Sal Arnuk, partner and co-founder of agency broker Themis Trading, will tell the US House Committee on Financial Services that payment for order flow presents an undeniable conflict of interest and increases overall costs for all investors.

Arnuk said in his written testimony to the committee that payment for order flow may enable zero commissions for retail investors, but they incur larger implicit costs.

He added: “While payment for order flow is legal, we have long wondered how it possibly could be. How can a broker, charged with the duty of getting its clients the best available prices, possibly do so by selling that client’s orders to amazingly sophisticated high-frequency trading firms, who in turn will make billions of dollars trading against these orders?”

#RELEASE – Chairwoman @RepMaxineWaters at Second Hearing on Ongoing Market Volatility: The Committee Must Assess Legislative Next Steps | https://t.co/p2d6Fgm9Ek pic.twitter.com/W526lxEJTj

— U.S. House Committee on Financial Services (@FSCDems) March 17, 2021

Retail broker dealers, such as Robinhood Financial, do not send customer orders to national exchanges but instead route them to principal trading firms or electronic market makers who may offer incentives such as payment for order flow. The market makers either execute these orders at a profit or route the orders to other market centers.

Arnuk will testify on March 17 before the committee which is holding a virtual hearing – Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide, Part II.

Themis testimony: https://t.co/Y4KNbwxWxR

— Themis Sal (@SalArnuk) March 16, 2021

Shares in GameStop rose 1,600% in January as retail investors drove up the price after users of online forum Reddit had posted that hedge funds had taken a large short position in the US video game retailer. Robinhood was forced to temporarily suspend trading in GameStop and other “hot” stocks in order to cover its clearing margins which led to allegations of market manipulation and unfair treatment of retail investors. The House Committee held its first hearing on the incident in February.

Arnuk continued that the most damaging elements of the ‘meme-stock’ craze are due to extremely poor investor education, payment for order flow and a lack of accountability for poor investor education and misaligned incentives. He noted that the Robinhood founders recently changed their payment for order flow method from a set payment per share to a percentage of the spread.

“Now Robinhood benefits most when the spread is as wide as possible as well!,” Arnuk wrote. “This is an amazing misalignment of interests”

Retail brokers and market making firms have defended payment for order flow as they claim to offer an improved price but Arnuk argued this is a flawed calculation based on a slower price feed; does not take odd-lots into account and the reference price used is largely set by the market makers.

“The SEC recently fined Citadel $22m for mishandling retail orders,” said Arnuk. “They also recently fined Robinhood $65m failing its best execution responsibilities.”

He continued that payment for order flow also provides a disincentive for displayed limit orders on exchanges as they are often stepped in front of by HFT market makers who piggy back the price set by them.

“Would any of you, when buying a home for example, put a sign out front of said home with the price you would pay, only to help someone else buy the house ahead of you for the same price or a dollar more?” said Arnuk. “Yet that is what happens to displayed orders in the market every day.”

Michael Blaugrund, chief operating officer at the New York Stock Exchange, said in his written testimony that internalization deprives investors in the public markets the opportunity to interact with retail orders, resulting in “inaccessible liquidity” for large institutional investors.

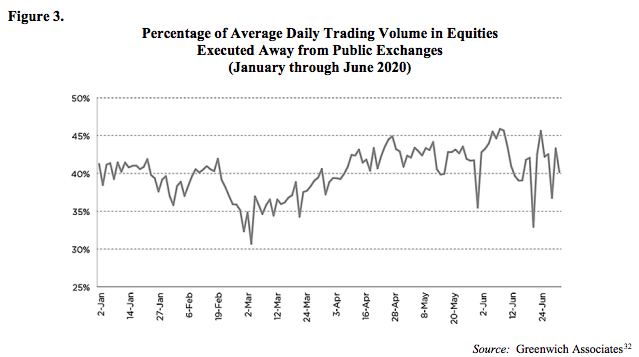

“Under today’s regulatory framework, the proportion of trading on public exchanges is at an all-time low,” added Blaugrund. “In fact, at the end of last year, on some days more shares were executed in private, dark venues than on lit, public exchanges with displayed price discovery.”

The NYSE believes that on and off-exchange price increment regimes should be harmonized. For example, if sub-penny trading is allowed in private dark trading, similar conventions should also be allowed on public lit exchanges.

“Reducing the minimum pricing increment on exchanges in active, low-priced securities would lower investor trading costs, improve market transparency, and provide an increased opportunity for investors trading on exchanges to interact with retail orders,” said Blaugrund.

@MichaelPiwowar @mblaugrund @SalArnuk among tomorrow's @FSCDems GME hearing. Join us after as we get early reactions from @JimToesSTA & @CBOE Adam Inzirillo https://t.co/gMRLwVojtw pic.twitter.com/3XpIJEyH0e

— SecurityTradersAssn. (@STA_National) March 16, 2021

The NYSE also wants increased transparency for securities lending and recommended that SEC should consider establishing a consolidated tape.

“At a minimum, stock loan information should be collected by the Commission and considered for public dissemination in the future,” Blaugrund added.

The exchange also supports the growing consensus to accelerate industry settlement cycles from two days after a trade, T+2, to one day, T+1, which would increase capital efficiency. However, Blaugrund warned that real-time or T+0 settlement would introduce inefficiencies.

He said: “Without intraday netting, massive capital inefficiencies would reduce and inhibit the liquidity retail and institutional investors depend upon to buy or sell with immediacy.”

Dennis Kelleher, co-founder, president and chief executive of Better Markets, a non-profit, non-partisan organization founded after the 2008 financial crisis to promote the public interest in the financial markets, said in his testimony that Robinhood reportedly received $687m in payment for order flow in 2020.

@DennisKellher points out that 47% of all trading is flowing into dark markets, some of which are using legalized kickbacks to brokers like Robinhood. Dark markets are making incumbents rich but that money is coming from pockets of retail investors pic.twitter.com/EyRKv9Sq82

— Better Markets (@BetterMarkets) March 17, 2021

Kelleher continued that payment for order flow across all retail broker-dealers last year was reportedly at least $2.6bn and the mechanism creates clear conflicts of interest.

“This is evidenced, for example, by a recent SEC enforcement action in which the SEC found that Robinhood executives internally reviewed the firm’s order routing practices, determined that limiting order routing to the payment for order flow executing dealers (HFTs) was harming its customers, and yet, continued to preferentially route orders,” he said.

Kelleher also highlighted that payment for order flow takes retail trading activity away from public securities exchanges and redirects that order flow to a very small number of HFTs that execute an alarming percentage of overall trading.

Off exchange trading. Source: Better Markets.

“The two largest HFTs involved in payment for order flow across the markets, Citadel Securities and Virtu Financial, together account for more of the U.S. equities trading market share than the New York Stock Exchange,” he added. “Such high levels of internalization structurally segment U.S. retail order flow in a manner that may increase market fragility, disincentivize resting orders on the exchanges, and widen quoted spreads, all of which adversely affect all investors in the securities markets.”