary underlying assets, but do not have high capital intensity, leading to full cycle strong returns. Davolos believes there is a unique opportunity in Europe given the different inflation dynamics and the impact on domestic economies relative to the US.

Alun Williams, chief operating officer of Horizon Kinetics, told Markets Media that navigating an ETF registration in Europe was a painful process that was significantly more complex than listing in the US. For example, Euronext Paris does not allow the listing of actively managed ETFs.

“We took our time to make sure we were partnering with the right service providers, correctly navigating the different exchange rules, registration requirements, tax regimes and the differences between the UK and mainland Europe as a result of Brexit,” said Williams.

However, he continued that although the initial registration took a lot of heavy lifting, adding new ETFs under the European umbrella will be much simpler going forward.

“We are certainly not close to the idea of launching additional ETFs in Europe as we would want to make sure it is the right move for us and the products,” he added.

Davolos said the manager is optimistic on launching additional products in Europe if this ETF is successful.

“We have a very different value proposition that you are never going to find in indices or conventional asset managers,” added Davolos. “That seems to be a big part of our success in the US and is even more prevalent for a European investor base.”

Davolos expects the growth in ETF assets in Europe to continue.

“Europe has a very long runway for substantial growth if you look at the US,” added Davolos.