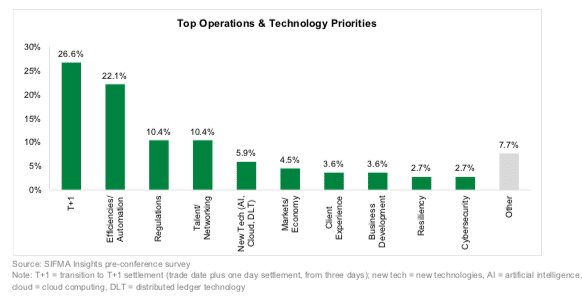

The US move to T+1, which reduces the time to settle equities transactions, was the top operations and technology priority for participants at SIFMA’s 50th Operations Conference in May this year.

SIFMA, which represents the US securities industry, surveyed conference attendees and select members on their top priorities for the year. T+1 topped the list of priorities, ahead of improving efficiency, automation and the proposed regulatory changes to US market structure from the US Securities and Exchange Commission.

The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 which the SEC said will reduce latency, lower risk, and promote efficiency and greater liquidity. In February this year the SEC adopted final requirements for a 28 May 2024 implementation date, which is earlier than anticipated. Canada is also implementing T+1 on the previous day, 27 May 2024.

Frank La Salla, president, chief executive & director of DTCC, gave a speech at the 2023 SIFMA Operations Conference which included the US financial market infrastructure’s role in the transition to T+1.

He highlighted that in 2017 DTCC had partnered with SIFMA and the Investment Company Institute (ICI) to shorten the settlement cycle to T+2, which represented one of the most significant changes to market structure in decades. He said the three organisations have partnered again to bring the T+1 initiative to the forefront in order to reduce risk, lower clearing fund requirements and improve capital and liquidity utilization.

In addition, they are having a global impact as Canada will transition with the US next year, and the UK, Europe and Mexico have begun their own assessments. Markets throughout Asia-Pacific, including Australia, Japan, Hong Kong and Singapore are watching the situation closely according to La Salla.

“As a former trader, I have a personal belief that if all major markets aligned around a T+1 settlement schedule, it would improve price discovery for institutional and individual investors alike,” he added. “When you reduce latency, you reduce friction – you reduce risk, and you ultimately reduce cost.”

Concerns

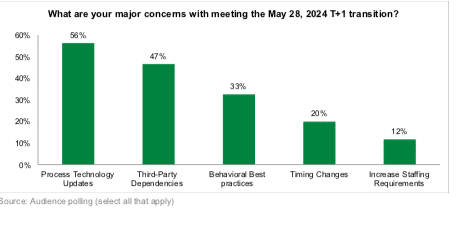

La Salla acknowledged that the transition to T+1 requires significant work from many market participants and there is concern about meeting the SEC’s implementation date.

“We’re sensitive to these realities, so I promise you this – we’ll continue to partner closely with the industry, as well as regulators, SIFMA, ICI and others, to help ensure a successful move to T+1,” he said.

The largest area of concern for meeting the T+1 deadline was process technology updates according to a poll at the SIFMA conference.

Katie Kolchin, head of research at SIFMA, said in a report on the conference: “Panelists noted that firms need to have the building blocks in place to make this transition: client preparedness in our interconnected markets; affirming trades on trade date in order to meet settlement on T+1; and system resiliency, as the nineteen hours between the end of the trading day and the affirmation cycle shortens to five hours.”

More than three quarters, 81.5%, of broker-dealer respondents felt their firms will be ready for the transition deadline but a lower proportion, 65.1%, expect their firms will be ready for the DTCC’s testing window this summer.

A slim majority, 54.5%, of poll respondents believe third-party vendors will be ready by the implementation date but only one third, 38.9%, think their clients will be ready by the deadline.

Panelists at the conference said compressed timelines, client and vendor readiness, trade affirmations and resilience are all concerns around the transition toT+1. For example, the report said one panelist suggested that firms begin processing trades intermittently during the day rather than at the end of the trading day as they will need to allocate trades by 7:00pm on trade date in order to affirm by 9:00pm.

“Today, affirmation is not a prerequisite for settlement. Going forward, this will change,” added the report. “ Market participants will need to affirm trades on trade date in order to settle on T+1, which has been identified by a panelist as one of the main friction points in the transition.”

In order to meet the deadline firms need the right data and information at the right time, and so they should already be analysing trends on settlement.

“For example, what are your firm’s affirmation statistics by client?” said the report. “To achieve settlement on day one, firms must affirm trades on trade date. Be ready.”