In July this year Schroders published its first Impact Report, which the UK fund manager said marked the culmination of the successful integration of the acquisition of impact investing firm BlueOrchard in 2019.

Peter Harrison, group chief executive at Schroders, said in the report: “In combination with our own cross-asset class expertise, we have developed a best-in-class Impact Framework. We have now applied our framework to 20 impact strategies across public and private markets.”

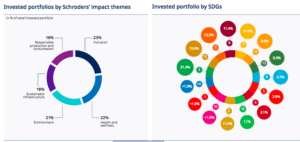

Schroders launched its Impact Driven range in 2022 and the 20 strategies span public debt and equity, private debt and equity, infrastructure, real estate, fund of funds and multi-private asset solutions, and have a total of $5bn in assets under management. The manager targets companies or assets where more than 50% of revenues, or business activities, are tied to impact or that are in the midst of shifting their entire business model to become highly impactful.

Catherine Macaulay, co-head of impact management at Schroders, told Markets Media: “Investing in business models where impact is core means they are providing genuine solutions to some of the world’s challenges. These companies and assets are placed to do well over the long term.”

Schroders worked very closely with Blue Orchard to think about how to bring their impact expertise into new asset classes and geographies and to develop an impact framework, toolkit and due diligence with the investment teams.

“The investment teams own the impact analysis, so impact is truly embedded into the investment process,” added Macaulay.

Impact vs sustainable investing

Macaulay described impact investing as distinct from sustainable investing.

“For us, the three core attributes of impact investing are intent, contribution and measurement,” she said. “Every one of our impact driven strategies has a distinct theory of change that sets out the objective of the fund so that we can track progress.”

Impact investing is not just about finding impactful companies and assets, but also about what investors provide in terms of both financial and non-financial support. Non-financial support may involve implementing impact targets into investment agreements or engaging with investees to improve impact and sustainability outcomes.

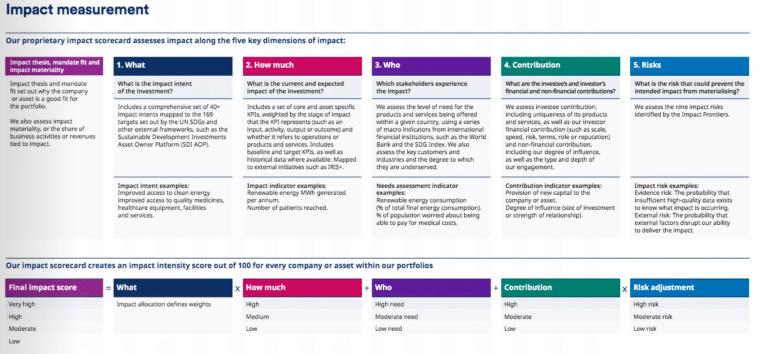

Measurement is core to impact investing and Schroders uses key performance indicators (KPIs) that can be tracked over time to monitor whether progress is in line with expectations.

Nadina Stodiek, co-head of impact management at Schroders, told Markets Media that impact investing is about the product and services of the companies and asset, whereas sustainable investing is more about their business practices.

“Sustainability is about how they do business, whereas impact investing is about the outcomes being generated though their products and services,” she added.

According to Stodiek, one of the unique selling points of Schroders’ approach is that the toolkit developed with BlueOrchard is used in the same way across public and private asset classes, geographies, and different intentions and risk return profiles in an equally rigorous manner

“We believe that the next hurdle for impact investing is scale, which is only achievable when you do things in a more efficient and effective way,” said Stodiek.”That is why we have constructed our practice as an impact capability rather than an impact product offering.”

If Schroders makes an impact claim, then it has to measure an impact KPI with bottom-up data. The data is gathered from many sources including sustainability reports, impact reports, annual reports and capital markets presentations. Macauley added: “The data may be publicly available, but you have to hunt for it.”

The proprietary scorecard for each transaction includes five dimensions of the what, how much, who, contribution and risks.

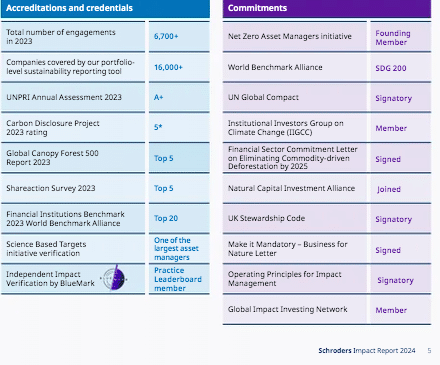

Impact governance is also important. Macaulay said: “We were really pleased to be recognized by BlueMark, who are the leading independent verifier. We were on their leader board of 10 impact managers, and the only large diversified asset manager on that list.”

In addition, Schroders has set up an independent Impact Assessment Group (IAG) to provide transaction and portfolio-level oversight to ensure alignment with the impact goals outlined in the strategy’s theory of change. The IAG meets every week to review new companies, transactions, or assets that the investment teams want to add to their portfolios, and has a veto over approval. Macaulay said: “I think that level of independence and rigor is unique.”

Growth potential

Macaulay believes there is huge growth potential for impact investing due to consumer demand from the younger generation, structural trends such as decarbonisation and demographic shifts, and policy and regulation pushing increased transparency.

“Impact is tracked, measured and reported and clients welcome that in the current climate,” said Macaulay. “I think it can be a bit of an antidote to some of the fears around greenwashing, because it is very tangible.”

There has also been an important shift in the market with clients that have historically invested in sustainability or ESG strategies beginning to test impact investing, according to Macaulay. She hopes that more mainstream investors will be exposed to impact and be convinced it is a core allocation.

Clients also have the ability to tailor impact strategies or mandates to suit asset owner preferences. For example, pension funds in a particular sector may want to target the impact within that same sector or clients can tailor preferences in asset, risk return or impact theme.

Schroders is also working with an academic institution to research the returns of impact strategies.

“Within all our impact funds, we are targeting competitive financial returns in the asset class,” said Macaulay. “We believe that you do not have to give up returns to deliver a positive impact.”