SIX migrates its Triparty Collateral Management (TCM) into the renewed and innovative Triparty Agent with the Collateral CockpitTM that already manages repo services since June 2020.

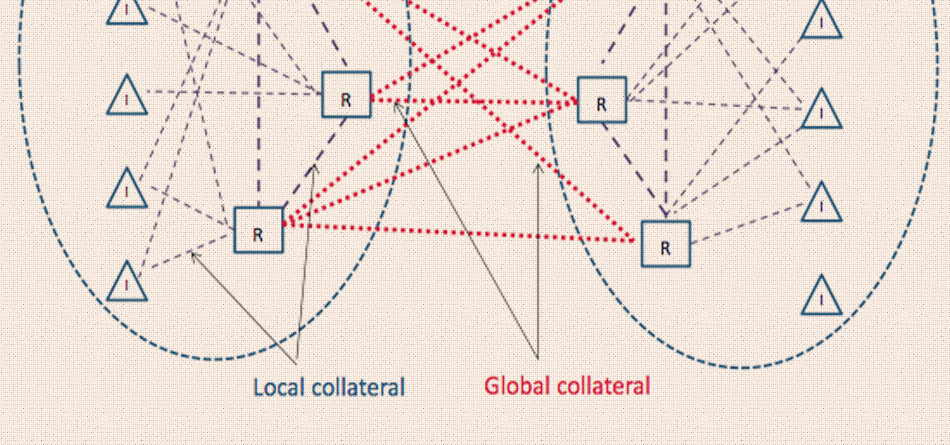

TCM complements the TPA with a leading-edge collateral management solution, providing a comprehensive service to the SIX clients. When using the TCM service, two parties to a transaction delegate their day-to-day operational responsibilities around collateralization to SIX. The SIX TPA performs tasks such as the selection and automatic execution of collateral transfers and ongoing validation that exposures are being appropriately collateralized through multiple daily mark-to-market checks on the collateral throughout the lifecycle of the transaction. This new service creates further tangible opportunities for clients and helps them to reduce operational risks & costs.

SIX introduces an innovative Triparty Collateral Management solutionhttps://t.co/db4muhfRLt

— Pablo Malumbres (@PabloMalumbres) August 30, 2022

Nerin Demir, Head Repo & Collateral Management, SIX: “With this solution combined with our sophisticated Collateral CockpitTM we provide a higher level of security, control and useability for our clients. In addition we established the backbone for collateral mobilization, enabling many new use cases for our collateral management service and a foundation for future growth”

The new TPA based TCM solution adds new features and opens up new possibilities. The main advantages for our clients of this new solution are as follows:

- The use of the Collateral CockpitTM in combination with TCM allows the monitoring of exposures and margin calls in real-time and simplifies processes in Collateral Management such as substitutions.

- All functionalities required to open, manage and close collateral exposures can be controlled in the Collateral CockpitTM. This brings TCM to a new level of user-friendliness and makes collateral management as easy as using a smartphone.

- Complying with uncleared margin rules (UMR) and provide initial margin becomes a piece of cake: We offer a direct link to the major Margin Calculation Agents & Margin Transfer Utilities and ISDA reviewed custodian documentation.

- Electronic collateral schedules provide full transparency and enable easy configuration of complex schedules by the contracting parties, involving their collateral managers and risk departments in the Collateral CockpitTM.

- Collateral takers which are not clients of SIX custody services can also get access to the Collateral CockpitTM.

Source: SIX