Moody’s Investors Service has lowered its forecast for the total issuance of sustainable bonds this year despite social bond volumes reaching a record in the first quarter of this year.

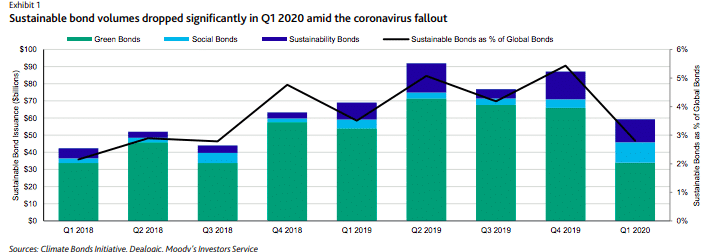

The ratings agency said in a report that global sustainable – green, social and sustainability – bond issuance was $59.3bn (€55bn) in the first three months of this year, 14% lower than a year ago due to the spread of the coronavirus pandemic.

We cut our 2020 forecast for sustainable bond issuance from $400bn to up to $325bn as green bond volumes dropped in Q1 due to the #coronavirus pandemic. But social bond issuance hit a record $12bn in Q1 on response efforts. Read more: https://t.co/Cc7AXl6L2S #MoodysESG #ESG pic.twitter.com/inbZLBMTBH

— Moody's Investors Service (@MoodysInvSvc) May 5, 2020

“A precipitous drop in green bond issuance was the main driver of the steep decline in sustainable bond volumes,” added Moody’s. “Record quarterly social bond issuance and steady sustainability bond issuance somewhat mitigated the decline.”

Moody’s had originally estimated $400bn in sustainable bond issuance this year. However the slowing economy has led to a decrease in the forecast to between $175bn and $225bn for green bonds, down from $300bn.

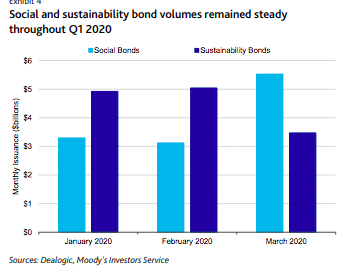

“We are maintaining our combined $100bn forecast for social and sustainability bonds, however, given the heightened market focus on coronavirus response efforts,” added the ratings agency.

Global green, social and sustainability bond issuance accounted for just 2.8% of overall global bond volume, the lowest percentage since the third quarter of 2018 .

“One possible explanation for the divergence in the first quarter is an increase in liquidity borrowings by investment-grade companies seeking to fortify balance sheets in anticipation of an economic slowdown,” said Moody’s. “This was especially evident in the last two weeks of March, when a surge of borrowing contributed to an all-time monthly record for new bond issuance by US investment-grade companies.”

Despite the fall in volumes, Moody’s still expects long-term growth in sustainable bonds due to investor demand, a heightened governmental focus on climate change and sustainable development, the gradual greening of the financial system, and increased need for issuers to highlight sustainability plans.

Social bonds

Social bond issuance was a record $11.9bn in the first three months of the year, more than double the previous quarterly record.

“The surge in social and sustainability bonds has been primarily led by multilateral development banks, which have increasingly turned to these instruments to finance their coronavirus response,” added Moody’s.

The surge in social and sustainability bonds has been led by multilateral development banks, which have issued securities to finance their Covid-19 response.

For example, the International Bank for Reconstruction and Development, part of the World Bank, sold an $8bn sustainable development bond, the largest US dollar-denominated supranational bond, and the African Development Bank issued multiple “Fight Covid-19” social bonds. In addition, Chinese regulators in February granted fast-track approval for bond issuance if the proceeds are used for projects to combat the coronavirus and alleviating pressure on issuers’ liquidity as a result of the outbreak.

Moody’s said: “Greater emphasis on social finance and sustainable development will likely be one of the lasting outcomes of the coronavirus crisis.”

BNP Paribas said in blog that the flurry of social and social-themed bonds issued in response to Covid-19 is a trend expected to continue in the coming months as other issuers – financial institutions and corporates – monitor this market. The bank added there may also be a second wave of social bonds focused more on the medium-term response.

Agnès Gourc, co-head of sustainable finance markets at BNP Paribas, said in the blog: “A change in investor behaviour could also see the demand continue for years to come as investors look to incorporate more ESG into their portfolios, shifting the focus to the social element in light of recent events.”