BNP Paribas reported that “robust business development” in the private capital sector and new mandates contributed to Securities Services having a “very strong increase” in revenues in the fourth quarter of last year.

The French bank said that Securities Services’ revenues increased by 13.4% to €776m in the final quarter of 2024, versus the same period in 2023. New mandates signed in the fourth quarter were particularly strong in Australia, including Insignia Financial, a large asset manager and pension fund. Transaction volumes also increased by 25.3% due to higher average volatility.

Karine Litou, deputy head of private capital and global head of product solution for private capital, Securities Services, BNP Paribas said in an email to Markets Media that she believes the success in winning new business is down to the bank’s global operating model which allows it to deliver a truly global experience with strong local presence and expertise.

Litou argued that BNP Paribas offers one-stop shop asset servicing and financing solutions to private capital managers to solve their pain points, so they can scale and operate more efficiently. In addition, its holistic operating platform brings all reporting and analytics features together in one place, with data flowing from a single golden source to ensure accuracy and consistency.

The bank is optimistic about growth in 2025, especially in private equity, and Litou said co-creating with clients and designing products tailored to their needs are crucial to growth.

“We are always very enthusiastic to explore partnerships with clients to further expand our reach and capabilities,” Litou added. “We all know artificial intelligence technology will continue to play a pivotal role in the new generation of asset servicing and client experience – our team will continue to embrace these trends and advancements to streamline operations and attain mutual growth with clients.”

Kyle Walters and Nicolas Moura, private equity analysts at data provider PitchBook, said in an email to Markets Media that broader economic uncertainty has cast doubt over public and private markets alike.

“Despite all this, private equity is seemingly business as usual, with deal and exit activity showing continued life after a welcomed rebound in activity in 2024,” added Walters and Moura.

PitchBook said in its Q1 2025 Global Private Equity First Look that global private equity deal activity continued at its robust pace, remaining at the elevated levels witnessed in 2024. This dealmaking rebound led to deal value in this year’s first quarter posting a higher deal value than each of the previous two years.

However, global private equity fundraising slowed in 2024, and that trend has continued into 2025. In the first quarter of 2025, funds raised $88.4bn, well below the $155bn to $160bn seen in the same period of the prior two years.

Data-driven operating model

BNP Paribas also embraced the trend of clients needing more data by launching new post-trade data management services in December last year. The French bank partnered with NeoXam to support clients by using the financial data technology provider’s Investment Data Solution (IDS).

Rémi Toucheboeuf, head of investment analytics and data services, Securities Services, BNP Paribas said in an email to Markets Media that institutional investors across the world are constantly looking out for solutions to improve their efficiencies and address the complexity of dealing with their ecosystem.

“They look for a partner like us to support their transition into a more data-driven operating model, particularly amid the current market dynamics,” he added.

Toucheboeuf argued that BNP Paribas’ data management capability, supported by the partnership with NeoXam, connects asset owners to a wider ecosystem of data, information and routes to market, while directly addressing their operational pain points.

For example, organisations often spend significant amounts of time and resources on processing data in multiple formats and from various sources. BNP Paribas’ data management service integrates a wide range of data management solutions, which provides clients with a unified, cross-asset class, multi-dataset portfolio view, regardless of their investment strategies or service providers.

In order to help clients with legacy platforms who cannot ingest and master multiple datasets, the bank’s data management solution also provides a full end-to-end process of capturing, normalising, and transforming data from a variety of sources, all under the client master data referential.

“Clients can then access and utilise these books of record through APIs and self-service capabilities, having the flexibility to continuously adapt their models and needs,” said Toucheboeuf.

The services also facilitates the integration of sustainability into the client referential, as well as in their operational processes. Toucheboeuf gave the example of being able to help analyse the climate impact of clients’ investments by measuring their portfolio’s carbon emission.

Digital bond issuance

In another technical innovation, Securities Services was also the issuing and paying agent for a digital bond issued by state-owned French bank, Caisse des Dépôts, in the fourth quarter of last year, The digital bond was issued as part of the European Central Bank’s wholesale central bank money experimentation program.

Wayne Hughes, head of digital assets, Securities Services, BNP Paribas said in an email to Market Media that as a global custodian, Securities Services at BNP Paribas aims to pave the way for its clients should they wish to enter the digital assets space.

“We are the long-term partner of choice for our clients, and as such, we believe that innovation and protection of our clients’ interests should go together,” added Hughes.

He said Securities Services has been preparing and laying the foundations in many domains such as tokenization, custody, fund services (depositary services, fund administration, transfer agent activity) and digital cash.

“BNP Paribas has been actively researching and developing its digital assets capabilities since 2019,” said Hughes. “We have participated in numerous live experiments and developed our own DLT platforms (AssetFoundry and NeoBonds).

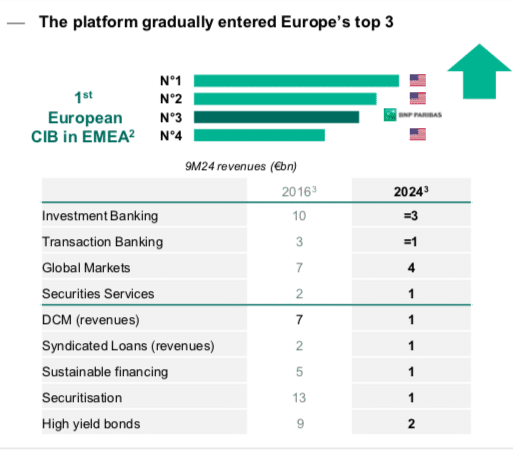

Overall for the BNP Paribas group, chief executive Jean-Laurent Bonnafé said in a statement that it achieved “very good” performances in the fourth quarter of last year and surpassed its 2024 objectives, while maintaining a solid financial structure.

“The ROTE [return on tangible equity] trajectory out to 2026 is confirmed and post-2026 drivers of growth are already in place,” added Bonnafé. “With corporate and investment banking, the group possesses a high-value-added platform and a powerful growth engine that continues to gain market share.”