Mosaic Smart Data, the UK fintech that provides real-time capital markets data and analytics, and Euroclear have worked together to convert the central securities depository’s raw unstructured data into a standardized format and contextualize it to provide market color and actionable insights.

In June this year Mosaic Smart Data and Euroclear said in a statement that they have launched Smart Markets to provide data-driven insights for the fixed income markets. Matthew Hodgson, chief executive and founder of Mosaic Smart Data, told Markets Media that financial market infrastructure providers, and other large institutions, hold an enormous wealth of untapped data from the market.

“It is sitting in dark repositories,” Hodgson added. “They have a desire to bring this data into the light of day but typically struggle to convert raw unstructured information into a standardized format.”

This struggle was behind the launch of Smart Markets. The fintech has been working with Euroclear to transform their data into insights that market participants can easily interpret, allowing them to detect market movements and build enhanced trading models and informed trading strategies.

Over a period of nine months Mosaic Smart Data used machine learning to help Euroclear understand their data in a deep way and to help enrich that data, such as applying risk metrics to every transaction. The solution was shown to a number of potential clients as a minimum viable product, and Hodgson said there was a universal desire for the data.

Philippe Laurensy, head of product, strategy and innovation at Euroclear, said in a statement that Smart Markets is able to provide trading firms with a true picture of aggregate fixed income activity, including government and corporate bond markets across both electronic venues and voice, by harnessing the scale and depth of Euroclear’s post-trade ecosystem. Euroclear settled the equivalent of more than one quadrillion of securities transactions last year according to Laurensy.

These insights are delivered via a “highly intuitive” user interface, as well as through APIs, according to Hodgson. The anonymity of market participants is always preserved as users receive aggregate data, and cannot drill down to individual transactions.

In addition, the data relates to transactions that are settled by Euroclear so the data is accurate, as trades will not be amended or cancelled.

“We are looking at allowing users to access pre-settled flow, but there are some potential issues around fat finger trades and cancellations,” said Hodgson.

Users can fully customize the data they choose to receive, for example, they may be interested in corporate bonds issued in Germany.

He gave the example of a sales person who may want to look at market sentiment analysis. e.g the breakdown of flow by investor types, or activity that is taking place across the various maturity spectrums across the yield curve. Traders may want to review activity across different sectors or European flow versus flow from their own clients. Regulators may want data to assess concentration risks. Smart Markets also includes an assessment of liquidity, which should provide more confidence to trade or to construct portfolios.

“Importantly, we have heard from a number of the issuers that they are interested in turnover and decay after issuance,” Hodgson added. “The whole market efficiency improves, and we felt that would be good for the whole ecosystem.”

Growth

Hodgson expects that Smart Markets will help drive market evolution as it includes more data providers. Although the initiative has started in Europe, the ambition is for global participation so that participants can eventually receive aggregate data from around the world and across multiple asset classes.

Smart Markets currently has 48 users participating in a trial including ABN Amro, Bank of England, Deutsche Bank, Pictet Asset Management, T. Rowe Price and Westpac Banking Corporation.

Smart Markets has started in fixed income but there have been conversations around equities. Mosaic Smart Data is also having conversations with CSDs around the globe in the US, Canada, Japan and the Middle East.

“Institutions would like a comprehensive view of all flow activity, and they want to see it across asset classes,” said Hodgson.

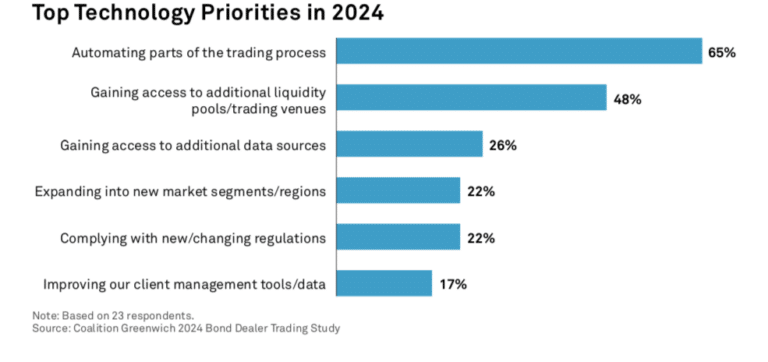

Consultancy Coalition Greenwich said in a report in June this year, Corporate Bond Dealers Focus on Trade Automation, that gaining access to additional data sources was the third top technology priority in 2024.

Kevin McPartland, head of research for market structure & technology at Coalition Greenwich, said in the report that a big question is where the line should be drawn between technical differentiation (aka secret sauce) and must-have utility

“One could also argue that the logic used to determine how to respond and with what price are differentiators but, given the quality and customizability of third- party solutions available today, it’s not the solution that is the differentiator but, instead, the way you use it,” McPartland added.