WisdomTree Connect has been launched to enable distribution of tokenized real world assets to institutions, adding to the asset manager’s existing retail offering.

Maredith Hannon, head of business development for digital assets at WisdomTree, told Markets Media: “WisdomTree Connect represents our first step into on-chain institutional investing and that is really exciting.”

WisdomTree Prime, a blockchain-enabled financial app which allows retail investors to save, spend, and invest in WisdomTree’s digital funds, was initially launched to retail users across 21 states in the U.S. In May this year. WisdomTree Prime became available to users in New York after the New York State Department of Financial Services granted a charter and is now available in 45 U.S states, having just added Rhode Island, according to Hannon.

Retail investors can access 13 digital WisdomTree funds which are all registered with the US Securities and Exchange Commission , as well as a gold token and a stablecoin.

“We have a full suite for any retail investor to build a diversified portfolio, which is very much an extension of our heritage,” added Hannon.

She described WisdomTree Prime as abstracting all of the difficulties of blockchain technology away from the retail investor, so they do not have to manage their own keys or their own wallet infrastructure. In contrast, most institutional investors have their own wallet infrastructure, and want to manage their own keys and make their own custody arrangements.

On 18 September, WisdomTree said in a statement that it is launching a new platform to allow a broader range of users to access tokenized real world assets. Institutions receive a digital record of the WisdomTree digital funds into their own wallets, which can be self-hosted wallets or held with a third-party custodial wallet service.

WisdomTree Connect is initially available via a web portal and API, and the firm is exploring other methods of interaction through a decentralized application (dApp).

“What has drawn us to this space is that digital assets can be used in a different way than traditional assets,” added Hannon. “Digital assets can be traded, used for spending, or for collateral and that really excites us.”

Growth

The first digital asset available on WisdomTree Connect is the WisdomTree Government Money Market Digital Fund (WTGXX), but the intention is to eventually add all of the firm’s other digital funds. WisdomTree has started with the government money market fund on Connect as many institutional investors, especially crypto-native institutions, want yield and access to regulated financial products without leaving the blockchain ecosystem.

Hannon explained that crypto-native firms are spending 48 hours or more to sell stablecoins, go into fiat and then purchase an off-chain money market fund. She said: “We are bringing that all on-chain.”

Will Peck, head of digital assets at WisdomTree, said in a statement: “WisdomTree Connect opens up additional business-to-business (B2B) and business-to-business-to-consumer (B2B2C) opportunities for WisdomTree to provide access to digital funds to on-chain firms without leaving the ecosystem.”

Once onboarded, institutional users will be able to purchase or redeem via US dollars, which can also be facilitated via USDC, a commonly used stablecoin that is redeemable 1:1 for US dollars. WisdomTree said the inclusion of these fiat-to-crypto on and off ramps further bridges the gap between traditional and decentralized finance.

Hannon argued that this seamlessness in using USDC, and the platform’s security, are differentiators for WisdomTree Connect.

“Being able to do everything on-chain in your own wallet and use a stablecoin that many people are familiar with is a huge value-add,” she added.

She claimed that another differentiator is WisdomTree Connect’s identity management, because many other platforms use whitelists of approved users. In contrast, institutions that are onboarded receive a non-fungible token (NFT). Clients who have these NFTs can transfer digital assets directly between one another 24/7/365, without using the WisdomTree platform. WisdomTree will monitor all its wallets on-chain, and track transfers, according to Hannon.

Currently, only WisdomTree’s digital assets can be used for these peer-to-peer transfers.

“The goal is that this will start this identity management on-chain, which is desperately needed,” added Hannon. “We have a long roadmap which is really exciting.”

She believes that WisdomTree is well placed for an increase in tokenization, as it has a suite of regulated digital funds including equities and asset allocation model funds, rather than just fixed income funds. Hannon said WisdomTree is also working with exchanges to accept their token as collateral.

“I definitely think that a year from now, the tokenization of real world assets will look very different, and use cases are going to be much more advanced,” she added.

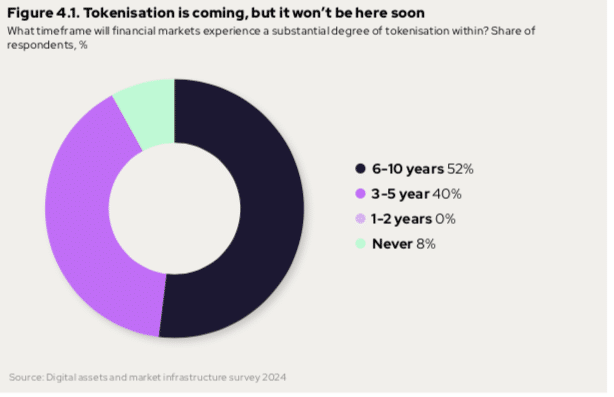

The OMFIF Digital Monetary Institute’s latest annual Digital Assets 2024 Report found that the majority of market participants expect tokenization to happen, but said that it is not yet imminent. Its arrival was predicted in the next three to five 5 years by 40% of survey respondents, and between five to 10 years by 40%.