The UK could become the largest crypto exchange-traded note market in Europe in three years, provided the regulator allows retail investors to buy the products, according to Alex Pollak, head of issuer 21Shares in UK and Israel.

The London Stock Exchange launched a market in crypto ETNs on 28 May 2024, following regulatory approval from the Financial Conduct Authority. However, the FCA only authorised professional investors to access this new market, with retail investors being prohibited.

Tom Stenhouse, head of equities trading product at the London Stock Exchange, said in an email to Markets Media that the new market for crypto ETNs will enable access for professional investors within a transparent and highly regulated environment.

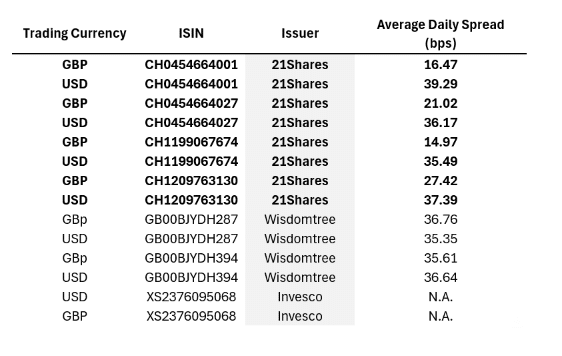

“From launch, we will be listing products from three issuers – 21 Shares, Invesco and WisdomTree,” Stenhouse added. “We look forward to welcoming further issuers and investors to the market, and expanding the product set available, as institutional demand for digital assets increases.”

Alexis Marinof, head of Europe at WisdomTree, said in a statement that FCA approval could result in greater institutional adoption of crypto. Marinof said: “Many professional investors have been unable to gain exposure to Bitcoin and other cryptocurrencies due to regulatory limitations and uncertainty – we would expect FCA approval of our crypto ETPs’ prospectus to remove those barriers to entry.”

Pollak told Markets Media that the crypto ETN listings mark progress for the UK, and that the seal of approval from the FCA and LSE does make a difference to some investors.

“In the UK the dial will not move properly until the retail ban is lifted,” Pollak added. “I think the UK will become the largest crypto ETP market in Europe over the next three years if the retail ban gets lifted.”

Pollak said the founders of 21Shares – chief executive Hany Rashwan and president Ophelia Snyder – were focused on the UK as a strategic market from day one due to its innovation, the active crypto community, the size of the asset management industry and its position as a global player in financial markets.

Snyder said in a statement: “The UK is one of the deepest, most-liquid capital markets in the world. As institutional interest in cryptocurrencies grows, it is only natural that the London Stock Exchange hosts responsible, properly-constructed funds offering access to these markets.”

Differentiator

21Shares celebrated its fifth anniversary in November 2023 and has listed more than 40 crypto ETNs in Europe. The issuer cross-listed four products in London, which are already listed in Europe – a bitcoin ETN and an ether staking ETN with exposures in US dollars and euros. The issuer had to submit a base prospectus to the FCA, and then go through a listing application process with the LSE, as it was a new issuer on the exchange.

Pollak claimed that this experience and track record is a differentiator for 21Shares.

“We have had a crypto winter that gave us the opportunity to stress test our products,” he added. “Investors could trade without any issues and our products came through the crypto winter very strongly.”

He also argued that this long experience is important for 21Shares’ capital markets team, which helps ensure the crypto products trade properly.

“We have the same relationships with market makers who are already trading our European products,” Pollak added. “ We have the tightest spreads for the crypto products listed on the LSE.”

In addition, Pollak argued that 21Shares has an advantage as a crypto-native firm. 21Shares has between $7bn and $8bn in assets under management and Pollak said 99% of its business is in the crypto space. He added that another differentiator is the education the firms provides, as the founders were passionate about making sure they were bringing content and education to the market, as well as products.

“We typically target traditional investors who are trying to allocate a little bit of capital into crypto,” he said. “The firm has a big in-house research team that can discuss crypto, and make it palatable and easily understandable to a traditional audience.”

He expects 21Shares to list more crypto products in London. For example, the issuer has a product that blends gold and bitcoin, as well as basket and coin products.

“I think this is just the beginning really of our journey in the UK,” Pollak added.

US spot crypto ETFs

21Shares was amongst the group of 11 issuers that launched a spot bitcoin ETF in the US in January this year, following approval by the Securities and Exchange Commission.

4 spot bitcoin ETFs are in top 50 of *all* ETF inflows this yr, incl 2 in top 5…

#2 – iShares Bitcoin ETF

#5 – Fidelity Wise Origin Bitcoin ETF

#36 – ARK 21Shares Bitcoin ETF

#48 – Bitwise Bitcoin ETF

There are 3,500+ ETFs, so puts these in top 1.5% of all ETFs by inflows.

— Nate Geraci (@NateGeraci) June 10, 2024

ETC Group, the European issuer, said in a report on 10 June that last week global Bitcoin ETPs had net inflows of $2.2bn, with $1.8bn related just to US spot bitcoin ETFs. The report said: “US spot bitcoin ETFs have seen 20 consecutive trading days of positive net inflows so far.”

In a research report, 21Shares said May was an exciting month for crypto, with institutional interest in bitcoin growing and inflows increasing after a quiet April.

📣 May’s 21Shares Monthly Wrap is out! From crypto regulations heating up, and the presidential debate to the SEC’s approval of Ethereum Spot ETFs, it’s been a game-changing month. Dive into our detailed analysis on our website. Stay informed👇!https://t.co/klmKich7Ol pic.twitter.com/LqK4MHhSDk

— 21Shares (@21Shares) June 6, 2024

“By the end of Q1, 937 professional investors owned $11bn in US bitcoin Spot ETFs, about 20% of the ETFs’ total assets,” added 21Shares. “In contrast, gold ETFs had only 95 professional investors in their first quarter post-launch, representing less than 10% of bitcoin ETFs’ reach.”

21Shares continued that the most significant take away from May was the SEC’s approval of ethereum spot ETFs’ 19b-4 filings on May 23, which marked a “crucial milestone” for the crypto industry. However, the products are not tradable until the regulator approves S1 filings, which could take weeks or months.

“Nevertheless, this moment signals a growing acceptance of ethereum within regulated investment frameworks, potentially opening the market to significant inflows from registered investment advisors and the local ETF market, with the latter valued at $8 trillion,”said the report. “Ethereum’s approval represents a significant step forward, highlighting the value of its on-chain ecosystem of decentralized applications.”