There will be more deals and more exits from the financial services sector as private equity sponsors are rich in dry powder and taking aim at poorly capitalized banks, asset managers facing outflows and market volatility, and brokerage firms suffering from regulatory changes according to data provider PitchBook.

On 9 August 2024 Hargreaves Lansdown, the UK listed investment platform, said in a statement that the board has agreed for the firm to be taken private by a consortium of private equity firms for £5.4bn. The acquiring consortium is made up of CVC Capital Partners, Nordic Capital and a subsidiary of the Abu Dhabi Investment Authority.

Nicolas Moura, EMEA private capital analyst at PitchBook, said in an email that the Hargreaves Lansdown acquisition highlights that private equity firms are targeting companies listed on the London Stock Exchange, which has struggled compared to other stock exchanges over the past two years.

“We’ve also observed significant consolidation within the financial services sector, particularly among brokerage firms, asset managers, and insurance companies,” added Moura.

The deal also highlights that multiple sponsors are involved in the acquisition as the increase in interest rates has led to more club deals, where sponsors collaborate on “large megadeals” according to Moura.

“Hargreaves Lansdown shareholders rejected three previous bids before accepting a higher offer, indicating a shift from a buyer’s market to a seller’s market,” he said.

The median ratio for a company’s enterprise Value (EV) to its earnings (EBITDA) multiple in Europe currently stands at 12.1x for the trailing 12 months, an increase from the 10.2x last year, following signs of monetary easing and anticipations of a recovery according to PitchBook’s Private Equity Breakdown for Europe for the second quarter of 2024.

One of the sponsors in the deal, CVC Capital Partners, started trading on Euronext Amsterdam exchange on 26 April 2024, almost two years after initially signaling its intent to go public. PitchBook said that CVC’s exit has boosted overall exit value for financial services in Europe in 2024 with close to €20bn in exits for financial services in the first half of this year, which is the highest in a decade.

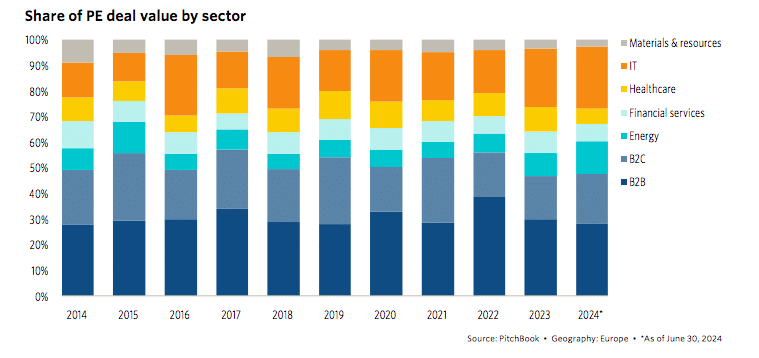

“Given the volatility in earnings in recent years for the financial services sector, linked at first to the COVID-19 pandemic and then to higher interest rates and finally to geopolitical risks, we have seen consolidation among banks, insurers, and brokerage firms,” said the report, “We expect more deals and more exits from this sector moving forward as PE sponsors rich in dry powder take aim at poorly capitalized banks, asset managers facing outflows and market volatility, brokerage firms suffering from regulatory changes, and more.”

Technology

Hargreaves Lansdown said the platform is expected to benefit from tailwinds over the coming decade, driven by increased individual responsibility for savings, pension freedom, an aging population, further digitalisation of the wealth process, the increasing importance of data, and artificial intelligence-led activities.

“At the same time, the direct-to-consumer market will become significantly more competitive, driven by a combination of increasing sophistication of established competitors, technology advancements and new entrants continuing to disrupt the market,” added the statement.

The acquiring consortium believes that a substantial transformation is required to accelerate the delivery of these objectives for clients and, in particular, in the technology platform to improve operational resilience, enhance capacity in systems, and deliver significant scalability and operating leverage in its cost base going forward.

Antonia Medlicott at Investing Insiders, said in an email that there is an urgent need for Hargreaves Lansdown to modernise its digital infrastructure and the inability to open accounts via an app is a glaring gap that needs immediate attention. Investing Insiders said strategic changes are crucial for Hargreaves Lansdown’s success under new ownership including lowering fees, embracing transformation, and improving returns for investors.