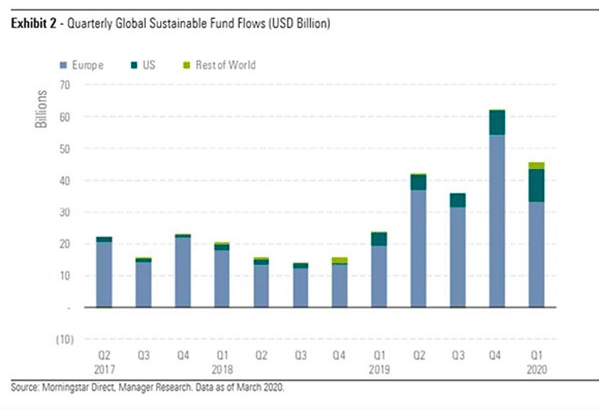

Environmental, social and governance funds had inflows of $45.6bn (€42.1bn) in the first quarter of this year while the overall fund universe had global outflows of $384.7bn due to the Covid-19 pandemic.

The latest Morningstar Global Sustainable Fund Flows Report said total assets in sustainable funds were $841bn at the end of March, down 12% from the record $960bn at the end of last year while assets in the wider fund universe fell 18%.

Sustainable and #ESG funds bucked the trend in the Covid-19 sell-off, enjoying positive inflows, the latest Morningstar Global Sustainable Fund Flows Report reveals @hortensebioy | @MorningstarInchttps://t.co/BPwNeciz9B via @uk_morningstar

— Morningstar UK media (@MstarUKmedia) May 13, 2020

Hortense Bioy, director of passive funds and sustainability research in Europe at Morningstar, said in the report that Europe had 76% of sustainable funds and 81% of assets.

“The continued inflows in first quarter of 2020 speak of the stickiness of ESG investments,” she added. “Investors in sustainable funds are typically driven by their values, invest for the long-term, and seem to be more willing to ride out periods of bad performance.”

Cameron Brandt, director – research at EPFR, a provider of fund flows and asset allocation data said in a virtual roundtable today that ESG equity funds had only one week of outflows during the recent turmoil while ESG bond funds had a record weekly inflow.

Brandt moderated the JConnelly roundtable, ESG Leadership Redefined: How the Coronavirus Pandemic Will Shape Sustainable Investing.

Marc-Olivier Buffle, senior product specialist at Pictet Asset Management, said on the roundtable that the Swiss fund manager had inflows of 4% over the last couple of months due to increased interest in ESG investment.

Pictet has 14 thematic funds based on megatrends such as water usage, cleaner air and digitisation. Buffle said these megatrends have been catalysed by pandemic.

He added: “12 out of 14 of our funds outperformed during the crisis, especially in February and March. It is a win-win as investors get performance and can do good at the same time.”

Spotlight on social

Martin Jarzebowski, director of responsible investing at Federated Hermes, said on the roundtable that the pandemic had shined a spotlight on social, which had previously been viewed as soft and intangible.

He added: “Investors had believed they had to trade off returns and ESG outcomes. However multiple ESG funds are navigating the current environment better than conventional counterparts.”

Jennifer Tonda, director of institutional trading at 280 CapMarkets, an electronic fixed income marketplace, said on the roundtable that she had received four calls last week from investors who wanted increase the ESG exposure in their bond portfolios.

“Last year green bond issuance was 80% and social bond issuance was 20%,” she added. “There has been a switch to 60% green and 40% social.”

Tonda highlighted that the International Bank for Reconstruction and Development, part of the World Bank, sold an $8bn sustainable development bond while the African Development Bank has issued multiple “Fight Covid-19” social bonds.

She continued that investors have a misconception that they have to give up yield in green or social bonds but she said they trade in the same way as conventional bonds.

Momentum

Jarzebowski argued that the interest in sustainable investing will last after the pandemic because ESG is a new quality factor and a natural extension to sound primary research.

“There is a correlation between ESG leaders and lower volatility and more consistent profits,” he said. “ESG is a new quality factor as ESG leaders are additive to performance.”

Buffle said momentum will continue as Pictet can show clients the impact of their portfolios. The funds are measured against nine planetary boundaries, the largest environmental issues defined by scientists, such as greenhouse gases.

“We measure portfolios against these nine dimensions to show they have a concrete and tangible impact,” he said.

Tonda continued that issues such as global warming and gender equality will still need to be addressed after the pandemic is over.

“Fixed income investors have seen that they do not have to give up yield so ESG investing is on the rise,” she said.