Canadian TD Bank Group’s acquisition of Cowen, the US independent dealer, could make it more difficult for smaller hedge funds to find prime brokerage.

On August 2 TD Bank announced the acquisition of Cowen in an all-cash $1.3bn transaction. The Canadian bank said TD Securities will accelerate its long-term growth strategy in the US by acquiring a high-quality and rapidly growing investment bank with highly complementary products and services.

We are proud to announce that we have entered into an agreement to be acquired by The Toronto-Dominion Bank (“TD”) & become part of the team at TD Securities, the investment wholesale bank division of TD. Refer to this press release here for more info: https://t.co/pMd1KIkUmZ pic.twitter.com/qPeEhKM3EO

— COWEN (@Cowen_Inc) August 2, 2022

The deal is expected to close in the first quarter of 2023. The combined business will then be known as TD Cowen, a division of TD Securities, and will be headed by Jeffrey Solomon, currently chair & chief executive of Cowen.

Andy Volz, chief operating officer at Clear Street, told Markets Media that the deal was not a surprise as Canadian banks, in general, have a lot of cash and have been making a push into the US market.

“My belief is that TD acquired Cowen for the research and investment banking franchise,” he said. “It will be interesting to see what happens with Cowen’s introductory prime brokerage business as TD already has a self-clearing prime business.”

Clear Street was launched in 2018 by industry veterans to build better infrastructure for capital markets. The firm’s first product is its cloud-native prime brokerage platform, which provides for clients trading U.S. equities and options.

Volz said there has already been a fair amount of consolidation in the industry, and there is definitely a tightening within prime brokerage.

“As one of the main independent providers was just acquired, the $5m to $500m hedge funds will generally have more trouble finding a home,” he added. “The industry needs independent non-bank prime brokers more than ever.”

Bharat Masrani, group president and chief executive of TD Bank Group said on a call about the acquisition that the firm had aspired for a long time to build an integrated North American franchise with global reach.

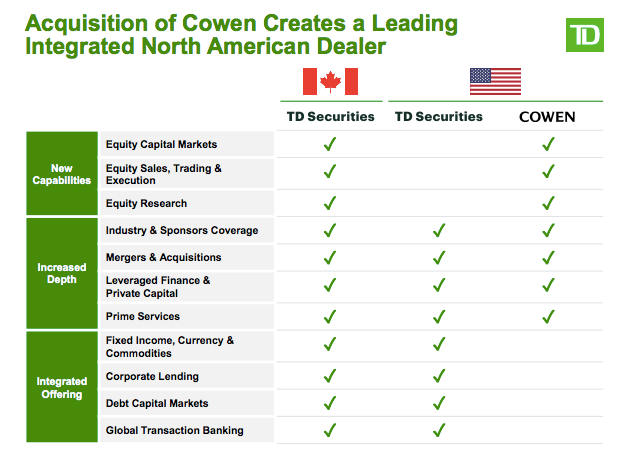

Masrani said: “The acquisition of Cowen will add key capabilities to our growing global markets platform – in US equities sales and trading and in US equity research. It will also add scale and industry expertise across US capital markets and M&A advisory.”

Riaz Ahmed, president and chief executive of TD Securities, said on the call that Cowen’s strengths are highly complementary to TD Securities’ existing businesses, with minimal overlap and accelerate growth by five, if not 10, years.

Ahmed continued that the acquisition will add new capabilities in US equities, including a strong sales, trading and execution platform and research covering 985 securities, about 45% of the S&P 500. In addition, Cowen will add scale and expertise in industry coverage, middle-market sponsors coverage, M&A advisory and public and private capital markets.

“The combination with Cowen is the next phase in our evolution, as we continue to build a leading integrated North American investment bank,” added Ahmed. “On a pro forma basis, this transaction would increase TD Securities’ revenue by over a third, bringing global revenues to just under $7bn, and more than doubling our US revenues.”

Solomon said on the call that Cowan has grown revenues from $288m to $1.5bn in the past decade.

“We have leading industry research, strength in key growth industry verticals as well as top-tier algorithmic trading and equities execution platform,” said Solomon. “The combination with TD Securities will allow us to better serve our existing clients – by providing access to an expanded range of products and services, and by leveraging TD Securities’ strong balance sheet and transaction banking capabilities.”

Michael Brown, an analyst at KBW, said in a report that the acquisition was a good outcome. He added: “While a subset of investors may have been expecting a higher price tag, we believe the $39 per share valuation—a 62% premium to the pre deal news price—represents a good outcome for investors, particularly when viewed against the very challenging 2022 backdrop for capital markets activity.”

Clear Street

Volz continued that the challenging environments for capital markets means there is a major need for fixed-income prime brokerage as liquidity is much lower than in equities.

“We have very good timing, as we are expanding our offerings from US equities and options into fixed income this year,” he added.

In the next 12 months Clear Street will also be expanding internationally

“Everyone we have talked to is dying for a new prime brokerage provider to come in, especially in the UK and Europe, where they are even more starved for new providers, especially for smaller hedge funds, proprietary trading firms or market makers,” said Volz.

Clear Street sees itself as the nexus of high tech and traditional finance as it is cloud-based and uses modern technology. Volz said the firm wants to offer every asset class, market, and customer a single source of truth, which is very different from the legacy mainframe batch processing.”

In May this year Clear Street announced the completion of a $165m Series B round led by venture capitalist Prysm Capital, which values the fintech at $1.7bn.

Clear Street has hired a lot of engineers in the past year to build its technology and will soon announce a lot of front-office hires to build the client offering according to Volz. He continued that Clear Street has been gaining market share and staying ahead of targets and last year’s numbers, while most prime brokerage firms are down 30% year-over-year.

“We are adding 10 to 20 institutional customers per month,” said Volz. “We have a long runway, and we’re excited to open up cross-selling as we add asset classes and markets.”