President Donald Trump’s new tariff regime will add to dealmaking hesitation and keep pressure on an already stalled exit environment in the near term according to data provider PitchBook, and also make capital deployment more difficult as they narrow the range of suitable investments.

PitchBook said in a report, Tariffs: From Uncertainty to More Uncertainty, that there had been hopes that the new tariff plan would provide needed clarity for investors to move forward with dealmaking, but the plan is generally regarded as more severe than expected, increasing the chances of a recession and retaliatory tariffs.

Paul Condra, global head of private markets research at PitchBook, said in an email that the tariff plan brings little relief for the private market ecosystem, which has already been struggling under the pressures of low exit activity.

“The industry now faces additional risk dimensions in assessing tariff exposure across portfolios, while added uncertainty extends the persistent hesitation toward dealmaking and capital deployment,” added Condra.

The Swedish BNPL giant Klarna has paused its planned IPO later this month on the New York Stock Exchange.

Klarna, which had planned to market its shares for the offering on Monday, decided to postpone this week. #Klarna #IPO #TrendingNewshttps://t.co/KWFxk8FYpx

— Sifted (@Siftedeu) April 4, 2025

so many IPO delays. Terminal headlines since 11am:

*CHIME IS DELAYING ITS IPO: WSJ

*MNTN SAID TO PUT OFF IPO LAUNCH THAT WAS PLANNED FOR NEXT WEEK

*KLARNA PAUSES PLANNED IPO AFTER TRUMP TARIFFS: WSJ

*STUBHUB DELAYS ITS IPO PLANS: WSJ— Katie Greifeld (@kgreifeld) April 4, 2025

In addition, PitchBook said portfolio managers will need to develop a deeper understanding of all aspects of tariff exposure across their portfolios and retail demand for private market investments could slow. However, PitchBook still expects asset managers to continue to pursue increasing access to private markets given the continued development of private market investment products and the potential for high fees. In the longer term, PitchBook said a pullback in investor activity and general risk aversion could drive a greater share of investment capital to large incumbents.

“However, the new tariff regime could pose challenges for large managers given the complexity of managing how tariffs impact their holdings with significant nondomestic asset exposure,” said the report. “This could make capital deployment harder as it narrows the range of suitable investments.”

PitchBook also said specialist fund managers could find an edge in navigating tariffs or focusing on niche opportunities. The report said these specialties could include helping startups navigate tariffs to keep technology costs down, finding tariff arbitrage opportunities, or helping investors access opportunities in tariff-free trade zones.

In a separate report , Potential Impact of Trump’s Tariffs on the VC-Backed Tech Ecosystem, PitchBook said that in the short term, a stronger dollar could encourage flight to US dollar-denominated stablecoins such as USDC. However, over a longer horizon, if tariffs and emergency economic measures undermine confidence in US governance, some investors might shift focus to self-sovereign assets such as bitcoin.

“This dual dynamic—dollar strength now, possible dollar skepticism later—will likely shape global crypto investment strategies,” added PitchBook. “Investors will be closely watching whether trade policies blend into broader economic actions, which could directly affect crypto market liquidity and capital flows.”

In fintech, PitchBook said payments, lending, and wealth tech will be hit the hardest by the tariffs. For example, a global trade war could decrease corporate confidence and reduce cross-border business activity, affecting international payment flows and foreign exchange spreads, and reduced discretionary spend for consumers will affect payment and retail investment volumes, as well as credit quality.

Public market indexes

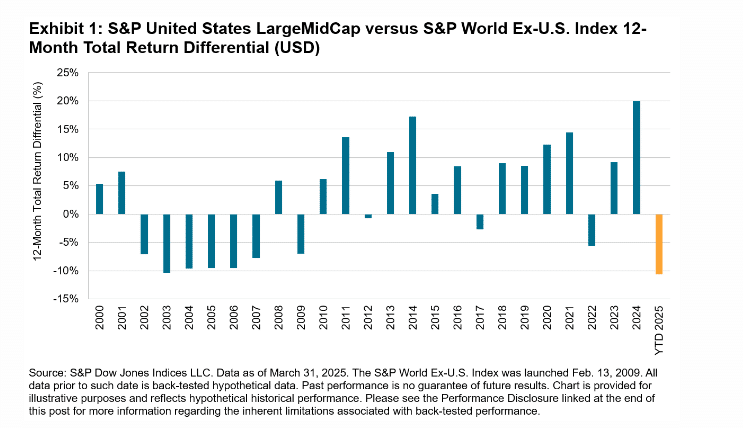

In the public markets, Michael Brower, associate director, index investment strategy S&P Dow Jones Indices said in a blog that the 12-month total return differential between the S&P United States LargeMidCap index and the S&P World ex-U.S. index turned negative in March 2025 for the first time since October 2023, compared to the 20% difference in 2024 due to strong performance for U.S. equities.

Brower said: “It’s important to recognize that the current shift in trade protectionism may signal a change in market dynamics for U.S. equities.”

Breaking: the U.S. stock market pic.twitter.com/mf3gW4bopD

— Brew Markets (@brewmarkets) April 4, 2025

Brower continued that a better understanding the potential benefits of country diversification may allow investors to use different combinations of equity indices. For example, they could hypothetically blend the S&P United States LargeMidCap with the S&P World Ex-U.S. Index and S&P China BMI with the S&P Emerging Ex-China BMI to produce different risk/return profiles.