Nasdaq reported record index options revenues in the second quarter of this year but believes that growth is just beginning.

Kevin Davitt, Nasdaq’s head of index options content, said in a blog that index options trading has grown dramatically during the last three years. He said: “Notably, S&P 500 index-pegged options saw a 31% increase from 2022 to 2023 and 8% from 2023 to 2024, and Nasdaq 100 Index Options (NDX) experienced a 59% rise between 2022 and 2023 and a 40% increase from 2023 to 2024.“

John Black, head of index options at Nasdaq, told Markets Media: “Elevated volatility has increased volumes but we think Nasdaq 100 index options have been more widely adopted because of the recognition of the names that make up that index, as there are many global brands.”

For example, the Nasdaq 100 index contains the “Magnificent Seven” technology stocks – Microsoft, Apple, Nvidia, Alphabet/Google, Meta/Facebook, and Tesla.

In addition, Davitt noted that retail investors had a 62% growth in average daily volume from 2022 to 2023, and a 38% increase from 2023 to 2024 (year to date). For institutional investors, growth was 57% between 2022 and 2023, and 41% from 2023 to 2024.

Greg Ferrari, head of exchange business management at Nasdaq, told Markets Media that the pandemic essentially enabled a new cohort to access the options market and Nasdaq is seeing a lot of different participant types.

“We think the US options market is in its early innings of growth,” Ferrari added.

As a result, Nasdaq is continuing to invest in infrastructure to enable frictionless trading. Ferrari highlighted that Nasdaq is a critical market infrastructure provider, and so plays an essential role in global capital markets by providing assurance, reliability and trust that quotations are being processed properly, orders are being handled in rank and that market data is distributed.

“We continue to invest in the headroom of our systems to enable that type of consistency with delivery,” he said. “In August our peak message traffic jumped about 20% and we hit some record days, but we were well prepared.”

Two of Nasdaq’s options exchanges, MRX and GEMX, have moved to Amazon’s cloud. Ferrari said Nasdaq hears a lot from customers that a common infrastructure where they have a single interface into the markets allows them to be more agile and nimble, and access liquidity more consistently.

Nasdaq has six options exchanges and Ferrari argued that their diversified market models allows Nasdaq to be very agile and support all types of participants.

Index options

“We have a great product in NDX but the true value is when you put that on Nasdaq technology,” said Black. “By providing a fair and safe environment for people to mitigate risk on this platform, that enhances the index option itself and its utility.”

Black said growth is boosted by the power of the brand of Nasdaq but is really about educating the investment community on the proper use case and efficacy for options in general. Nasdaq spends a lot of time on education and partnerships to build out the ecosystem so that people feel comfortable and understand its flagship Nasdaq100 options.

Growth has also been boosted by the increase in exchange-traded funds that generate yield and have buffer strategies.

“The implied volatility of Nasdaq 100 is slightly higher, so a lot of those ETFs are benchmarked to our flagship index and we are seeing more use cases,” said Black.

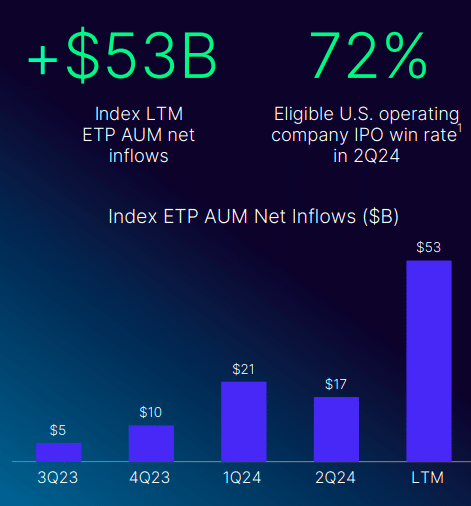

Nasdaq reported that it reached record assets under management in exchange -traded products linked to its indices in the second quarter of this year. AUM ended the quarter at a high of $569bn, including $53bn of net inflows in the trailing twelve-month period and $17bn in the second quarter of this year.

Ferrari believes the growth of Nasdaq 100 index options is on a “very good” trajectory as a result of the work the firm has been done across the franchise.

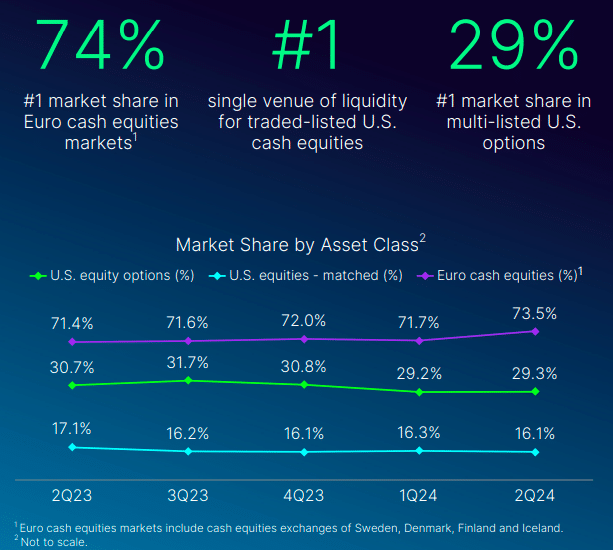

“Participants trust our brand and different ETF issuers are building yield-enhancing strategies using options on Nasdaq companies or indexes,” he said. “We have a track record of being the market share leader in multiple listed options for 14 years.”

Competition

Nasdaq faces increased competition in the options market as Miami International Holdings (MIH) launched MIAX Sapphire, its fourth national securities exchange for U.S. multi-listed options, on 12 August 2024. The rollout of options began with its first symbol, IBM, and the venue will launch trading in additional symbols in multiple phases on a weekly schedule until 21 October 2024.

The MIAX Sapphire electronic exchange will be followed by the opening of a physical trading floor in 2025 as the the first national securities exchange to establish operations in Miami.

Shelly Brown, executive vice president, strategic planning and business development of MIH, said in a statement: “MIAX Sapphire is built using the same proprietary technology and infrastructure underpinning other MIAX exchanges, enabling existing MIAX Exchange members to access the new exchange with minimal additional technology efforts.”

Private equity firm Warburg Pincus has also invested $100m in MIH, part of which will be used to fund the construction and fit-out of the physical trading floor in Miami.

The investment will also support further growth and expansion of MIH’s agricultural and financial futures businesses on its two U.S. futures exchanges, Minneapolis Grain Exchange (MGEX) and MIAXdx, including the development of new matching engine and clearing technology using MIH’s proprietary technology.

Additionally, the investment will fund expansion into international markets including the development and trading of new proprietary and other financial products.