Matt Hougan, chief investment office of Bitwise Asset Management, the US crypto index fund manager, said the US election will install a pro-crypto Congress and president and boost the industry which has operated for the past four years with “both hands tied behind its back.”

Hougan said in a blog that the crypto industry has faced numerous lawsuits from the regulators, been stopped from accessing banking services and prevented from providing custody for institutions which has stopped mainstream adoption.

“That is now gone, swept away in a momentous election that will install a pro-crypto Congress and president in Washington,” he added. I suspect the lifting of this veil will accelerate every aspect of crypto’s growth. We are entering the Golden Age of Crypto.”

We are entering the Golden Age of Crypto. pic.twitter.com/a18LNn1pcl

— Bitwise (@BitwiseInvest) November 6, 2024

Hougan continued that the new administration will take over in January with a strong mandate to follow through on its campaign commitments to the crypto industry, which include the end of Operation Choke Point 2.0, which restricted crypto’s ability to access the traditional banking system; legislation on stablecoins and market structure, and a change of leadership at the US Securities and Exchange Commission.

Still Hearing $HOOD's Gallagher for SEC Chair pic.twitter.com/FFCh7TEsVs

— matthew sigel, recovering CFA (@matthew_sigel) November 6, 2024

Commenting on the US election 2024 results, AIMA CEO Jack Inglis said:https://t.co/UFGj8s1Bqx pic.twitter.com/hHrTZAqsnn

— AIMA (@AIMA_org) November 6, 2024

.@realDonaldTrump, Congratulations!

Some fodder for your first 100-day checklist to get things moving:

– Fire Gensler. Day 1, no delays.

– In his place, appoint Giancarlo, Brooks, or Gallagher – they’d be massive upgrades in rebuilding the rule of law (and reputation) at the…— Brad Garlinghouse (@bgarlinghouse) November 6, 2024

Crypto markets

In August this year, Bitwise acquired ETC Group, a London-based crypto exchange-trade product issuer. ETC Group said in a report that a more pro-crypto stance among US regulators will likely allow a more diverse set of investment opportunities such as ETFs.

“There are still several spot crypto ETFs waiting for the SEC’s approval including spot ETFs on Solana, and XRP,” said ETC Group. “Cryptoasset service providers will be freer to operate and will likely face less pressure by regulators, i.e. the so-called “Operation Chokepoint 2.0” will likely end.”

ETC Group highlighted that the incoming administration has also said it will establish a strategic national bitcoin stockpile; favourable regulation to encourage domestic Bitcoin mining and to install a bitcoin/crypto advisory council in the first 100 days in office.

“Cryptoasset markets have already performed very well in anticipation of these developments,” said ETC Group.

Crypto data provider CCData said in a report that the combined spot and derivatives trading volume on centralised exchanges rose 19% to $5.19tn in October, the fifth-highest monthly volume this year, and coincided with an increase in digital asset prices ahead of the US presidential election.

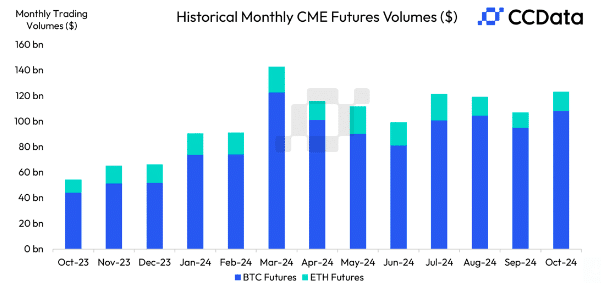

In October, CME recorded a 17.2% increase in total trading volume of crypto derivatives to $133bn, its second-highest monthly volume on record according to CCData.

CCData also highlighted that following the election results on 6 November, bitcoin surged 8.67% to an all-time high of $75,392.

“Digital asset volumes and open interest followed suit, with the hourly spot trading volume for BTC reaching $8.53bn at 3:00 AM GMT,” said CCData. “Furthermore, the open interest across all instruments on retail exchanges surged to a new all-time high of $71.4bn.”

6 November is also likely to be the biggest bitcoin ETF trade volume day in history:

Damn, $IBIT has seen $1b in volume in the first 20min- that's about what it does in full day. Other bitcoin ETFs in same boat, crazy volume. Set for a record-breaking volume day (and given price is up so much, this is likely feeding frenzy volume vs crisis volume = look for… pic.twitter.com/1gSvV5Lwzo

— Eric Balchunas (@EricBalchunas) November 6, 2024

Looser regulation

Outside crypto, regulation is expected to decrease in other sectors. Murphy O’Flaherty, senior portfolio manager and senior equity analyst for small cap equities at RBC Global Asset Management, said in an email that less regulation could result in more mergers and acquisitions activity.

“For example, the biotech and pharma industries have had less M&A activity over the past few years and some of that is related to regulation and oversight, as well as higher rates,” he added.

The new administration can also be perceived as positive for metals, mining, energy, financials/banks according to O’Flaherty. In contrast, he expects headwinds for alternative energy, especially wind, and said this could negatively impact companies associated with climate change.