The TCW Group is aiming to develop a suite of active exchange-traded funds and to expand into fixed income ETFs following its acquisition of Engine No. 1, which had built a platform of active thematic ETFs.

Jennifer Grancio, formerly chief executive of Engine No. 1, has taken on the role of TCW’s global head of wealth since the completion of the acquisition, with responsibility for global wealth distribution, the ETF business, and directing TCW’s brand and digital marketing strategy. She was also previously a founding member of BlackRock’s ETF business, iShares, and led European, U.S. and global distribution.

Grancio told Markets Media that Engine No. 1 had grown to more than $600m in assets in less than two years due to its differentiated ideas, which were reflected in its active, thematic ETFs. TCW acquired Engine No. 1’s Transform ETF platform, which includes three active ETFs based on the themes of climate change and the energy transition; the transformation of supply chains and onshoring, and an index fund composed of small and mid-cap US firms.

She said: “We are very excited at this huge opportunity which provides a sweet spot to put TCW’s active equity strategies into an ETF wrapper.”

For example, Engine No. 1’s capabilities complement TCW’s existing thematic strategies in artificial intelligence, space technology, next-generation mobility and renewable energy infrastructure. There is also an opportunity to expand ETFs into TCW’s fixed income strategies and to expand geographically in Europe and Asia.

Grancio said: “Our strategy is to build a suite of very high quality active ETF solutions. In a year we would like to have a broad range of active equity products, have expanded our thematic range and have a fixed income ETF.”

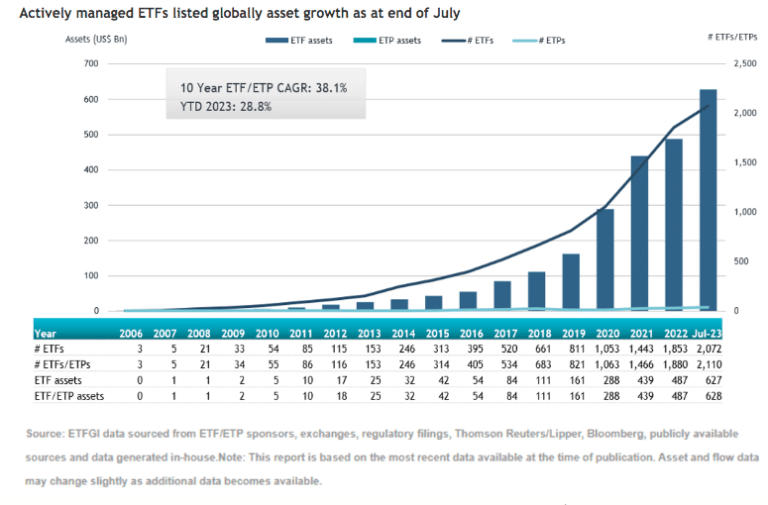

Active ETFs have been attracting inflows and assets invested in actively managed ETFs listed globally reached a record of $628bn at the end of July, according to ETFGI, an independent research and consultancy firm covering trends in the global ETFs ecosystem. Year-to-date net inflows to the end of July were $84.7bn, the second highest on record, as assets increased 28.8% over that timeframe.

Katie Koch, president and chief executive of TCW, said in a statement: “Integrating Engine No. 1’s Transform ETF platform into TCW is an important part of our efforts to enhance our capabilities and provide a greater range of investment vehicles for the benefit of our clients.”

Koch continued that the acquisition of Engine No. 1’s signifies an early chapter in TCW’s next stage of growth. She took on the role of president and chief executive at TCW following the retirement of David Lippman at the end of 2022.

Her previous role was a partner in Goldman Sachs’ asset management division and chief investment officer of the $300bn public equity business.

In April this year TCW also expanded its investment solutions in leveraged finance by announcing a strategic partnership with Lakemore Partners, a private credit investment firm primarily investing in super-majority control collateralized loan obligation equity, to support the growth of TCW’s CLO platform. TCW already manages more than $70bn in credit assets across private and public markets.

Mohamed Seif, co-founder and managing partner of Lakemore, said in a statement: “During this period of market volatility and rising interest rates, we are seeing growing interest from sophisticated investors around the globe who are seeking solutions for long-term, non-correlated fixed income assets.”