Refinitiv and MarketPsych have launched an environment, social and governance data feed which uses artificial intelligence to provide a more timely view of the perception of a company based on news and social media.

Leon Saunders Calvert, Refinitiv

Leon Saunders Calvert, head of research & portfolio management at Refinitiv, which is now owned by the London Stock Exchange Group, told Markets Media that MarketPsych has been working exclusively with the firm for a number of years to provide sentiment analysis. MarketPsych ESG Analytics was launched last month.

“They suggested the ESG space,” he added. “We can provide data at a much higher frequency while companies only report once a year.”

The model uses AI and natural language processing to provide scores oN media perceptions of corporate and country-level ESG across a number of themes in intervals of minutes, hours or days. The feed is derived from millions of credible news and social media stories going back to 1998, rather than from a company’s own reports or press releases in order to minimize corporate “greenwashing.” The analytics cover more than 30,000 companies and 252 countries and territories.

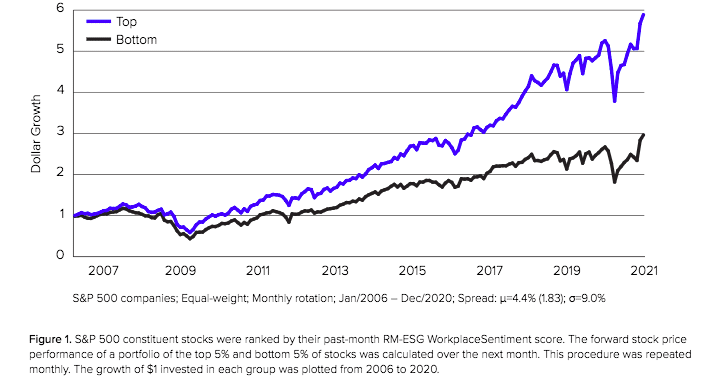

“The data is granular, publishing scores on 200+ ESG themes and controversies minute-by-minute,” said Refinitiv. “It is used in quantitative, risk management, and research applications. Initial quantitative research found substantial global stock and equity index predictive power.”

Quantitative investors can use the data to enhance alpha generation and risk management while discretionary investors can use the data to improve portfolio construction. Analysts and researchers can explore relationships between ESG and economic performance, for example between the share price and workplace sentiment.

Source: Refinitiv.

Richard Peterson, chief executive of MarketPsych, said in a statement: “Through the lens of this data, our clients can explore how media perceptions and corporate behavior impact business performance over time. For example, we’ve found that the share prices of companies with higher Workplace Sentiment scores significantly outperform their peers, and it appears that happier employees generate more value for shareholders.”

Saunders Calvert added that ESG data is treated as fundamental data in the same way as audited financial data. However challenges include lack of standardization and disclosure.

“In financial reports you know what you will see in the cashflow statement and balance sheet, but that doesn’t yet exist for ESG reporting,” he said.

In addition, companies reported on their own operations but not yet on their products and services or supply chains and there is little data on private companies.

“We cannot afford to wait until the data gaps are filled,” said Saunders Calvert. “This is a new space but there is useable and actionable data available now and reporting is becoming mandatory.”

Green taxonomies are being developed, such as in the European Union, and governments are mandating ESG reporting.

For example, the UK government intends to make TCFD-aligned disclosures mandatory across the economy by 2025, with a significant portion of mandatory requirements in place by 2023. The Task Force on Climate-Related Financial Disclosures issued a voluntary framework for reporting in 2017 which has been endorsed by more than 1,800 companies and 10 governments.

Saunders Calvert said: “Disclosure levels have been improving every year and there is increasing pressure from regulators and investors. Progress never happens in a linear fashion but I am optimistic.”

ESG market

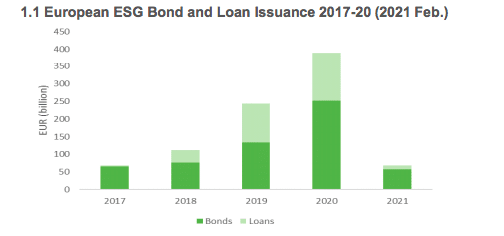

The growth in ESG was highlighted by new data from The Association for Financial Markets in Europe’s which found a 58% increase in Europe last year.

European ESG bond and loan issuance grew 58.8% from 2109 to €389bn last year according to AFME’s first European ESG Finance Quarterly Data report.

Source: AFME.

Social bond volume increased by nearly 700% to €94.3bn last year, from €11.8bn in 2019, helped by the European Commission’s €39.5bn issuance in the fourth quarter.

“ESG bond issuance was 8.3% of total European bond issuance in 2020, up from 5.0% in 2019,” added AFME.

European ESG bond and loans issuance in the first two months of this year is €68.7bn, half of the €139.7bn in the same time frame last year according to the report.

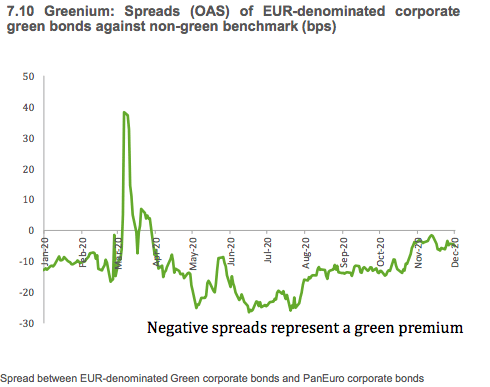

The study also found that green corporate bonds performed at a premium, or “greenium”, of about 5 basis points against non-green benchmarks.

Source: AFME.