The annual Russell Reconstitution is usually one of the most heavily traded days of the year in the cash equities market, and investors have also increasingly been using futures to manage their risk or take advantage of possible opportunities in stock additions and deletions.

Each year the Russell 1000, 2000 and 3000 indices, part of index provider FTSE Russell, are reviewed to ensure they remain representative of the segments they are targeting after taking account of market events in the previous 12 months.

The annual #RussellRecon reveals style classification shifts in the Russell Index, impacting industries. Stay updated on the evolving market trends here: https://t.co/8KxvSKaB7g #MarketEvolution #MarketShift #TechLeaders pic.twitter.com/BUOSRiD3ja

— FTSE Russell, An LSEG Business (@FTSERussell) June 22, 2023

This year the Russell Reconstitution concludes on June 23 and it is also the 20th consecutive year for the Nasdaq Closing Cross, which is used to rebalance affected Nasdaq-listed securities and provide an accurate price for the market close. In 2022 a record 3,3 billion shares representing $63.8 bn were executed in the Closing Cross in 2.04 seconds for the Reconstitution.

Catherine Yoshimoto, director of product management at FTSE Russell, said the process begins with the transparency of the methodology and rules, which are announced well in advance. This year the announcement of the methodology enhancements was moved forward to January from May.

Yoshimoto told Markets Media: “Transparency and getting the market prepared is a really critical part of making sure this is an orderly event.”

The newly reconstituted index membership will take effect when markets open on 26 June.

Futures trading

Tim McCourt, global head of financial & OTC products at CME Group, said the exchange’s focus is on educating clients on how futures can be useful tools to manage risk. Investors can use futures instead of having to trade the additions and deletions of stocks in the Reconstitution themselves.

McCourt said: “We see trading in advance of the Reconstitution as clients may look at using futures instead of trading the cash basket on the close. We expect continued swelling of interest in Russell contracts in and out of the Reconstitution.”

Volumes are also heightened as 16 June was the quarterly expiration for derivatives contracts.

Investors can also use the Basis Trade at Index Close (BTIC) mechanism which allows equity index contracts, such as the CME Group E-mini Russell 2000 Index futures, to be traded at a spread to the day’s closing price instead of having to trade many cash baskets, which increases operational efficiency and reduces costs. BTIC volumes increased almost 10% versus last year to about 5,000 contracts a day according to McCourt.

“The idea of trading against the close is continuing to resonate with clients across our index suite,” he added. “It has become a more important part of their risk management toolkit.”

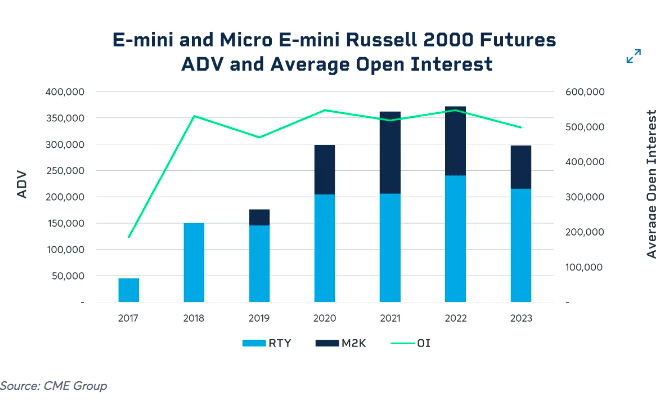

In addition, active managers also take positions on stocks that will be added or deleted to the indices and use single stock futures to hedge some of those strategies. McCourt described the Russell 2000 complex as a tremendous growth story at CME since it won the contract in 2017.

“In the first few quarters we were about 90,000 contracts a day,” he added. “So far this year through to May we have been trading 350,000 contracts a day.”

Micro E-mini futures contracts on the Russell 2000 are trading between 75,000 and 100,000 contracts per day according to McCourt. Volumes of options on Russell 2000 futures have also risen one third versus 2022.

“A lot of the increase in interest is because investors are being more precise about how they want to manage their index exposure,” he added.

International interest

Another reason for the volume growth is that although the Russell indices are US-based, they have become more important for overseas investors. McCourt said investors see the Russell 1000 index as a pure play on the large-cap space while they see the Russell 2000 as a distinct expression on the US economy.

“The small-cap names are very distinct companies that are often innovating faster, growing faster and do not have the same multinational exposure as large caps,” added McCourt.

Yoshimoto agreed that there was more international interest in the Russell indices. As volatility has increased outside the US, Yoshimoto said overseas investors had renewed their interest in coming back into the US equity markets. Approximately 40% of the revenues in the Russell 1000 come from outside the US, which falls to 20% in the Russell 2000.

“Even though it is a US-based index, it is certainly a global story,” she added.