The ability of investors to efficiently secure financing against a fund’s underlying assets with a net asset value (NAV) loan using blockchain could be a catalyst to bring private funds on-chain over the coming years.

Anthony Moro, chief executive of Provenance Blockchain Labs (ProvLabs), a blockchain development company, told Markets Media that in order for real world assets to be widely tokenized, an asset on a blockchain has to be cheaper, faster and safer than in traditional finance. He explained that investors are able to take out an NAV loan on their private fund positions but the process is paper intensive, costly and time consuming.

“If you can’t be cheaper, faster and safer, then you need to add interesting new capabilities, which is what NAV Lend does on blockchain,” he added.

In August this year ProvLabs launched a tokenization platform with Figure Markets and NAV Lend.

Managers can list funds on Figure Markets’ digitally-native “everything marketplace,” a decentralized custody marketplace for crypto, stocks, bonds and other assets. Figure Markets gives investors the option to use its streamlined universal passport for onboarding. Funds can also be traded on the Figure Securities, a regulated alternative trading system (ATS).

The NAV Lend platform offers investors the ability to use their fund interests as collateral for loans using the Provenance blockchain and Digital Asset Registry Technologies (DART) to register, verify and perfect counterparties’ assets and ensure assets remain under the appropriate control until the transaction is completed.

ProvLabs has a unique capability to put an escrow on assets in a digital wallet according to Moro, which is necessary for institutional adoption. He said: “Provenance has a superpower because we have the ability to place an escrow hold on a position in a wallet if it is being used as collateral, and the ability to perfect ownership of any lien or collateral through DART.”

Mike Cagney, chief executive of Figure Markets, said in a statement that ownership perfection and cross-collateralization are the capabilities that will unlock broad investor and issuer adoption of blockchain-based, real-world asset-focused private funds.

Private fund investors currently have to keep their holdings for many years or sell their interests at significant discounts in the secondary market. Frank Fernandez, co-founder of NAV Lend, said in a statement that pledging an illiquid fund as collateral for a loan provides a better way for them to make these long term assets more productive.

“Asset managers will be able to offer funds that have an NAV lending capability, which will be more attractive to investors than funds without a NAV lending capability,” added Moro. “We think this NAV lending capability might be the initiative that brings trillions of funds on-chain over the next couple of years.”

In addition, there needs to be some regulatory clarity on digital public fund transfer agents, which Moro said is a big reason for funds not yet coming on-chain.

Differentiation

ProvLabs was carved out from the Provenance Blockchain Foundation in August this year in order to focus on real world asset issuance according to Moro. He said that a differentiator of the Provenance blockchain is that it was purpose-built for financial services, with interoperability and privacy incorporated into the protocol. Provenance said it has over $12bn in financial asset value locked on-chain and more than $30bn in supported transactions.

Moro continued that a generic blockchain needs a stack of smart contracts to perform certain functions for financial services. He compared the stack of smart contracts needed by a generic blockchain to a Jenga tower. For example, a cap table smart contract needs to talk to a distribution smart contract, which needs to talk to a privacy smart contract. Another issue is that the smart contracts are generally owned by third parties, rather than the operator, who have different upgrade schedules and compatibility.

“As more assets get issued on chain, the Jenga tower starts to get more wobbly and eventually falls over,” he said.

However, Moro argued that Provenance includes all these aspects directly built into the core protocol, which are upgraded holistically by the community.

“It’s an open source software so there are no incompatibility issues,” Moro added. “We think that is a better way forward for financial services.”

He believes the future of blockchain will be “horses for courses,” with, for example, blockchains for financial services and blockchains for gaming, each optimized for their specific segment.

“We think there will be a small number of interoperable public blockchains that register and exchange trillions of dollars of the world’s assets,” said Moro.

He also recognizes the need for private permissioned blockchains for highly regulated financial services firms. The Provenance ecosystem includes Private Zones, an exact copy of the public protocol but with a validator set of permissions and tokenomics controlled by the operator, who gets complete privacy and control of the network.

For example, Private Zones were used in Singapore’s Project Guardian, which tested how blockchain technology could be used to manage large-scale client portfolios, execute trades and enable automated portfolio management of tokenized financial assets. J.P. Morgan’s Onyx Digital Assets team led development of a proof-of-concept system in collaboration with alternatives manager Apollo to tokenize funds and enable wealth managers to purchase and rebalance positions in tokenized assets across multiple, interconnected blockchains.

“Private Zones future proof projects that are now being built in a private networks as they can literally move to the public blockchain at the push of a button when appropriate” said Moro.

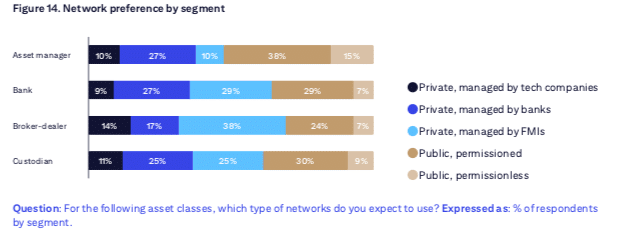

A report from Citi Securities Services – Evolution 2024: Disruption and transformation in financial market infrastructures, found that 64% of sell-side respondents opt for a private blockchain today, while understanding the inherent conflict with interoperability and the need to comply with regulations such as the Digital Operational Resilience Act (DORA) in the European Union.

“In this context of heightened security and resiliency concerns, it is perhaps not surprising that 29% of sell-side respondents (who are almost always financial market infrastructure participants and members today) see financial market infrastructures as the natural provider of blockchain infrastructure to the industry, making it the preferred network option for this group today,” added Citi.

However, Citi noted that there is a strong desire to explore the world of public networks more actively outside of the world of exchange members and clearing participants. The report said that while 25% of asset managers see bank-run blockchains as inevitable, 53% of them prefer public chains to enable distribution.

Growth

Moro continued that JPMorgan and Goldman Sachs have announced intentions to put several funds on-chain before the end of this year. Blackrock and Franklin Templeton have already issued tokenized money market funds.

“It’s a question of crawling before walking,” said Moro. “We are starting with tokenized money market funds but in 12 months time we will have moved to non-traded public funds.”

BUIDL continues to deliver consistent returns, paying out $2.1M in August, bringing total dividends to over $9.3M since March. 📈

As @BlackRock's USD Institutional Digital Liquidity Fund grows, so does its impact on tokenized finance. This steady performance highlights the… pic.twitter.com/0Ux2gyFEDy

— Securitize (@Securitize) September 3, 2024

Private equity funds and venture capital funds will then also come on-chain due to the increased efficiencies and the NAV lending ability.

“At the end of the day, we are going to see every asset in the world on blockchain because it’s cheaper, faster and safer,” Moro added.

The Citi report said that after years of relative inactivity on DLT and digital assets, the buy-side is now beginning to take significant, commercial steps in adopting this technology. Around 13% of banks and custodians surveyed are looking to use tokenized money market funds as their cash mechanisms, making them the most desirable funding option after central bank digital currencies for the world’s largest users of institutional funding.

“By targeting retail investors directly and by bypassing the heavily intermediated fund distribution ecosystem (that includes retail investment advisors, banks and others), asset managers can not only transact better but they can also radically transform their connectivity to end investors, removing further cost and inefficiencies in the process,” said Citi.

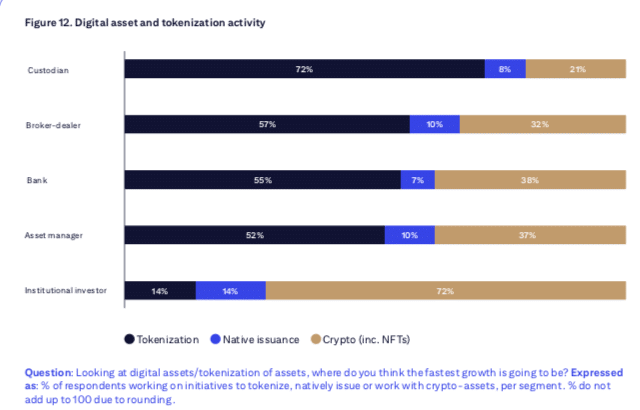

In 2024, 62% of sell-side respondents are focusing their DLT and digital asset efforts on tokenization, versus only 8% for natively digital security issuance.

“Trillions of dollars in tokenized collateral are now being exchanged every day and millions of dollars are accumulating in tokenized money market funds,” said the report.

Moro also gave the example of infineo, which said in a statement on 4 September that it has minted $100m worth of life insurance policies on the Provenance blockchain.

“This milestone has been achieved in just three months and represents a significant leap in the tokenization of real-world assets, positioning life insurance as one of the most rapidly growing sectors in digital finance,” added infineo.

infineo said tokenization creates opportunities for peer-to-peer transactions, securitization, new investment products backed by life insurance policies and unprecedented liquidity for policyholders with instantaneous lending against their policies in a $3 trillion market.

Another example that Moro gave is Figure Technology Solutions using the Provenance blockchain to provide customers with a decision on a HELOC (home equity line of credit) in as few as five minutes and funding in as little as five days. Moro said Figure shaves more than 100 basis points off the process of issuing a HELOC, and this year will have north of 10% of all HELOCs originated in the US.

“If you are doing something 100 basis points more efficiently than your competitors, you know you are not going to have many competitors,” Moro said. “Cheaper, faster and safer will always win the day in financial services.”

The Citi report said 12% of all its survey respondents are in commercialization mode today with digital assets and the volumes of live DLT-based transactions continue to grow, driving a marked industry shift towards practical execution in blockchain choices and in digital cash.

Moro believes traditional financial firms are going to need a lot of help to move to blockchain, and so will partner with firms like Provenance Labs.

“We are still in the first innings of this industry,” said Moro. “There are $700 trillion of assets tokenize, so there is lots of space for everyone.”