TP ICAP, the inter-dealer broker and market infrastructure provider, has added Standard Chartered as a custodian for its regulated spot crypto exchange, which is meaningful for institutional adoption.

Simon Forster, global co-head of digital assets at TP ICAP, told Markets Media said that when TP ICAP was thinking about building a crypto business, the firm knew that the business, and particularly the spot exchange, would need to connect to multiple custodians in order to scale and to meet clients’ preferences.

Segregation of execution and custody was one of the key principles on which the exchange has been built. Fusion Digital Assets is a UK-based spot cryptoasset exchange that is registered with the Financial Conduct Authority.

The exchange launched with custody provided by Fidelity Digital Assets and TP ICAP wanted to add a complementary custodian. TP ICAP said in a statement in October that it would connect Fusion Digital Assets to Standard Chartered’s recently announced digital asset custody product.

Standard Chartered launched its digital asset custody service in the UAE in September to initially support bitcoin and ethereum, after being granted a licence by the Dubai Financial Services Authority.

Bill Winters, group chief executive of Standard Chartered Bank, said in a statement: “We firmly believe that digital assets are not merely a passing trend, but a fundamental shift in the fabric of finance,”

Brevan Howard Digital, the dedicated crypto and digital asset division of Brevan Howard, was the inaugural client for the product. Gautam Sharma, chief executive of Brevan Howard Digital said in a statement that Standard Chartered’s global reputation and demonstrated commitment to this space adds a layer of credibility that is meaningful for institutional adoption.

“Standard Chartered is the sort of participant that our clients are used to, and this is the sort of infrastructure that is important to bring in the next wave of risk capital into this ecosystem,” added Forster.

Fidelity has an international digital assets business but is more US-centric, while Standard Chartered has a bigger presence in Middle East and Asia. Forster described the scale of Standard Chartered’ presence outside the US and Europe as almost “unparalleled.” He continued that Standard Chartered is a global investment bank which resonates with both TP ICAP and its customers.

“We have known the team at Standard Chartered for many years,” he added. “It feels like a natural and obvious fit in terms of brand, and our focus and appreciation for all things regulation.”

A number of clients have contacted TP ICAP since the announcement to say that they are exploring spot crypto and Standard Chartered makes that more interesting, according to Forster. He said: “We feel the opportunity this creates is going to be pretty significant.”

Margaret Harwood-Jones, global head of financing & securities services at Standard Chartered, said in a statement: “This collaboration represents a significant development in the digital asset landscape by providing institutional traders and investors with a seamless, secure, and regulated environment for their digital asset activities.”

Growth

Five years ago TP ICAP launched a crypto brokerage business, which focuses on derivatives on regulated exchanges and ETFs. Forster said the broking business had a very good year in 2024, which reflects the maturity of the asset class, but also the consistent and measured approach that TP ICAP has taken.

“We have had to be very patient, but this now looks like a nice little business for the firm, and we think there is huge growth ahead ,” he added.

The Fusion Digital Assets spot crypto exchange has been live all this year and Forster said the firm started to see traction in the second half.

“It has been a serious undertaking and a long journey for us to stand up a crypto exchange under the purview of the FCA as a traditional financial institution,” he added.

This year TP ICAP has been doing a lot of work behind the scenes to make sure that the exchange can scale and is connected to the firm’s internal control systems.

“We feel very confident that the exchange is going to be robust and scalable,” said Foster. “A lot of our clients are thinking about accessing the spot market and it feels like we are certainly on a short list of institutional exchanges and partners that they are going to consider.”

As a result, taking a big step forward on the exchange will be a focus for 2025, including building out product, functionality and adding more custodians. Forster said: “The story of 2025 is going to be volume.”

Outlook

Sygnum, the Swiss regulated digital asset bank, said in its market outlook for 2025 that the crypto industry has long been anticipating the time when institutional investors regard crypto as a legitimate asset class and allocations become standard practice.

Katalin Tischhauser, head of research at Sygnum, said in the report: “2025 may be the year when this happens.”

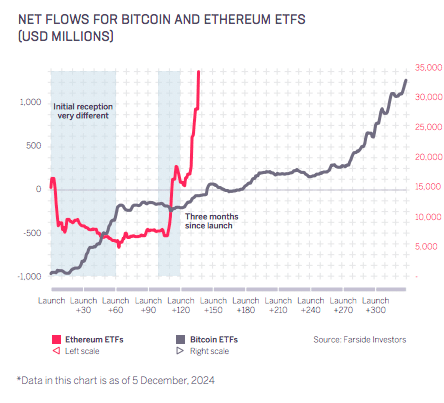

Forster believes the industry will collectively look back and say 2024 was the year that things changed for crypto, starting with the regulatory approval in spot bitcoin exchange-traded funds in the US in January.

“The amount of capital that has got into those products is pretty staggering,” he added.

In addition, the ETF issuers are amongst the most significant traditional finance firms which Forster said has validated crypto. For example, Larry Fink, the chief executive of BlackRock, has spoken positively about bitcoin and ether.

“I think that was a watershed moment,” said Forster.

In addition, the incoming Trump administration is enthusiastic about crypto and is likely to introduce favourable regulation, which will allow many more institutions to enter the market. Sygnum agreed that 2025 is likely to see regulation in the US that clarifies the status of crypto assets, and this would be transformative for the industry.

“We are well placed to capitalize on what we think may happen in the US,” added Forster. “I think this year has been really significant.”

In this optimism proves valid, Forster expects that during 2025 and beyond, traditional financial institutions will race to become relevant in crypto, especially if the industry coalesces around forms of digital money that will be used, such as stablecoins.

He argued that TP ICAP will have an advantage from being consistent over the last five years and developing relationships. TP ICAP is now familiar with crypto as an asset class across all of the firm’s control functions and three main regions, which Forster said cannot be fast tracked.

In addition, he believes the crypto business will benefit from TP ICAP’s distribution network.

“The firm has been very patient with this asset class and is aware that it takes time to build a meaningful business,” said Forster. “Moving into 2025 our crypto business has started to become a much more significant story for the firm, and we are excited to see that.”