Jon Winkelried, chief executive of alternative asset management firm TPG, spoke about the evolution of private equity and alternative markets on the podcast, Goldman Sachs Exchanges: Great Investors.

He was interviewed by Alison Mass, chairman, investment banking, global banking & markets at Goldman Sachs on 13 June 2024.

In 1982 Winkelried started as an intern in equities trading at Goldman Sachs, when there was not a single PC in the building. He spent 27 years at the bank and rose to become president and co-chief operating officer, before joining TPG in 2015. The shift from a very risk-averse, agency advisory orientation to a risk culture in the early 1990s was one of the biggest changes in the history of the bank according to Winkelried.

He was on Goldman Sachs’ management committee in 1999 when the bank completed an initial public offering, during our 1999 IPO, and also led TPG through an IPO in 2022 which raised $1bn.

Mass highlighted that TPG had $110bn of assets under management when it went public, and assets have more than doubled to $224bn. Winkelried said much of TPG’s growth has been driven by its origins as a family office, as founders David Bonderman and Jim Coulter had worked together for the Bass family in Texas.

“A family office mentality implies a lot of range and flexibility and being creative around where they would allocate capital,” he added. “Most of the other large private equity firms that became alternative asset platforms, their origin was people who came from Wall Street, people who came from where, frankly, we came from and saw the opportunity in private equity.”

Winkelried gave an example of TPG’s flexibility as when it launched a real estate business after the financial crisis by allocating capital from the buyout fund. TPG seeded its first credit business in a similar way.

“When Alan Waxman came to TPG from Goldman Sachs and started what is now Sixth Street Partners, the first billion dollars of investing actually came out of TPG Capital VI, which was the buyout fund,” he said. “That all happened after the crisis.”

Shifts reshaping alternatives markets

Winkelried described the “tectonic” shifts that are fundamentally reshaping the alternatives markets.

“The plates are rumbling for sure in terms of how things are changing,” he added.

One shift is consolidation and concentration, as capital formation has become more difficult. The largest pools of capital, including institutional as well as mass affluent, high net worth and private wealth want to do more with fewer managers according to Winkelried. By focusing their mandates, they will be more important to their managers and get better terms, more strategic dialogue and “top of the house” relationships.

“As a result of that, we are having to pull back in terms of giving capital to smaller, boutique-style managers,” Winkelried added. “You are starting to see that manifest itself also in M&A activity in our industry.”

He identified another big shift as the integration of alternative asset management and insurance. Life and annuity players have realized that they can offer higher rates for annuities with better asset management according to Winkelried. At the same time fund managers recognize that retirement and annuity products will continue to be very important.

In addition, the private equity industry is undergoing the first turnover from the founders who launched firms 30 to 35 years ago, which has led to institutionalization or “permanentization” of franchises. Alternatives managers have realized they can lengthen the duration or “permanentize” their capital base, as TPG did by going public, rather than raising funds every three to five years,

“Some firms have made the switch and some firms have not,” said Winkelried. “I think that that is going to prove to be a catalyst that is affecting consolidation and some firms will survive the transition, and some will not.”

Angelo Gordon acquisition

In November last year the alternatives manager completed the acquisition of Angelo Gordon and formed TPG Angelo Gordon, a $74bn diversified credit and real estate investing platform within TPG led by Josh Baumgarten and Adam Schwartz.

Winkelried said it was clear that Sixth Street wanted to become independent.

“When that happened, we knew from day one that we wanted to be back in the credit business,” he added. “We knew it was an important asset class in the market, our clients wanted it from us and we had experience.”

Being a public company gave TPG an acquisition currency. Winkelried said that once TPG said it wanted to own a private credit business, about 25 different credit managers got in touch.

“We kicked the tires on a lot of things,” he said. “What was interesting to us about Angelo Gordon was that it had critical mass and scale.”

Additionally, Angelo Gordon had a good brand, a good track record of investing and had been through a transition from the founders to the next generation. Portfolio managers were mid-career, with a “lot of runway in front of them” but the business was undercapitalized.

“They had a diversified business, which was important,” said Winkelried. “We felt those businesses were in the sweet spot of where the growth was going to come from in the market.”

Winkelried identified “compelling” opportunities in the middle of the capital structure. For example, sponsors may have a lot of equity in a company but be under pressure to return money to investors as they have been underwriting 20%-plus returns. As a result, many sponsors are asking TPG to invest in the middle of the capital structure.

“In today’s environment we like that risk/reward of coming into the middle of the capital structure with a strong sponsor underneath,” he added.

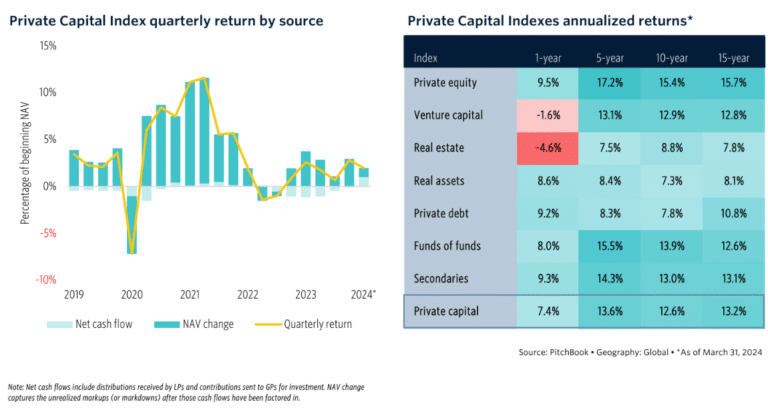

The Q1 2024 PitchBook Private Capital Indexes Report said returns have been mixed this year with real estate turning negative, while venture capital made a small gain after more than two years of negative returns.