The Investment Association (IA), the trade body and industry voice for UK investment managers, is about to open applications for the eighth cohort of its Engine Innovator Programme, part of its ambition to help the asset management industry embrace new technology and work with fintechs.

Gillian Painter, head of membership and Engine at the Investment Association, told Markets Media that she was “really proud” of the Engine Innovator Programme.

“We are in our seventh cohort, and it has gone from strength to strength, she added. “We are about to open applications for our eighth cohort in September.”

IA launched a specialist fintech accelerator for the asset management industry in 2018, which was then called Velocity. The six-month accelerator programme aims to connect best-in-class fintechs innovators with asset managers looking to transform the investment process. The participating fintechs gain access to industry experts, exposure to potential clients in the asset management sector, as well as guidance from experts and an advisory panel of senior industry leaders and digital technology specialists.

In 2020 Velocity was rebranded as Engine which the trade body said reflected the growth and maturing of the IA’s fintech ambitions. Since launching its fintech hub, the IA had expanded the accelerator in London, launched its co-working ‘Engine Room’ in Birmingham, and developed global fintech initiatives and partnerships.

The IA now has over 150 firms in its Engine ecosystem and 14 global partners, which has helped fintechs build industry connections and been instrumental in their growth by offering mentoring and support, according to Painter. She added that one firm said it had generated over £1m a year in additional annual revenue due to the support of Engine.

The association itself has worked with fintechs that have been on the innovator program. Fundipedia has worked on IA’s share class register and other data initiatives, and the IA has partnered with Gretel on the dormant assets portal. Painter said: “We eat our own cooking.”

In addition, three out of the five firms have female founders in the latest cohort of innovators.

“There is research that suggests that female founders are considerably more effective – in fact, firms with female founders achieved over 30% more turnover growth than those with male only founders – and that is part of the growth agenda,” added Painter.

She highlighted that artificial intelligence is “absolutely at the forefront” of the new technologies being investigated by asset managers because AI enables the sector to boost productivity, while improving decision making. Fund managers can also use AI to manage personalized portfolios, enhance the efficiency of deal teams, draft white papers and communicate directly with clients.

Distributed ledger technology and the tokenization of assets are other areas of interest according to Painter, as they are looking at the opportunity to improve efficiency and transparency.

“Since Engine was set up, asset management has really embraced innovation in a far more open way,” said Painter. “The Investment Association has an innovation agenda, because that is ultimately how the sector is going to grow and develop.”

SPARKS and Advanced Access

In order to further boost innovation, the IA launched SPARKS in 2021 to kickstart fintechs in their initial stage of growth and allow them to work closely with experts to develop their industry proposition.

“We have to search out firms for SPARKS because they are at a super early stage,” said Painter. “We are able to support them before they have even developed their proof of concept and enable them to have the conversations to pivot early, rather than spending time, effort and money to create something that is not relevant for our industry.”

SPARKS runs in November so Painter said the IA is “very keen” to talk to firms and has an application process that really helps define their value proposition. Painter hopes that fintechs will go from “cradle to unicorn” through the SPARKS programme, into the Innovator Program and then transition to the Advanced Access Programme over the years.

The Advanced Access initiative was launched at the beginning of 2024 to target maturing fintechs, that are larger, more established firms. Painter described these types of fintech as too big for the Innovator Programme but still providing useful innovation. The new three-month initiative provides opportunities for them to showcase and share what they are doing through connectivity and engagement with the Engine advisory panel and the ability to access the wider IA membership.”

The first two firms chosen for the Advanced Access initiative were Here, then called OpenFin, a unified workspace for enterprise productivity used by over 90% of major global banks, and FINBOURNE Technology, which provides cloud-based investment data management software.

Chris Brook, co-founder and head of architecture at FINBOURNE Technology, said in a statement that collaborating with IA and its wider member base will enable the firm to demonstrate the value of its innovative solutions. Vicky Sanders, chief digital officer, at Here added in a statement that the firm’s tried-and-tested technology enables firms to boost their enterprise productivity through better workspace management, app utilisation and workflow automation.

In April 2024 IA Engine also published a whitepaper which Painter said provides visibility and openness to build greater understanding of procurement and onboarding processes, which can be “super helpful” for both asset managers and fintechs. Thepaper was created in collaboration with 28 investment management firms that sit on Engine’s advisory panel as well as firms from Engine’s fintech growth panel.

Painter said the white paper was the first that IA Engine produced as a collective with input from both asset managers and fintechs in its ecosystem. She added: “We are incredibly proud of the paper because it’s useful, allows both sides to really understand what we can do and see where opportunities exist.”

Global partnerships

Another boost for innovation is by forming global partnerships. IA has 14 global partners and Painter said they are vital for growth going forward.

“The UK is seen as the home for innovation but it’s really important that we have cross pollination and exchange, and we want to make sure they are relationships that we can actively foster,” she added.

IA recently added Uzbekistan, which Painter described as a really interesting conversation in terms of a very young economy. South Africa and Poland are looking to come on board this year and in the US, IA is talking to hubs in New York City, Washington and South Carolina.

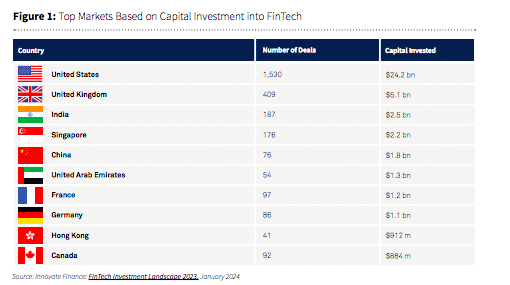

There was a fall in fintech investment in 2023, but Painter said the IA has reported an increase in fund inflows in the first half of 2024, indicating improving investor confidence. She said the UK fintech sector is growing again, particularly in the first half of this year, and there is a hope that there will be signs of economic recovery in the last part of this year. In addition, the UK is still the largest fintech hub in Europe and the second globally behind the US.

“We need to ensure that confidence continues to grow as fintech provides cost reduction, and increases efficiency and investment, so it’s a win for all sides,” said Painter. “Our member firms are very aware of innovation being critical to success so we are raising awareness and showing available opportunities.”