Citi has completed a proof of concept on tokenizing private funds with fund managers Wellington Management and WisdomTree, while private markets manager Hamilton Lane is using blockchain to expand access to one of its funds.

Private markets are illiquid, rely on an infrastructure that is complex and heavily manual, suffer from a lack of standardization and transparency, and often have complex legal and regulatory restrictions.

As a result, private markets is one of the areas of traditional finance that could benefit most from tokenization, the process of using blockchain technology to convert an asset or ownership rights of an asset to digital form. Putting assets on-chain could revolutionise traditional markets by allowing instant settlement and the ability to rapidly transfer assets, reducing risk and potentially increasing liquidity.

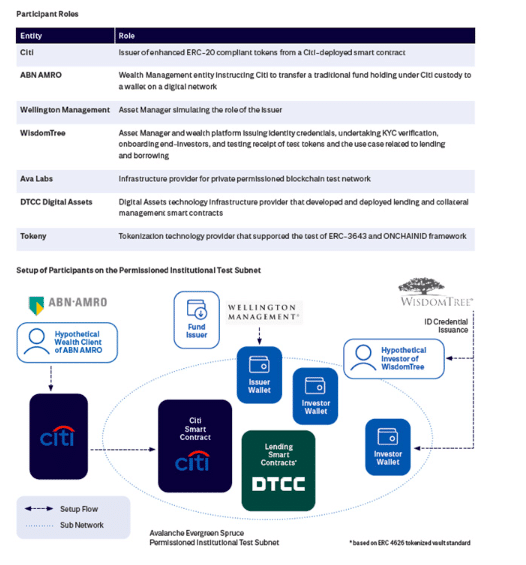

In February this year Citi said in a statement that it had successfully completed a private markets proof of concept conducted on the Avalanche Spruce institutional test Subnet. Wellington issued a private equity fund on a distributed ledger and ABN Amro simulated the role of a traditional investor. The underlying fund distribution rules were encoded into the smart contract and embedded in the token transferred to hypothetical WisdomTree clients.

Nisha Surendran, emerging solutions lead at Citi Digital Assets, told Markets Media that the bank has been working closely with a group of asset managers, including Wellington Management and WisdomTree, around exploring digital assets because this space is evolving so quickly in order to exchange ideas and approaches and learn from each other’s experience.

“Wellington and WisdomTree joined Avalanche Spruce in April 2023, along with a few other buy-side firms, and they requested that Citi join the permissioned network as a sell-side institution to test joint use cases,” she added.

Mark Garabedian, director, digital assets & tokenization strategy at Wellington ManagementT said in a statement that Avalanche Spruce test network has proven to be an ample technical sandbox environment for coming together with partners and exploring the potential of blockchain technology within the industry.

Working closely with Wellington Management gave Citi a perspective into the view of an asset manager and how they are evaluating a scalable operating model. WisdomTree brought some unique insight because the fund manager has launched some initial digital funds in the market, so the firm has a wealth of experience on how to build and deploy production grade solutions in this space.

The bank’s primary objective of joining the Avalanche Spruce Permissioned Institutional Test Subnet was to evaluate the legal and operating framework for tokenizing traditional funds.

“We wanted to test our smart contract rules and conditions to enforce compliance by design and to enable permissioned distribution,” said Surendran.

Maredith Hannon Sapp, director of business development, digital assets at WisdomTree, said in a blog that the proof of concept highlighted that tokenization and smart contracts could automate operations, improve efficiency, eliminate errors and create standardized identity credentials.

Use cases

In the proof of concept, Citi evaluated multiple transfers using smart contracts relying on simulated identity credentials issued by WisdomTree and using a private fund token as collateral in an automated lending contract with DTCC Digital Assets.

Nadine Chakar, managing director at DTCC and global head of DTCC Digital Assets, said in a statement that the financial market infrastructure believes digital asset technology offers exciting potential to capture benefits and could ultimately lead toward a more streamlined and resilient financial ecosystem where blockchain networks and traditional rails seamlessly integrate.

“We are committed to supporting the industry shift from blockchain experiments to production-ready capabilities,” Chakar added.

Citi also wanted to experiment with standards as the bank considered use cases for security tokens and to kick start it exploration around identity models, which are very important for permissioned access.

WisdomTree tested use cases including tokenizing a traditional private fund with embedded smart contract-based distribution rules, such as jurisdiction or investor status requirements, that could be sent cross-chain to a WisdomTree client/investor; testing identity/credential-based transfers through smart contracts with WisdomTree issuing credentials, as a wealth management platform, to investors’ wallets.

Surendran continued that using tokenized assets in the context of more open networks requires industry-wide identity models and standards, so regulated institutions can rely on know-your customer credentials issued by other regulated institutions to enable permissioned distribution.

“Operational efficiency by itself is not going to make a valid business case but tokenisation will become valuable in combination with enabling investors to do new things which they cannot do in the traditional form of the asset,” she said.

Citi also wanted to explore additional use cases, which go beyond a new format for investors to hold assets. Hannon Sapp said the proof of concept also demonstrated the potential of smart contracts to automate the workflow of securities lending.

WisdomTree tested utilising smart contracts to use a tokenized private fund as collateral in an automated lending contract to borrow WisdomTree money market fund tokens.

“We will slowly start seeing more use cases and a lot of value come from moving beyond distribution to secondary trading, or collateral, because these cannot be done well in a traditional form of the asset today,” added Surendran.

She gave the example of investors typically getting in very early in a traditional private equity fund and holding it for 10 to 12 years. Tokenization could enable them to get in and out through the lifecycle of the fund could be really powerful.

The main areas where Citi sees tokenization and digital assets making the most impact include digital money, trade, securities, custody, asset servicing, and collateral mobility.

“We are working on a number of collateral management use cases internally and externally,” said Surendran.

Citi piloted token services for cash and trade last year and Surendran said other tokenization initiatives are in various stages of exploration and development. She added that the bank will continue to develop digital asset solutions in line with its risk appetite, its unified set of technology capabilities and a common strategic approach focused on its products and services.

Challenges

Although the proof of concept was successful, challenges remain in making the use of tokenization mainstream in traditional financial services.

Hannon Sapp said legal considerations, identity standards, data flow, privacy concerns and compatibility with existing standards need to be further evaluated in collaboration with regulators.

“We believe that the financial services industry should work collaboratively to build an identity infrastructure to facilitate wider tokenization adoption, addressing jurisdictional complexities and ensuring data security in digital networks,” she added.

Surendran continued that regulatory certainty and consistency is required in global approaches. In any tokenization project multiple institutions will play different roles and it is very likely that they will be based in multiple jurisdictions.

Contractual rights embedded in the tokens and how they enforce obligations such as anti-money laundering and their tax implications also need to be considered.

In addition, Citi anticipates that the biggest challenge will not be the technology, but more around the different market participants coming together and committing to a shared vision, and especially around adopting standards as the technology is still maturing. Surendran explained that technology to wrap a traditional asset and issue a digital token is fairly straightforward, but the industry needs to solve adjacencies such as digital documentation, end-to-end data rails and automated asset servicing.

“The challenges around data and digital documentations being worked on across the whole ecosystem and tokenization is very dependent on all these other enablers coming together to be really impactful,” she added.

There are also operational challenges such as bridging the atomic real-time settlement of tokens against the longer settlement timeframe for the traditional asset. For example, net asset values (NAVs) for private funds are not propagated in real time, so valuation data would have to be bought on chain in a more systematic way tokens to be used as collateral.

Surendran said a form of tokenized money is needed to enable the benefits of atomic settlement, which could be a central bank digital currency, tokenized bank deposits or even a regulated stablecoin.

“Programmable money coming together with programmable assets will make new use cases possible,” she added.

Despite the challenges Surendran still expects that meaningful steps will be made across the industry this year in tokenization..

“For Citi, the proof of concept was a big step in terms of our exploration of private markets and we think there could be meaningful steps towards bringing tokenized assets on chain,” she said.

Hamilton Lane private fund tokenization

One real life use case is the tokenization of Hamilton Lane’s Luxembourg based $3.8bn Global Private Assets Fund, which the firm said has had an annual average performance growth of 14.6% since 2019.

On 29 February 2024 Swiss digital asset banking group Sygnum, private markets manager Hamilton Lane and financial services firm Apex Group said in a statement that they are expanding access to private markets through issuing new shares on the Polygon blockchain.

The statement said that using DLT allows the minimum investment to be a significantly lower fund entry point than direct investments into traditional private markets’ evergreen funds. These DLT-registered shares will be available exclusively to Sygnum professional, institutional and corporate clients.

The firms said novel project aspects include the “fractionalisation” of assets to enable smaller investment entry-points, streamlined compliance, the end-to-end automation of the on-chain share registry and transfer agent activities, as well as increased levels of transparency due to the open nature of DLT.

Fatmire Bekiri, head of tokenisation at Sygnum , said in a statement: “The new DLT-registered share class in Hamilton Lane’s GPA Fund marks the first entry in Apex’s on-chain share register. This is a significant breakthrough in making private markets more broadly accessible and investible via DLT solutions.”