Environmental, social and governance investing is a source of outperformance for investment grade bonds from European issuers, but the opposite for American issuers according to research from Amundi Asset Management.

The European fund manager analysed euro-denominated investment grade bonds, dollar-denominated investment grade bonds and high-yield bonds.

? [Instit Invest]

"We have crossed the Rubicon: the positive relationship between #ESG and performance in the 2014-19 period shows that ESG is materializing to the point that it has become a factor"

Read ESG's evolution analysis on our #ResearchCenter ⤵https://t.co/EJDnYmTUzK pic.twitter.com/jZtDov9DEw— Amundi (@Amundi_ENG) February 11, 2020

Amundi said in a report: “We observe that ESG has had a more positive impact on euro investment grade bonds in recent years than on the US dollar investment grade and high-yield investment universes. Nevertheless, we observe a common trend that ESG is increasingly integrated into the pricing of corporate bonds and is a concern when building an investment portfolio.”

The asset manager had previously analysed the link between equities and ESG and found that it was source of outperformance from 2014 onwards. Thierry Roncalli, head of quantitative research at Amundi, said in the report that the fund manager intends this research to cover all the traditional asset classes

“We now turn to the question of the impact of ESG investing in the fixed income space, a domain that has yet to be fully explored by academics and professionals,” added Amundi. “Our new study shows that the performance of ESG investing has improved over time in corporate bond markets between 2010 and 2019.”

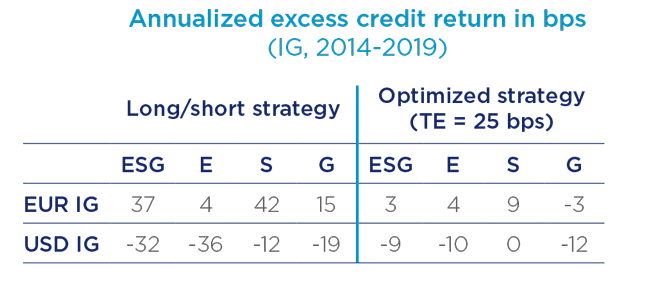

The research found that since 2014, the credit return of the long/short strategy between the 20% best-ranked ESG bonds and the 20% worst-rated bonds is positive in euro-denominated investment grade bonds for both the ESG global score and the three individual pillars of environmental, social and governance. Buying the best-in-class ESG-rated bonds and selling the worst would have generated an annualized performance of 37 basis points between 2014 and 2019.

In contrast, for dollar-denominated investment grade bonds, ESG investing was a source of underperformance from 2010 to 2019. Buying the best in class ESG-rated bonds and selling the worst would have led to a loss of 32 basis points over that period.

Alban de Faÿ, head of socially responsible investment fixed income processes at Amundi , said in a statement: “Contrary to common ideas, ESG investing may generate performance in euro investment grade bonds. In the case of US dollar investment grade bonds, ESG investing is penalized. But we are beginning to see the light, as the cost of ESG investing has been dramatically reduced these recent years.”

Amundi also found that issuers with higher ESG scores have lower cost of capital than issuers with lower ESG scores for the same credit rating.

“After controlling for the credit quality, we estimate that the theoretical cost of capital difference is equal to 31 basis points between a worst-in-class corporate and a best-in-class corporate in the case of euro investment grade corporate bonds,” added the fund manager.

In the case of US dollar investment grade corporate bonds, the theoretical cost of capital difference is lower but still 15 basis points.

Eric Brard, global head of fixed income at Amundi, said in the report: “On ESG, there is no turning back. The integration of ESG is now a matter of fiduciary duty for both asset managers and investors.”

MarketAxess’ green bond initiatives

The growing importance of ESG in bond markets was highlighted last month when MarketAxess, the electronic trading platform for fixed income securities and reporting, launched new capabilities to streamline clients’ trading and sustainable investing in green bonds.

MarketAxess said in a statement there was a 108% year-over-year increase in global green bond trading on its platform in 2019 to more than $19bn. Trade volume in bonds financing environmentally friendly activities on Trace, the US reporting platform, rose to more than $57bn last year, up from nearly $30bn in 2018.

We're going green… today we announced our #GreenBond trading initiative to support our clients' #sustainable investment strategies. @blackrock @Russell_Invest and @WesternAsset lend their perspectives to this important topic. Read more https://t.co/lVAJnj84UK #electronictrading pic.twitter.com/3J85m0btxJ

— MarketAxess (@MarketAxess) January 28, 2020

The new green bond trading functionality includes flags to easily identify green bonds, issuers and dealers and enhanced functionality to identify dealers that are providing liquidity in this market.

Ashley Schulten, head of responsible investing, global fixed income at BlackRock said in a statement: “As an active green bond investor, ease in identifying securities and sourcing qualifying issues is helpful in managing our growing sustainability focused funds and adds further support to this nascent but growing asset class.”

MarketAxess also launched a “Trading for Trees” incentive program last month in partnership with the One Tree Planted charity. The program will plant five trees for every $1m of green bond trading volume executed on MarketAxess. Based on global historical trading data, MarketAxess said it expects the program to plant over 100,000 trees this year.