Sébastien Rozès, EMEA chief executive at TP ICAP, said the interdealer broker tripled its amount of carbon emission trading last year and has created a centre in Brazil as 80% of its activity in the country is linked with renewable energy.

TP ICAP’s Brazilian power team has operated since October 2021 to allow institutional market participants across the world to trade the country’s energy – over 80% of which is renewable as the country has the second- largest hydropower capacity in the world. Subsidiary Tullett Prebon said it is the first international brokerage company to transact an energy deal in the Brazilian market using OTC broking .

The group’s sustainability report for 2022 said energy and commodities division brokered 1.8bn CO2 metric tonne equivalents of emissions credits, and 77m metric tonnes of voluntary emissions credits, up 271% on 2021. In addition, TP ICAP launched a client-facing Fusion screen covering Green Certificates in Norway.

Rozès told Markets Media: “There are lots of things which make us relevant as we link those producing green assets with those who can invest.”

He continued that as a broker TP ICAP does not invest, finance and or insure sustainable investment. Instead, the broker’s role is to provide connections.

For example, in April this year TP ICAP invited experts from the public and private financial sectors to discuss sustainable finance in a conference in Paris. Two panels discussed how to deploy public finances in the climate change transition and the impact of private investments on sustainability.

“Our role at TP ICAP is to connect through our people and technology, here in the context of this event the public and private sectors, and to provide liquidity and data solutions to drive change,” added Rozès. “Via these connections, it is really important to promote sustainable finance in our ecosystem.”

Pierre-Alexandre Moussa, head of climate and sustainable investment solutions at TP ICAP, told Markets Media that sustainable finance has had a difficult time due to widely-publicised greenwashing practices.

“We wanted to demonstrate to the attendees that good practices do not only exist, they also allow investors to achieve strong financial performance,” he added. “According to an ESMA study based on 2020 data, ESG funds can provide a stronger return than non-ESG funds, which is a new paradigm.”

The conference was attended by approximately 80 to 90 investors ranging from leading asset managers, pension funds and private banks for this third sustainability event. At the first conference in March 2022, TP ICAP had 50 attendees, so Moussa said interest has been increasing.

The presence of senior French officials and other government agencies, including the French Treasury and, previously, the French Minister for SME’s, demonstrates the importance of the topics covered and of connecting public bodies with private investors according to Moussa. For example, panellists included staff from the Banque de France, Agence France Trésor and Ademe Investissement, French government agency for the environmental transition.

Moussa added: “The United Nations has estimated it will need $7,000bn per year until 2030 to finance the 17 Sustainable Development Goals and the transition, so the purpose was to convince attendees to increase their investment, by trying to improve their understanding of the way forward.”

In addition, the European Union’s new regulatory framework came into force in March 2021, which makes it mandatory for financial investors to disclose their sustainability exposure and Moussa said TP ICAP can allow clients to be at the forefront of best practice.”

“Finance is a very powerful tool that can support the environmental transition at the crossroads of capital flows,” said Moussa. “Sustainable finance will become mainstream and the regulatory framework is reshaping the asset management industry which is why we have to make sure our clients are set up for success.”

ESG strategy

Rozès continued that the group defined its environmental, social and governance strategy in 2021 around three priorities – to ensure it measures and reports on its ESG performance; to support clients in the energy transition and to have a positive impact both economically and socially in the various communities in which it operates.

The group also made a commitment to incorporate mandatory ESG scoring into the evaluation, and approval process, for new business initiatives by the end of 2022, which Rozès said is operational. The sustainability report said the firm added a mandatory ESG questionnaire to the Change Management Framework process through which all new business initiatives are reviewed.

“The questions focus on emissions, gender representation, and type of asset class. They seek to identify risks and opportunities associated with any new business initiative,” said the report. “The outcome is an ESG score that forms part of the information for approval that the Change Subcommittee reviews.”

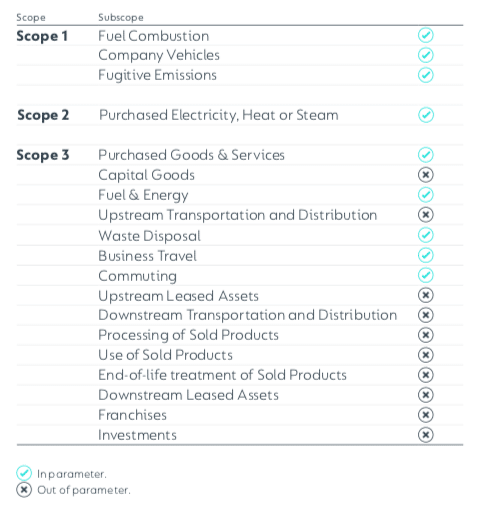

TP ICAP reports on Scope 1 and 2 and is working on Scope 3 with suppliers.

“We reduced Scope 1 and 2 emissions by over 20% last year and the effort continues,” he added. “Our aim is to be net zero on Scopes 1 and 2 greenhouse gas emissions by the end of 2026.”

Scope 1 emissions cover GHG emissions that a company makes directly while Scope 2 are indirect emissions. Scope 3 emissions are those that the organisation is indirectly responsible for throughout its value chain, for example, from buying products from its suppliers.

TP ICAP said in the 2022 sustainability report that emissions reduction was a primarily due decrease in the number of office locations and data centres, principally because of the ongoing property rationalisation programme, including the Liquidnet integration.

“2022 was a peak year for the property rationalisation programme; we do not anticipate maintaining the same pace of consolidation,” added the report.

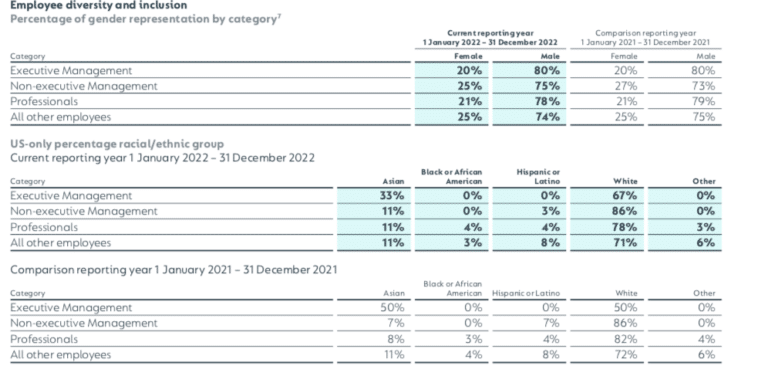

As part of its ESG strategy, TP ICAP has a target for increasing female representation in non-broking staff from 34% to 38% by the end of 2025 and has already reached the 25% target for women in senior manager roles by the end of 2025 according to Rozès.

“We are promoting diversity and inclusion in every respect,” he added. “We recently appointed Claire Harvey MBE, a GB Paralympics champion, as our new Group head of Inclusion, Diversity and Engagement, and she has many great ideas.”

Rozès said that a for-profit organisation, TP ICAP also wants to hire and retain the best talents.

“Our colleagues service key banks and asset managers and I believe it is essential we promote our ESG-centric solutions, as this will drive sustainable returns for us, for our clients and for society,” he added.