Dear client:

I know every year is crazy, but this year was REALLY crazy.

Sincerely,

Every CEO in financial markets (or just everyone)

Okay, but seriously, 2023 WAS different—even if the same sentiment applied to last year and the two before that—this time it was a unique mix of historic interest rate moves, a debt ceiling stalemate, major bank collapses and massive geopolitical instability. Despite all of these challenges, however, what’s been really fascinating is how well markets adapted.

Thanks to a combination of rapid-fire recalibration, innovation in the way we access new markets, and unprecedented levels of industry collaboration, market participants have evolved beyond just weathering the storms to developing entirely new tools and skillsets to better deal with future shocks.

It’s been a wild ride in 2023, and more than just hanging on we’ve moved markets forward. Thanks to changes in behaviors and the transformative potential of AI and other innovations, the table is set for the most exciting chapter yet in the history of electronic trading.

A Wild Ride for Fixed Income Markets

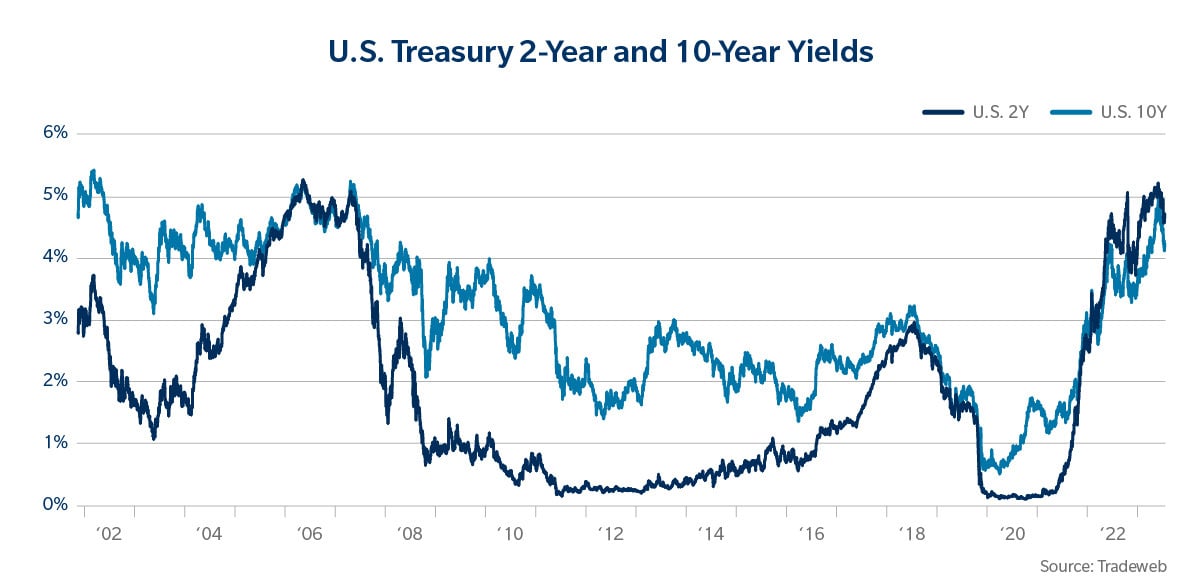

If there’s one image that captures the angst that colored fixed income market sentiment throughout 2023, it’s the chart below, which depicts the yields on the U.S. Treasury 2-year and 10-year notes over the last 17 years.

Following a period of historically low yields, the 2-year note moved nearly 150 basis points over the course of the year, rising from a low of 3.7% in May to a high of 5.2% in October. Meanwhile, 10-year Treasury yields were experiencing their own 170 basis point rise, nearly touching the 5% threshold in October. Throughout, the 2-year/10-year yield curve was inverted, reflecting market participants’ persistent concerns about the likelihood of a recession.

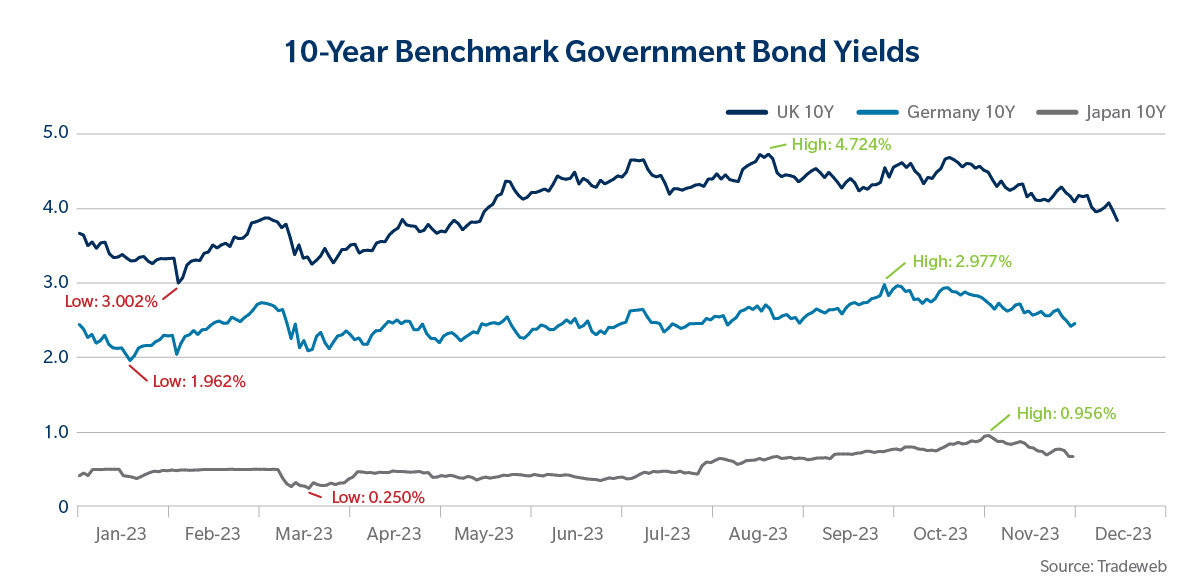

Similar patterns played out globally. We saw a 101 basis point rise from this year’s trough to peak in the 10-year German Bund, a 172 basis point move in the 10-year UK Gilt and even a 70 basis point move in the notoriously stable 10-year Japanese Government Bond.

Although the macroeconomic situation was largely defined by long periods of fear and uncertainty interspersed with moments of optimism, one thing was certain: bond yields were attractive again. Throughout the year, fixed income market participants stayed in the game, taking each new aberrant move in stride and adjusting their course accordingly. Through November, we continued to see record trading volumes on our platform. Average daily volume (ADV) in U.S. government bonds was up 19.5% year-over-year (YoY), European government bond ADV was up 30.5% YoY, Japanese government bond ADV was up 31.9% (42.8% in JPY) YoY, fully electronic U.S. credit ADV was up 32.0% YoY and European credit ADV was up 29.7% YoY.

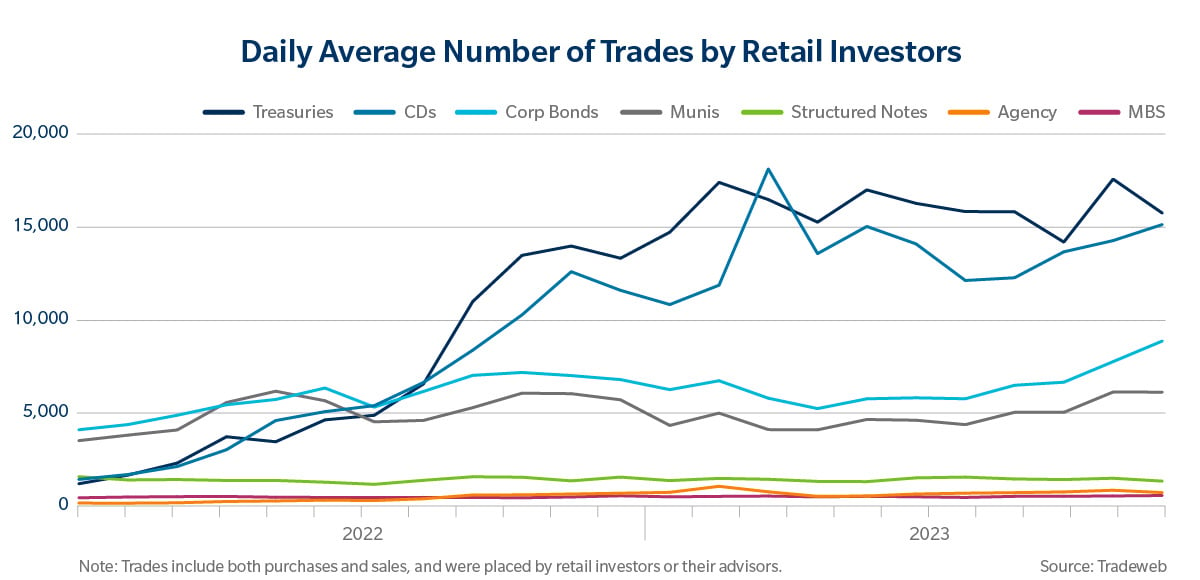

The enthusiasm for bonds was not only felt by the institutional community. Retail investors, having previously strayed from the conventional 60/40 investing strategy toward a greater equities focus, now gravitated toward bonds for increasingly attractive yields. On our Tradeweb Direct platform, we saw the number of daily retail trades in some areas soar over the last year, as retail investors embraced Treasury bonds and brokered certificates of deposits.

Toward the end of the year, we also saw institutional and retail investors take advantage of the recent yield volatility to book advantageous losses through tax-loss harvesting – an opportunity rarely available to this market given munis’ historic stability. Municipal bid wanteds routed on our platform spiked, with October sell inquiries 65% higher than the August year-to-date average and November liquidation requests 70% above that level.

Another particularly interesting trend was the continued institutional focus on fixed income ETFs, which have proven to be an indispensable product for investors looking to transfer risk quickly and at a lower cost. According to data from Invesco, in Europe, fixed income ETFs have seen record annual inflows over the past 12 months, with bond ETFs accounting for $63 billion (bn) of net new assets in 2023, surpassing the inflows seen in 2019. What’s more, in the first three quarters of this year, fixed income ETFs boasted $51.6bn inflows, making up a staggering 49% of all ETF inflows in Europe. We expect this trend to continue into 2024, as the heightened focus on trading costs, cross-asset expertise and expanding electronic trading offerings in corporate credit pick up steam.

Marketplace Evolution

The resilience of fixed income markets and players throughout this period of idiosyncratic risks can be chalked up to the mental toughness we’ve all developed over the last few years. But there’s more to it than that. We’ve also evolved quite a bit when it comes to new approaches to trading and price discovery, and a collective spirit of innovation that has fundamentally changed market structure.

For example, one area where we saw a significant change in market participant behavior was in the use of electronic and automated trading protocols in places where phone-based trading was once dominant. This evolution manifested itself in a couple of ways. First, we saw a remarkable level of “stickiness” in electronic trading volumes throughout the period of extreme volatility we experienced in March, coinciding with the Silicon Valley Bank (SVB) and regional banking crises.

These banking failures were some of the biggest crises to impact market confidence since 2008, but the underlying infrastructure of electronic credit markets was largely unaffected. In fact, overall trading volumes across protocols including portfolio trading, request-for-quote (RFQ) and sweep sessions held strong throughout the crisis period. Even Tradeweb’s Automated Intelligent Execution (AiEX) tool’s volumes were largely unaffected by the crisis, dipping briefly during the immediate aftermath of the SVB collapse and then normalizing by the end of March. This is a significant departure from the early days of electronic trading, when the slightest blip in macroeconomic data would send traders back to their phones seeking stability. Now, market participants are realizing that they have more options and more visibility on electronic markets during periods of volatility and they are increasingly riding out the storms on their screens.

Another area where we saw major changes this year was in the accelerated adoption of our request-for-market (RFM) protocol in emerging market interest rate swaps. We believe that ability to deliver transparency while simultaneously preserving client intent has become an incredibly valuable tool in emerging markets interest rate derivatives during periods of increased volatility, and it’s an area where we expect to see continued innovation over the coming months and years.

Next Generation of Pricing and Trading is Now

We also got some glimpses of the future amid all of the tumult of the past year. One of those revealed itself in the trading activity of hedge funds on our platform, with some funds increasingly incorporating AiEX into their systemic trading strategies. The AiEX technology, which was originally conceived as an efficiency tool to free up traders’ time by automating low-touch tickets, has evolved to move in new areas, now that it’s gotten into the hands of some of the world’s most sophisticated traders. Rather than merely replacing existing manual workflows, AiEX is creating entirely new avenues of trading across various asset classes and trading environments.

As hedge fund clients began to experiment with AiEX during different market conditions, they found they could deploy various trading protocols such as RFQ and RFM in a more automated fashion to maximize results. Similarly, clients leveraged our click-to-trade protocol within AiEX, allowing them to determine when, at what level and with whom to execute their trade, all while creating a minimal market footprint.

Together, this collective spirit of innovation combined with the wide availability of technology that makes it possible to maximize liquidity and improve transparency, is helping market participants find new ways to navigate challenging economic scenarios.

That’s a trend we’re doubling down on as we look to future product development and opportunities to work closely with clients and partners. An example of this is the strategic partnership we announced with FTSE Russell in October to develop the next generation of fixed income pricing and index products. The goal of that effort will be establishing benchmark fixed income closing prices and extending pricing coverage to the majority of constituents featured in the FTSE Fixed Income Index universe.

Across virtually every client interaction and every different market environment we encounter, it’s become clear that the availability of more reliable and transparent data coupled with the rise of new innovations brought on by electronic trading, have led to unique opportunities to find liquidity and carve out a strategic edge, and we’re committed to leading that charge.

The Way Forward

The rapid pace of change and instability we’ve all experienced over the past few years is not showing any signs of going away.

Meanwhile, businesses are investing trillions in generative AI and other technologies that will transform the way we access and process information, and market participants continue to experiment with new ways to cover more ground faster. What’s more, technology advancements like AiEX are turbo charging an electronic trading revolution across asset classes. The $10 trillion U.S. corporate bond market, for example, is going through its own metamorphosis, as the combination of electronic trading, sophisticated algorithms and ETFs is helping to boost liquidity and attract new players to the game. As an example of the trend toward more sophisticated trading, most recently, we’ve taken our intelligent execution capabilities even further by announcing a definitive agreement to acquire r8fin, a technology provider specializing in algorithmic-based execution for U.S. Treasuries and interest rate futures.

The path ahead will not be an easy one, but we will find our way forward by continuing to work together to make continuous improvements to the way markets operate. By looking across products, across geographies and across the technology landscape, our clients are finding that even the smallest tweaks to conventional trading protocols and creative approaches to seemingly insurmountable challenges can yield dramatic changes in outcome.

As we turn the page on a new year, I am certain about two things: events that we never could have imagined, much less planned for, will occur, and ingenuity and grit will help us navigate our way through them. I look forward to working with all of you to keep leading that way forward. Thank you to our clients and employees for your continued collaboration and support, and wishing you all a happy holiday season and a prosperous new year.

-Billy Hult