Private Markets & Technology to Grow to Over 20% of Blackrock’s Revenue

01.15.2025

Senior management said 2024 was a “milestone” year for BlackRock as it made a series of strategic acquisitions in private markets and had record net inflows, assets under management and annual revenue.

Martin Small, chief financial officer, described 2024 as a “milestone” year for BlackRock on the results call on 15 January. He said BlackRock saw record net inflows in 2024 powered by two back-to-back quarters of record flows in the second half, and double-digit growth in annual revenue, operating income and earnings per share.

#BlackRock is eating the world: Assets Under Management (AUM) grew by 15% to hit a fresh ATH at $11.55tn. BlackRock has raised $641bn in investor funds in 2024. Tally incl $390bn flowing into its ETF business overall, $226bn into equity funds, and $164bn into fixed-income. (BBG) pic.twitter.com/cCdTNgWAYo

— Holger Zschaepitz (@Schuldensuehner) January 15, 2025

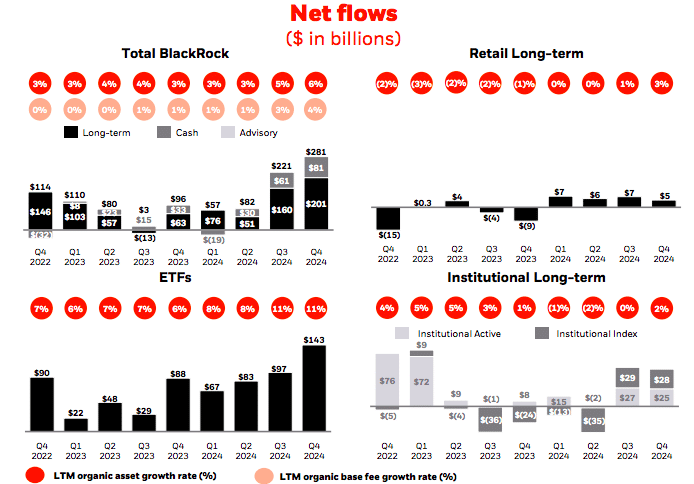

At the end of 2024, BlackRock reached a high of $11.6 trillion in assets under management, following a record $641bn of full-year net inflows, including $281bn in the fourth quarter. The firm also crossed $20bn of annual revenue for the first time to reach $20.4bn, an increase of 14% from 2023. Fourth quarter revenue of $5.7bn was 23% higher year-over-year.

Larry Fink, chairman and chief executive, said on the results call that 2024 was also a “milestone” year for strategic acquisitions. BlackRock has made a series of acquisitions to expand in private markets. Fink said: “We executed on the most significant acquisitions since BGI over 15 years ago.”

In June 2009, BlackRock announced it was acquiring Barclays Global Investors (BGI) for $13.5bn, which allowed the asset manager to build its exchange-traded fund franchise, iShares.

In December 2024 BlackRock agreed to a $12bn acquisition of HPS Investment Partners to create an integrated private credit franchise with approximately $220bn in pro-forma client assets. The deal is expected to close in the middle of this year. In June 2024 BlackRock also announced its £2.55bn purchase of Preqin, an independent provider of private markets data, which is expected to close in the first quarter of this year.

The acquisition of Global Infrastructure Partners (GIP), an independent infrastructure manager, closed in October last year.

Fink said: “We are positioned ahead of market opportunities that we believe will drive outsized growth for BlackRock in the years to come.”

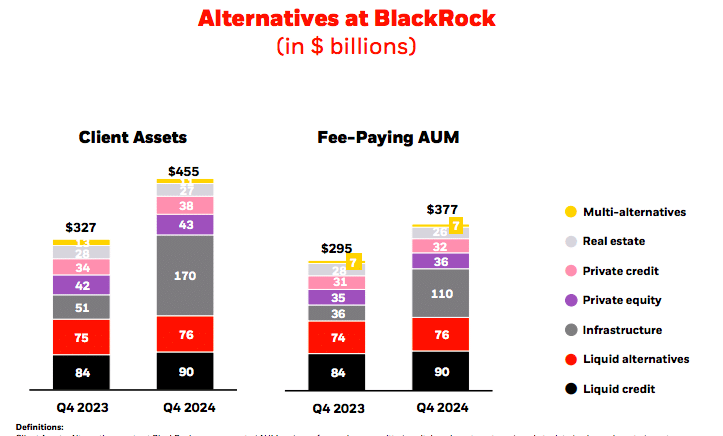

Small explained that clients want portfolios that are seamlessly integrated across public and private markets, that are dynamic and underpinned by data, risk management and technology. When the HPS deal closes, BlackRock’s private markets and alternatives platform is expected to reach $600bn in client assets, making the firm a top-five provider. The current private markets and alternatives platform contributed over $3bn in revenues in 2024, or about 15% to the group.

In addition, Small said that BlackRock’s technology platform, Aladdin, contributed $1.6bn in revenues in 2024, and is powering a whole portfolio ecosystem across public and private markets. The need for integrated risk analytics and whole portfolio views across public and private markets is driving strong demand for Aladdin, and BlackRock signed some of its largest ever clients for the platform in 2024.

“With our planned acquisitions of Preqin and HPS, private markets and technology are expected to make up over 20% of Blackrock’s overall revenue,” Small added. “Our mix continues to evolve towards higher secular growth areas with clients.”

In 2024 private markets had $9bn of net inflows, which Small said was driven by infrastructure and private credit. There were also realizations of $13bn, primarily from private equity, private credit and infrastructure strategies. Distributions are a key metric for measuring performance in the private markets.

“GIP has a strong track record of operating portfolio companies and returning capital to investors through exits with strong uplift,” said Small. “We expect to recognize approximately $5bn of realizations in the first quarter from older GIP fund vintages executing on successful exits.”

Fink continued that blending public and private markets, especially private credit and infrastructure, will be critical to fully capturing growth opportunities.

“Long held investing principles need to evolve, including the traditional 60/40 portfolio mix of stock and bonds, making resilient portfolio construction more critical than ever,” added Fink.

More than half of the $11.6 trillion of assets managed by Blackrock manages are related to retirement and Small said there are real potential benefits for retirees through blending public and private assets.

“We’ve been thinking about how to potentially bring private markets into target date structures,” added Small. “There will have to be some reforms, so we are watching the space closely and keeping in touch with trade associations and Washington DC.”

Fink stated that regulatory oversight requires better systematic analytics and data under ERISA laws in the US, which govern most voluntarily established retirement and health plans in private industry to protect individuals in these plans.

“I think this is essential, and is one of the key reasons why we made the acquisition of Preqin,” said Fink.

ETFs

ETFs generated record net inflows of $390bn in 2024 , representing 11% organic asset growth and 7% organic fee growth. Small highlighted that net inflows included $41bn into digital asset ETFs that BlackRock launched in 2024.

Fink said one quarter of ETF net inflows were into products launched in the last five years. This included the spot bitcoin ETF in January 2024 which he said was the largest launch in history, growing to over $50bn assets in less than a year.

“The bitcoin ETF was the third highest asset gathering ETF in history, only behind the S&P 500 index funds,” added Fink.

In 2024 BlackRock’s European ETF offerings scaled significantly, and have experienced double-digit organic growth in each of the last two years. European ETFs had over $90bn in net inflows in 2024 and the regional ETF platform is nearing $1 trillion of assets, which is larger than the next five issuers combined, according to Fink.

Fixed income

Fink continued that the world is moving from an inverted yield curve to one where the yield curve is steepening. As a result, he expects the $10 trillion sitting in money market funds to be put to work.

Robert Kapito, president, said on the call that a more balanced term structure of interest rates is an indicator of the demand for intermediate and longer duration fixed income.

“We see that people are under-allocated to fixed income through our models business, and we see that they’re looking to increase their weightings in longer duration fixed income,” said Kapito.

As countries around the globe have budget deficits there is going to be a lot of issuance, he expects the premium over Treasuries to be significant enough to move money from cash into intermediate and longer term duration fixed income, across both public and private markets.

Fixed income flows were $164bn in 2024, which included $24bn in the fourth quarter alone according to Kapito. He added that fixed income demand was across iShares, index, active strategies and both retail and institutional, primarily from insurance companies.

Financials

BlackRock generated 7% annualized organic base fee growth in the fourth quarter of 2024, the firm’s highest in three years according to Small, and had record client activity. Annualized organic base fee growth was ahead of BlackRock’s 5% through the cycle target.

Small added that the record organic growth and financial results do not yet reflect the full integration or pending acquisitions of GIP, HPS and Preqin.

“We didn’t need M&A to achieve and rise above our organic base fee growth target,” said Small. “Our expansions are more about serving clients in high growth segments that can exceed our 5% goal.”

The acquisitions of Preqin and HPS are expected to bring approximately 2,300 new staff to BlackRock.

The results call was Fink’s 100th earnings call since BlackRock went public 24 years ago. Small said: “We did a little research and counted only 15 current CEOs in the S&P 500 that have celebrated 100 earnings calls as CEO.”

Fink highlighted that at the time of the IPO, Blackrock had 650 employees and $165bn in assets under management, which has grown to $11.6 trillion.

In the same year as the IPO, BlackRock began selling Aladdin to clients for the first time, and the technology platform now has more than 130,000 users according to Fink. He described Aladdin as the operating system that unites all of BlackRock and provides clients with sophisticated risk management, portfolio analytics across public and private markets, and eventually, private market data from Preqin.

Fink continued that the most important thing has been investing in talent and developing leaders with a broad range of experiences and connectivity across the firm, which he calls horizontal leadership.

“Today, we are excited to announce that many leaders across the firm are taking on new and expanded roles and responsibilities that will help drive our next phase of growth,” he added. “Part of the leadership changes reflect Mark Wiedman’s desire to pursue his next chapter.”

Wiedman has spent nearly 20 years at BlackRock and is currently head of the global client business. Fink said Wiedman’s transition has been discussed over a number of months, and will be at the firm through spring.