The wholesale banking business could add between $55bn and $90bn of revenues by 2027 versus a 2019 baseline, but need to assess the continued rise of non-bank players in liquid and private credit according to research from Oliver Wyman and Morgan Stanley.

The 2024 edition of the consultancy’s annual wholesale banking industry outlook with Morgan Stanley, Extending Credit: The Evolving Role of Wholesale Banks In Credit Markets, said wholesale banks have transformed their businesses since the global financial crisis and built resilient and sustainable returns.

“We are confident that the industry is not at significant risk of returning to the pre-pandemic doldrums, thanks to three structural shifts: interest rates in line with historical norms across the globe, sustained levels of market volatility, and the ongoing change in demand from corporate clients,” said the report.

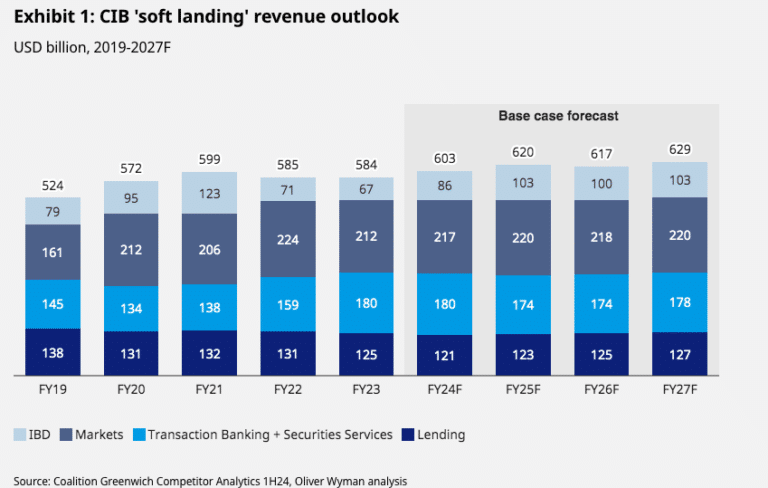

As a result of these structural shifts, the study estimated that the wholesale banking business could add approximately $55bn to $90bn of revenues by 2027 versus a 2019 baseline. The industry-wide return on equity is also estimated to rise to 14% by 2027, up from 12% in 2023, driven by a strong recovery in investment banking.

The positive outlook is dependent on the diminishing risk of a significant increase in capital requirements as part of the Basel 3 Endgame package in the US and other jurisdictions, especially in the wake of the US elections.

“While this remains a wild card worth monitoring — every 5% uplift in industry-wide capital would reduce return on equity by approximately 60 basis points — it is an increasingly remote possibility,” said the report.

Credit

The report highlighted that credit is one area where the transformation of the wholesale banking business model is not complete and market share is shifting toward non-bank players

“However, the transformation is now accelerating under the weight of increased regulatory pressure, product innovation, and the entry of new competitors,” added the study. “In parallel, private credit managers continue to expand their reach into product areas that have historically been dominated by banks, such as asset-based financing and infrastructure finance”

Banks have particularly ceded share to private credit managers in middle-market direct lending according to the report, while maintaining their roles in the high-yield bond and broadly syndicated loan markets.

“Future shifts will be across two dimensions: penetration into other types of credit and expansion outside the US,” said the report.

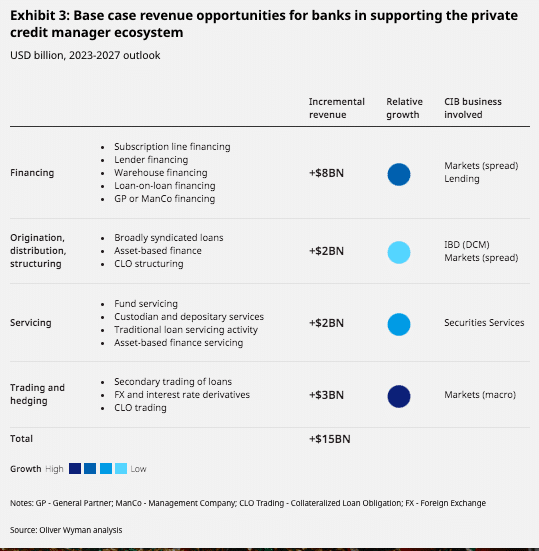

An estimated incremental $35bn to $50bn of existing revenues is potentially at risk for wholesale banks, which represents 8%-11% of their total credit revenue. However, there are also potential new opportunities for banks to position themselves as strategic partners. The study estimated that up to $15bn of incremental revenue will be up for grabs by 2027, with the provision of financing to the credit manager ecosystem as the largest opportunity.

“Banks will continue to play a key role in originating, distributing, and structuring private credit assets in partnership with managers, increasing balance sheet velocity and retaining a share of the economics through origination fees,” said the report. “Banks can also capture opportunities to provide fund and loan servicing to private credit managers, and support trading and hedging of private credit assets as secondary trading becomes more common.”