Taurus SA, a Swiss fintech, is collaborating with State Street to add tokenization and digital custody services to the US financial services group as institutional interest in digital assets continues to accelerate.

In August this year State Street said in a statement that the agreement with Taurus will further enhance State Street Digital which seeks to provide an integrated business and operating model that supports the digital investment lifecycle. State Street already offers fund administration and accounting offerings for digital assets.

Lamine Brahimi, co-founder and managing partner of Taurus SA, told Markets Media in an email that the partnership between Taurus and State Street developed from a mutual interest in improving digital asset services for institutional investors. He argued that State Street needed a reliable partner to enhance its digital asset offerings, and Taurus’ expertise in custody, tokenization, and blockchain technology made the firm a natural fit.

“This collaboration is focused on leveraging each other’s strengths to provide effective solutions for managing digital assets,” Brahimi added.

State Street said it will use Taurus’ fully integrated, custody, tokenization, and node-management services to automate the issuance and servicing of digital assets, including digital securities and fund management vehicles, subject to regulatory approvals.

In October this year State Street also appointed Vanessa Fernandes as head of digital asset solutions, reporting directly to Donna Milrod, chief product officer. Fernandes was previously global head of digital experience at BNY Mellon, where she developed a digital-first strategy to transform the bank’s products and platforms.

State Street said in a statement: “Fernandes’ appointment comes at a key moment for State Street’s digital business, following the firm’s recent strategic agreement with Taurus SA, a global leader in digital asset infrastructure.”

Brahimi continued that partnering with regulated financial institutions is at the core of Taurus SA’s strategy and these collaborations are crucial for making tokenization mainstream. He added: “By doing so, we build trust and make it easier for traditional investors to enter the digital asset space.”

For example, last year Deutsche Bank also formed a global agreement with Taurus SA to use the fintech’s custody and tokenization technology to manage cryptocurrencies, tokenized assets, and digital currencies. Deutsche Bank also took part in Taurus’ $65m Series B funding round in 2023 which was led by Credit Suisse. New institutional investors included Pictet Group and Cedar Mundi Ventures, alongside Series A investors, Arab Bank Switzerland and Investis, a listed real estate group.

Sabih Behzad, head of digital assets and currencies transformation at Deutsche Bank, said in a statement at the time that the bank will integrate Taurus‘ technology into its own IT environment. He added: “This will form a key part of our digital asset custody platform and will make it easier for us to develop and roll out our digital asset custody offering.”

Brahimi highlighted that a key gap in digital asset infrastructure is integrating digital assets with traditional financial systems and regulatory frameworks. He continued that the industry also needs more scalable and flexible solutions to handle a broader range of digital asset types and use cases, to improve interoperability and boost overall security.

“Another gap is the lack of marketplaces to trade tokenized securities to unlock liquidity, a gap we are filling with our organized trading facility, TDX,” he added.

Differentiator

Brahimi claimed that Taurus stands out due to its comprehensive approach to digital asset infrastructure as it can offer secure storage, advanced tokenization capabilities, and broad blockchain connectivity.

In October this year Taurus announced a strategic collaboration with Chainlink Labs, the primary contributing developer of Chainlink. Taurus will use the Chainlink technology infrastructure which can enrich tokenized assets with high-quality off-chain data and unlock cross-chain interoperability to accelerate the adoption of tokenized assets by financial institutions. Taurus will integrate Chainlink’s data feeds, proof of reserve and its cross-chain interoperability protocol (CCIP), which provides seamless transfer of tokenized assets to any public or private blockchain.

Angie Walker, global head of banking and capital markets at Chainlink Labs, said in a statement: “Taurus’ integration of the Chainlink platform demonstrates the growing demand for secure data and cross-chain infrastructure in the tokenized asset economy.”

Brahimi also argued that Taurus’ leadership in the banking segment, combined with its expertise with tokenized securities on top of cryptocurrencies and digital currencies is unmatched.

“Additionally, our strong market presence across continents and our flexible deployment options—whether on-premise, hybrid, or managed—set us apart,” he added.

Tokenization growth

Taurus believes that the digitization of private assets represents the next trillion-dollar opportunity for the digital asset industry to grow to more than $10 trillion.

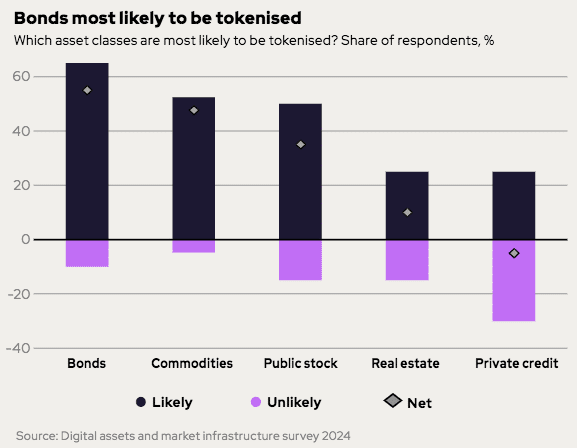

Brahimi predicted that tokenization of real-world assets is set for continued growth, bringing more physical assets into the digital world and offering benefits like increased liquidity and fractional ownership. For example, Franklin Templeton and BlackRock have launched tokenized treasury funds and Brahimi expects other large asset manager to get on board and explore similar opportunities.

“We’ll likely see this trend expand across various asset classes, from real estate to art and beyond,” he added. “As technology and regulations evolve, tokenization will become more mainstream and widely adopted.”

He also highlighted some hurdles that need to be overcome before tokenization can reach its full potential including regulatory uncertainty, and technological challenges related to interoperability and scalability. There is also a need for wider acceptance within traditional financial systems, the need to ensure the security and integrity of digital assets and to address data privacy and compliance issues.

“Last, tokenized cash, such as regulated stablecoins or central bank digital currencies, is a must to fully unlock greater market efficiencies when swapping with tokenized securities,” Brahimi added.