A clear regulatory framework and the building of more digital asset infrastructure will help drive adoption of the new asset class according to a panel at the Digital Assets TradeTech conference in Miami.

Jeff Lewis, director of capital formation at hedge fund Pantera Capital, said on a panel, Strategies for Driving Digital Asset Adoption, that the digital asset industry has been like the boy who cried wolf.

“We keep saying it’s coming, it’s coming, and people are becoming rightfully skeptical,” said Lewis.

He also compared the current early days of digital assets to the early days of the internet where the creation of the necessary took six to seven years.

“In those days videos wouldn’t play and it just didn’t work very well,” added Lewis. “You need to go through a phase of infrastructure building before you start to see use.”

Blue Macellari, head of digital assets Strategy at T. Rowe Price, agreed that the sector has struggled for a long time as it has been incredibly difficult to access for most users.

She said: “I’m very excited that we are starting to see user interfaces that make sense for regular adults who don’t have hours to spend on GitHub, [a coding platform].”

As a result, she described the launch of spot bitcoin and ether exchange-trade funds as enormously successful, as the products can fit in a standard portfolio.

Macellari added: “It is nearly impossible for any large asset manager to be to be looking around the space and ignore those types of numbers.”

Great stats, never ceases to amaze. I'll go one further: in the last four years 1,800 ETFs have launched and $IBIT is the most successful of all of them at $26b. https://t.co/8Nq6YwXhYj

— Eric Balchunas (@EricBalchunas) October 24, 2024

Samed Bouayana, portfolio manager at Altana Wealth, agreed on the panel that the adoption of crypto ETFs has been important. He continued that the industry has “massively evolved” since the collapse of exchange FTX in November 2022.

“We have realized that we need segregation of duties between custodians and trading exchanges,” he said. “We have more adults in the room and more TradFi adoption from the likes of Larry Fink and Fidelity.”

Bouayana said market neutral strategies had been popular for the last few years. However, Altana is starting to see investor appetite shifting to get potentially smarter exposure to the asset class, for example, capturing the downside efficiently though perpetual futures, which do not exist in traditional finance.

Lewis said: “One of the great misconceptions about crypto is that we’ve invented a bunch of things that didn’t exist before, but almost everything that’s in crypto already exists. Most tokenizations are just securitizations, but they are difficult to do because the rules around tokenization are not clear.”

He continued there many mundane processes that can become more efficient using crypto, but are being held back by regulation.

“We just need clear regulation and I think that the adoption will sort of take care of itself,” added Lewis.

Impact of US election

David Easthope, senior analyst and head of fintech research on market structure and technology at consultancy Coalition Greenwich said in a blog that the US election could be a turning point for crypto market structure.

“For crypto, the SEC is the clear “elephant in the room” on the regulatory front, with enforcement actions driving the U.S.’s crypto agenda over the past several years,” he wrote. “Chairman Gensler’s current appointment goes through 2026, but a Trump presidency would likely mean a new chairman.”

However, he also warned that the regulator staggers the appointment of its five commissioners, so the election will not change the composition of the SEC overnight, especially as new commissioners will need to be confirmed by the Senate.

Easthope said the biggest items being watched by the industry are market structure, including the definitions and roles of custodians of digital assets, exchanges and brokers; stablecoins and tokenization, where the US has fallen behind overseas jurisdictions.

He highlighted that the regulatory environment has already become more hospitable to crypto as BNY Mellon has been allowed to offer custody for asset managers issuing crypto exchange-traded products on a case-by-case basis.

“These and other shifts have the potential to unleash a flurry of changes that will make it easier for institutions to invest in and trade spot crypto and move beyond some of the more basic investment products, ETFs/ETPs and exchange-traded futures (like futures on CME or CBOE) and potentially become more like global FX trading in the U.S.—similar to what is happening in places like Singapore, Hong Kong, the Middle East, and Switzerland,” said Easthope.

Easthope said: “One specific area where we expect tokenization to keep up its rapid rise is in collateral.”

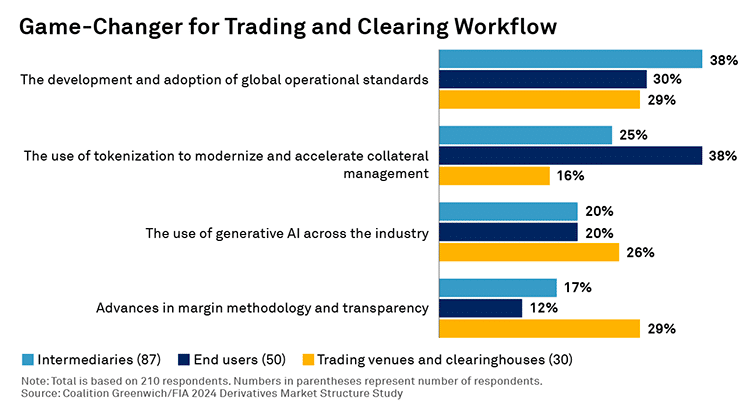

Coalition Greenwich research has found that 25% of intermediaries and 38% of end users believe that tokenization has the potential to modernize and accelerate collateral management, upgrading trading and clearing workflows.