TP ICAP, the intermediary which connects buyers and sellers in wholesale financial, energy, and commodities markets, expects the wholesale cryptoasset market to be increasingly serviced by traditional brands and providers in 2024.

Duncan Trenholme and Simon Forster, global co-heads of digital assets at TP ICAP, said in an email that operating models for spot crypto exchanges will continue to change with the segregation of execution and custody becoming the default for institutional market participants. They expect a continued shift of trading activity to traditional, regulated exchanges and venues and that overall spot crypto volumes, once dominated by offshore exchanges, will begin to migrate toward more regulated providers.

“In November, CME overtook Binance as the leading exchange from an open interest perspective on the bitcoin futures contract,” added Trenholme and Forster. “We believe that will be seen as a watershed moment for the broader crypto derivatives market.”

They continued that the biggest opportunities for their business is the continued institutionalization of the crypto space.

“The world’s largest banks and asset managers are now actively rolling out blockchain technology, like the World Bank which issued a digital bond on Euroclear’s DLT solution and BlackRock, who filed for a spot Ethereum ETF,” they added.

Tokenization

Consultancy Coalition Greenwich agreed that the pace of adoption of blockchain technology in capital markets has been robust, despite many firms, particularly in the US, maintaining a low profile at home or focusing their efforts in other jurisdictions.

In its report, Top Market Structure Trends to Watch in 2024, Coalition Greenwich said progress toward the tokenization of financial instruments is particularly interesting.

Tokenization and blockchain can increase efficiency by offering standardized processes across multiple participants in trade life cycles to allow automated order processing, settlement, ownership tracking and data management. The ownership and properties of an asset can be represented as a smart contract encoded on a distributed ledger. Smart contracts can be programmed with automated rules for settlement and corporate actions which update all the related data for the relevant participants.

Coalition Greenwich gave the example of corporate and government bonds which have been issued digitally “on chain” and represent a small, but growing, portion of the traditional market.

“Traditional financial institutions, often perceived as slow to adopt innovations, are now making decisive moves into production beyond proofs of concept (POCs), pilots and sandboxes,” added the report.

These are signals that a significant turning point is coming, according to Coalition Greenwich, as tokenization moves beyond real estate, art, venture capital, and private equity.

“As we delve into this transformative journey, the center of gravity may not ultimately be New York or London,” said Coalition Greenwich. “The market is closely watching developments in places like Singapore and Switzerland, as regulators in the U.S. and U.K. still leave potential market participants in search of clarity.”

For example Project Guardian, an initiative from the Monetary Authority of Singapore has explored tokenization in partnership with traditional financial institutions. In 2022 SBI Digital Asset Holdings, the digital asset arm of the Japanese financial services firm SBI Group, announced its participation in Project Guardian to explore the institutional trading of tokenized bonds and deposits to improve efficiency and liquidity in wholesale funding markets.

In November 2023 UBS, SBI and DBS launched the world’s first live repo with a natively-issued digital bond on a public blockchain as part of the project. The transaction automatically and instantly settled a repo, digital bond purchase and redemption using regulated digital payment tokens across regulated entities in Japan, Singapore and Switzerland. The transaction demonstrated benefits including real-time 24/7 settlement, and operational and capital efficiency while ensuring compliance and security requirements.

In additionally US ETF issuer WisdomTree, alongside JPMorgan and Apollo, announced a new proof of concept on the institutional use cases of tokenization and smart contracts for model portfolio rebalancing as part of Project Guardian,

Trenholme and Forster believe the trend towards tokenisation is only set to accelerate and that as digital assets gain legitimacy and acceptance within traditional financial institutions, they will gain more trust from a wider audience, further integrating into the mainstream financial system. However, they also warned that blockchain interoperability is a huge challenge.

“With leading institutions launching their own chains alongside leveraging public chains like Ethereum, you could get a fragmented ecosystem that creates trapped liquidity and hampers the efficiency gains that blockchain technology can unlock,” they added. “The advancement of blockchain interoperability protocols will be crucial in breaking down the existing silos between different blockchains”

Alternative Investments

Tokenization could present a $400bn opportunity in distributing alternative investments according to a report from JP Morgan’s Onyx Digital Assets and consultancy Bain & Company.

Tyrone Lobban, head of blockchain & Onyx Digital Assets, Onyx by J.P. Morgan, and one of the authors of the report said blockchain and tokenization could directly address the distribution challenges facing the alternatives industry to both institutions and individuals, which is a new $400bn annual revenue opportunity.

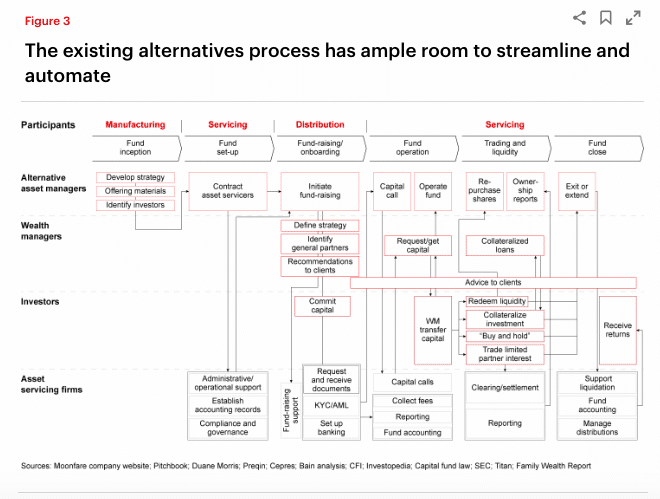

Lobban argued that the alternatives industry is still heavily manual and involves lengthy, multiparty processes with siloed data and costly reconciliations. Using DLT and tokenization to increase automation will vastly improve investor experience and the introduction of additional features could enable more widespread adoption of alternatives by eligible individuals while providing new streams of revenue and cost efficiencies for fund managers and distributors.

The bulk of the $400bn opportunity comes from increased distribution and assets under management as companies across the value chain generate new revenue from improving liquidity, with fund managers having a $270bn opportunity according to the report.

“Fund managers may attract more capital by expanding their investor base, leading to increased assets under management and revenues from management fees and carry,” said the report. “ New revenue streams may arise from secondary transactions or partnerships with distributors, while administrative simplification could also generate cost savings.”

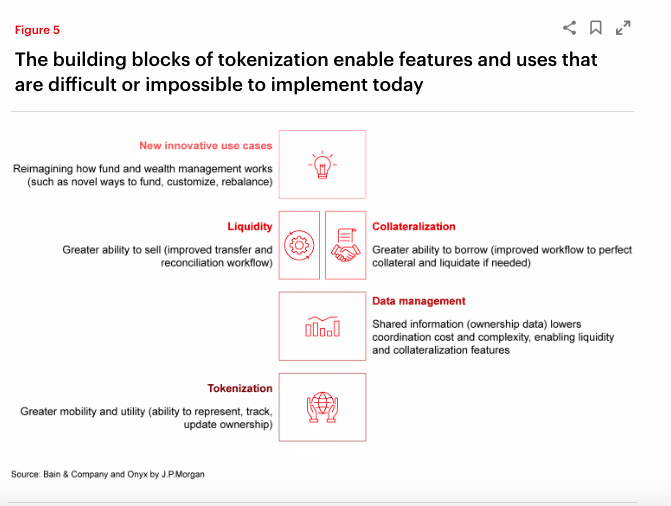

Tokenization could make illiquid investments more cash-convertible for individuals.

“Note that enhanced settlement and better ownership records alone will not create liquidity; a sufficiently robust network of buyers is essential,” added the report.”This could come from existing holders or secondary funds that would have the opportunity to purchase the new supply of smaller positions in a familiar fund at a discount to net asset value.”

There is also the potential for a new class of market makers to emerge who will provide liquidity in previously illiquid assets.

The technology also offers the possibility of introducing new features such as tokenizing underlying investments (e.g. individual company shares within a private equity fund) to enable partial divestments; programmatic rebalancing of discretionary model portfolios; and automating capital calls, which are unpredictable, time-sensitive and manual. When the private equity fund calls capital, a smart contract could enable the automatic redemption of the liquid tokenized investment, using proceeds to satisfy the capital call.

“Consider asset management firms that build customized portfolios of alternatives for large institutions,” added the report. “These firms could leverage scalable, transparent platforms to simplify manual processes, enabling them to reinvest in higher-value functions like manager due diligence.”

Trenholme and Forster said on-chain cash, specifically stablecoins, will be increasingly recognised as one of the most important use cases for crypto.

“With the ongoing professionalisation of the industry, alongside the likely approval of spot-based Bitcoin and Ether ETFs in the US, we believe 2024 could be defined by a significant shift in overall sentiment,” they said.