Nearly two thirds of investors said systematic strategies helped them manage market volatility in the last year according to a survey from Invesco.

Systematic investors use structured, rules-based quantitative models and algorithms to make investment decisions. Invesco’s Global Systematic Investing Study 2023 said that risk management is seen as one of the most important benefits of a systematic approach allowing investors to measure the potential impact of various scenarios on their portfolios. The fund manager interviewed 130 systematic investors responsible for managing $22.5 trillion in assets as at 31 March 2023.

One wholesale investor from North America said in the report: “The more uncertainty there is, the more attractive systematic strategies become as they can better react to risk.”

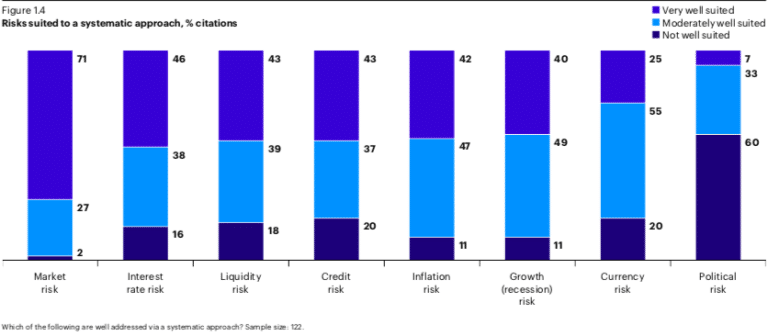

Nearly three quarters of investors said systematic strategies are most suited to manage market risks, but they have also become more popular for addressing interest rate changes, liquidity concerns, credit issues, and inflationary pressures.

The survey said that when both equity and fixed income markets fell in 2022, investors put more emphasis on having a deeper quantitative-based understanding of how risks might change in a portfolio across different macro environments. One North American institutional investor said in the report: “A systematic approach tends to be much more risk-aware, shedding light on the blend of exposures.”

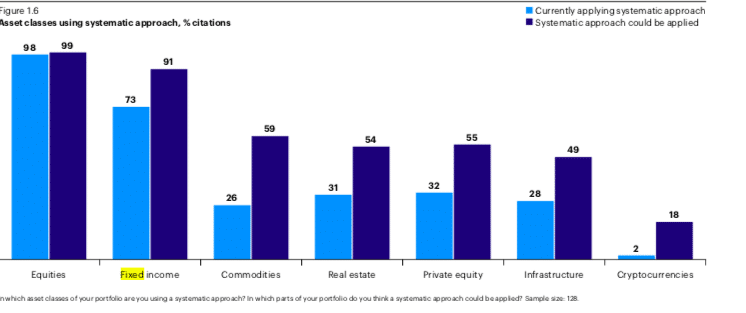

More than half, 60%, of respondents said higher inflation and rising rates was supportive of a systematic approach. In addition, almost three quarters of respondents now adopt a systematic approach in fixed income.

One EMEA-based institutional investor said in the report: “With the market now reflecting a genuine discount rate, fixed income has grown more appealing. This realignment has nudged us towards increasing allocations to fixed income, particularly through systematic strategies.”

The survey also suggested that systematic models may spread from fixed income and equities into other asset classes such as commodities and foreign currency . For example, 59% of investors expect to target commodities with systematic strategies, compared to just one quarter investors who currently use systematic strategies in the asset class.