The rise of private credit, semi-liquid funds and democratization of access are key trends in private markets according to Lata Vyas, alternative funds product head in Europe at financial services group Brown Brothers Harriman (BBH).

Investors in private market funds have traditionally had to lock up their money for the life of a fund, which is usually between eight to 10 years, due to the underlying assets being illiquid but have been rewarded by higher returns. In contrast, semi-liquid funds have a mix of public and private assets which allows investors to redeem on a quarterly or bi-annual basis and reallocate their capital.

Vyas told Markets Media: “Democratization and semi-liquid funds are huge trends. We are having 17 conversations at the moment with asset managers who want to launch these types of funds.”

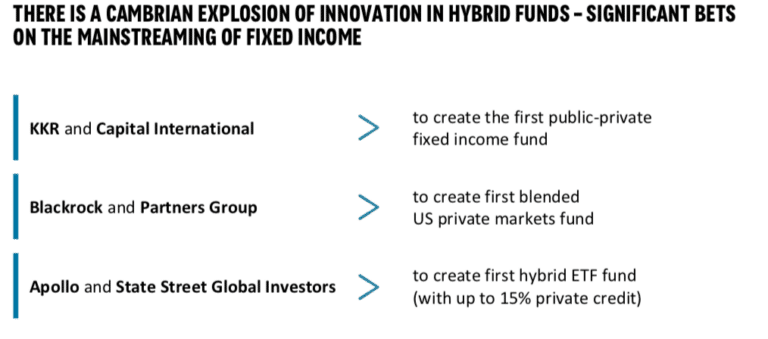

In September this year BlackRock and Partners Group said in a statement that they will provide access to private equity, private credit, and real assets in a single portfolio, which is currently not available to the US wealth market. Retail wealth investors allocated $2.3 trillion to private markets in 2020 and are expected to increase their allocations to $5.1 trillion by 2025 according to a Morgan Stanley/Oliver Wyman Study.

The two fund managers are creating a single, managed account with unified portfolio construction and management. Retail wealth investors will choose from three risk profiles to determine allocations to BlackRock and Partners Group funds, including BlackRock’s private equity, private credit, and systematic funds and Partners Group’s private equity, growth equity, and infrastructure funds.

Mark Wiedman, head of BlackRock’s global client business, said in a statement: “In a world where private markets are growing by $1 trillion or more every year, many financial advisors still find it too difficult to help their clients participate. We aim to crack that.”

In the same month State Street Global Advisors, the asset management business of State Street said in a statement that it is working with alternatives manager Apollo Global Management to democratize access to private asset exposures through ETFs and other investment products, as they have previously only been available to large institutions and ultra-high net worth investors.

Anna Paglia, chief business officer at State Street Global Advisors, said in a statement: “It is our goal to bring these investments to scale and help facilitate the process of making private assets more accessible and liquid over time. We see this as only the beginning of a new wave of innovation as public and private markets increasingly converge.”

However Better Markets, a US non-profit organization working to build a more secure financial system, said in response to the filing from State Street and Apollo that a private credit ETF further blurs the line between the public and private markets. The comment letter said the difficulty of valuing the loans in a private credit portfolio could lead investors in the funds to experience losses and the illiquid nature of the loans poses additional risks.

“Investors in ETFs normally expect high liquidity,” said Better Markets. “But it is unclear how retail investors could easily withdraw money from funds filled with illiquid assets.”

In October this year Capital Group and KKR said in a statement that they had filed registration statements with the Securities and Exchange Commission for two public-private fixed income funds. If approved, the funds are expected to launch in the US in the first half of 2025 and be offered through financial professionals to the wealth market. Capital Group manages over $555bn in public fixed income assets, while KKR manages over $100bn in private credit assets according to the statement.

Holly Framsted, head of global product strategy and development at Capital Group, said in a statement: “These strategies aim to solve the access gap that individual investors currently face when it comes to private investments, and we expect these two public-private strategies will be the first of many across asset classes and geographies.”

Private credit

Vyas also highlighted that there is a push from asset managers to launch private credit strategies, especially in Europe. She said: “Between 60% and 70% of the conversations that we are having are leaning towards credit strategies.”

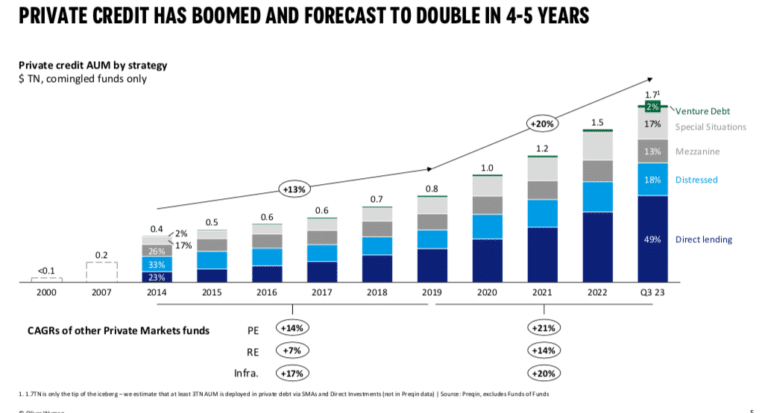

The global private credit market has reached US$3 trillion in assets under management according to research from The Alternative Credit Council (ACC), the private credit affiliate of the Alternative Investment Management Association (AIMA).

The 10th edition of Financing the Economy, published in partnership with EY in November this year, found that around half of respondents expect to increase their investment in the US, European and Asian markets over the next three years due to a desire for diversification and ongoing bank retrenchment.

Vincent Remy, EY Luxembourg private debt leader, said in a statement that private credit has been the fastest-growing alternative asset class over the past two decades and the sector is continuing its steady growth despite headwinds.

“Whilst institutional money constitutes the main source of financing, retail and insurance capital have played a more significant role,” said Remy. “The rapid growth has gathered increased attention from regulators, yet the sector continues to provide a vital source of alternative financing to the real economy which benefits both borrowers and investors.”

The International Monetary Fund said in a report this year that rapid growth of opaque and highly interconnected private market funds could heighten financial vulnerabilities given its limited oversight.

Data

Vyas continued that the opportunity in private markets is immense but there is a lack of standardization and lack of access to data, which could hinder the industry being able to scale. BBH has a single technology stack that the firm uses across all private markets strategies, which she believes is a differentiator. Clients can see an aggregate view across both their public and private strategies.”

“Most of the asset management clients we work with are cross-border and across strategies, so they need consistent data,” she said. “The data can be managed better and it can then be reported in a more timely and accurate manner.”

Vyas argued that BBH’s unique proposition is the ability to service blended private and public portfolios. The platform can provide daily prices for public securities, as well as monthly or quarterly valuations for combined public and private portfolios.

She said: “In the next year we want to reach a stage where private market data can be accessed daily, or even multiple times during a day.”

One of the biggest challenges of managing a semi-liquid is monitoring liquidity. In May this year BBH announced the launch of a new automated liquidity management tool for traditional and alternative funds, which allows asset managers to supervise multiple fund liquidity scenarios based on investor flows.The tool receives real-time transactional feeds and proactively notifies asset managers if their custom thresholds have been exceeded. It can also project the fund’s liquidity needs and fulfil the growing requirements from regulators around liquidity transparency.

“Further driving the demand for an automated liquidity management tool is the growing interest among managers in ELTIF 2.0, LTAF and evergreen funds, which are open-ended structures that offer high net worth and retail investors exposure to private market asset classes that have traditionally been harder to access,” added BBH.

Half of of asset managers plan to go to market with European long-term investment funds (ELTIFs) and Long-Term Asset Funds (LTAFs) in the next three years according to BBH’s 2024 Fund Distribution Outlook survey,