Nearly three quarters of investors expect the sustainable investment market to grow significantly in the next one to two years despite political backlash and regulatory scrutiny.

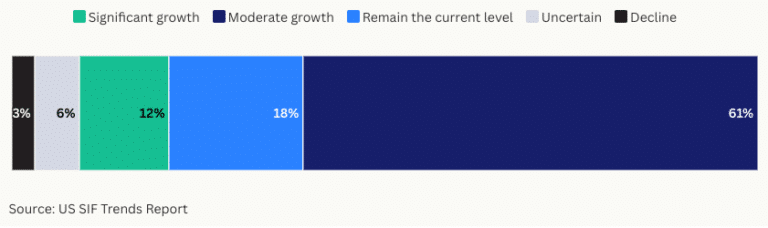

The fifteenth edition of US SIF Foundation’s Report on US Sustainable Investing Trends found that 73% of survey respondents expect the sustainable investment market to grow significantly, driven by client demand, regulatory evolution and advances in data analytics. The Sustainable Investment Forum advocates for sustainable investing and members represent $5 trillion in assets under management or advisement.

The US market size was $52.5 trillion, of which $6.5 trillion or 12%, was specifically identified or marketed as sustainable or environmental, social and governance (ESG) investment, setting a new baseline for the size of the market. US SIF’s analysis is based on submissions to the Securities and Exchange Commission.

Maria Lettini, chief executive of US SIF, said in the report said that in the two years since the survey was last published sustainable investing has became the target of political culture wars, anti-ESG legislation was introduced in multiple states and ESG-marketed funds came under scrutiny for potential greenwashing.

For example, on 18 December 2024 Tennessee Attorney General Jonathan Skrmetti filed a lawsuit against BlackRock alleging the fund manager made false or misleading representations to consumers regarding how ESG considerations affect its investment strategies. Law firm Crowell said in a report this is the most aggressive lawsuit to date in the ongoing partisan debate among public enforcement officials regarding the corporate focus on ESG-related issues.

Lettini said: “The attention on sustainable investment is a natural outcome for an industry that has grown in both size and influence over the past 30 years. Rather than a roadblock, this is an opportunity to continue to refine the way we address the systemic issues shaping everything from the global economy to our day-to-day lives.”

Global sovereign and public pension funds are also spending a lot of time and resources in considering their long-term investment approach to sustainable finance, according to the Official Monetary and Financial Institutions Forum, an independent forum for central banking, economic policy and public investment policies.

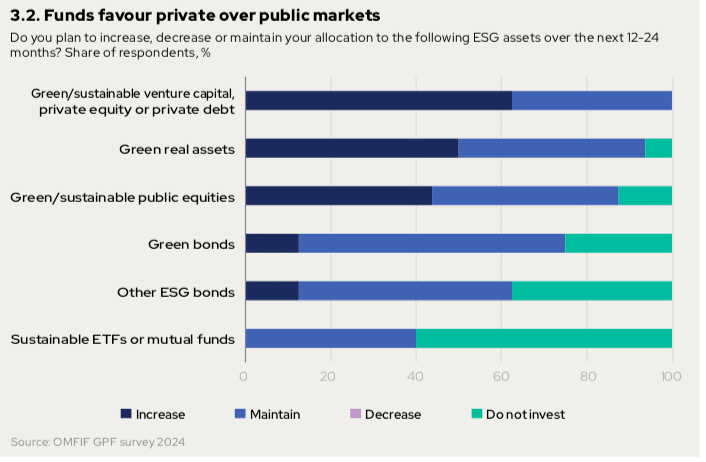

OMFIF’s Global Public Funds 2024 report said global sovereign and public pension funds are looking to private markets to play an active role in developing approaches to transition finance. The survey covered 28 global public pension and sovereign funds with more than $6.5 trillion in assets under management between September and October this year, before the US election.

“Most funds (56%) think they can make the biggest impact on transition finance via private equity, compared to 25% through public equity,” added OMFIF. “They continue to build their investment pools, despite the so-called ‘ESG backlash’, in particular in the US, where isolated incidents of greenwashing have led some naysayers to critique the entire ethos of sustainable investing.”

The OMFIF report cited one major North American fund who said sustainable investment is one of the top five strategic initiatives across the firm.

All survey respondents said they integrate ESG criteria internally in their investment decisions, an increase from less than 80% of funds in the 2022 OMFIF survey. Hurdles for investors were the unclear policy environment, alongside inconsistent disclosure and the lack of commercially viable projects and investments.

“The good news on that front is that many of the funds that have engaged with OMFIF this year have vouched for the fact that returns in sustainable investments have mostly matched, or in some cases passed, the returns across their portfolios,” said the report.