There will be at least ten stablecoin launches backed by TradFi (traditional finance) partnerships according to researchers at Galaxy, the digital asset and blockchain firm.

Stablecoins are a type of cryptocurrency designed to maintain a stable price over time by pegging its value to a reference asset which is often a fiat currency, such as the US dollar, or a commodity as it is backed by collateral. Jianing Wu, research associate at Galaxy, said there will be at least ten stablecoin launches backed by TradFi partnerships in the firm’s Crypto Predictions for 2025: 23 Predictions for Crypto in 2025.

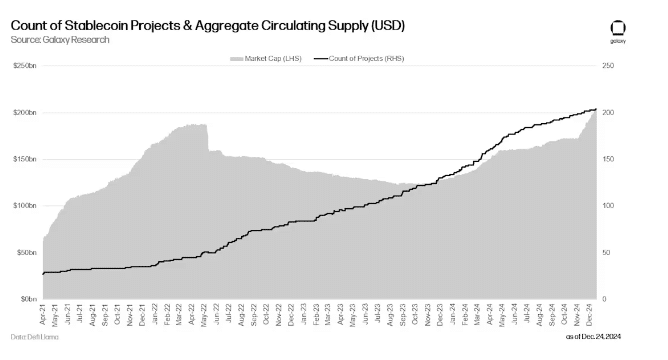

Galaxy said that between 2021 and 2024 the number of stablecoin projects has grown to 202, including several with strong ties to TradFi. Growth in transaction volumes have also been greater than that of major payment networks such as Visa. For example, the US-licensed FV Bank supports direct stablecoin deposits and Project Pax involved Japan’s three largest banks collaborating with payments system SWIFT to make cross-border money movements more efficient.

“In 2024, stablecoins are increasingly interwoven into the global financial system,” added Wu.

In addition, Galaxy said asset managers such as VanEck and BlackRock are collaborating with stablecoin projects to establish a foothold in this sector.

“Looking ahead, with growing regulatory clarity, TradFi players are expected to integrate stablecoins into their operations to stay ahead of the trend, with first movers poised to gain an edge by building the foundational infrastructure for future business development,” said Wu.

Alex Thorn, head of firmwide research at Galaxy, predicted that stablecoin legislation will pass both houses of US Congress and be signed by President Trump in 2025. He said the growing number of stablecoins backed by the US dollar is supportive of the currency’s dominance and Treasury markets, and lead to significant growth in stablecoin adoption.

However, Thorn argued that market structure – creating registration, disclosure, and oversight requirements for token issuers and exchanges, or adapting existing rules at the SEC and CFTC to include them – is more complicated and will not be completed, passed, and signed into law in 2025. He also predicted that total stablecoin supply will double to exceed $400bn in 2025.

“Stablecoins have increasingly found a product-market fit for payments, remittances, and settlement,” said Thorn. “Increasing regulatory clarity for both existing stablecoin issuers and traditional banks, trusts, and depositories will lead to an explosion of stablecoin supply in 2025.”

Coinbase, the US-listed crypto exchange, described stablecoins as crypto’s “killer-app” in its’s 2025 Crypto Outlook.

Stablecoins increased total market capitalization by 48% in 2024 to $193bn as at 1 December according to Coinbase, who believes the next wave of real adoption in crypto could come from stablecoins and payments, thanks to their ability to facilitate faster and cheaper transactions.

“Closer to the institutional front, we see significant potential in stablecoins and payments (bringing crypto and fiat banking solutions closer together), undercollateralized onchain lending (facilitated by onchain credit scores), and compliant onchain capital formation,” added Coinbase.

Stablecoins settled nearly $27.1 trillion in transactions through to 30 November 2024, almost tripling the $9.3 trillion in the same 11-month period in 2023 according to Coinbase, including significant volumes of peer-to-peer transfers and cross-border business-to-business payments.

“Indeed, businesses and individuals increasingly leverage stablecoins like USDC for their regulatory compliance and widespread integrations with payment platforms such as Visa and Stripe,” said Coinbase. “Indeed, Stripe’s acquisition of stablecoin infrastructure company Bridge for $1.1bn in October 2024 was the largest deal in the crypto industry to date.”

We believe this will be led by U.S. regulators such as the SEC, enabling more diversified financial or investment products associated with crypto such as ETFs or tokenized security products

— Franklin Templeton Digital Assets (@FTDA_US) December 30, 2024

We will see Major TradFi players and crypto infrastructure begin to intersect. A stablecoin regulatory framework in the U.S. is anticipated and will open doors for major financial institutions to issue their own stablecoins

— Franklin Templeton Digital Assets (@FTDA_US) December 30, 2024

Bitcoin will solidify its position as a global financial asset acting as a digital store of value, accelerated by sovereign and institutional adoption. We expect to see strategic BTC reserves added by several nations

— Franklin Templeton Digital Assets (@FTDA_US) December 30, 2024

We will see the convergence of AI and crypto accelerate, with blockchains providing transparency and verification, pivotal for expanding the AI-driven economy

— Franklin Templeton Digital Assets (@FTDA_US) December 30, 2024

Overall, 2025 will mark a shift from speculation to utility, as crypto's foundational technologies become integral to global financial and operational systems. Stakeholders should watch regulatory developments, institutional moves, and advancements in AI-crypto convergence to…

— Franklin Templeton Digital Assets (@FTDA_US) December 30, 2024