President-elect Trump has nominated Paul Atkins, a former commissioner at the Securities and Exchange Commission, as chair of the US regulator.

🇺🇸 BREAKING: Donald Trump nominates Paul Atkins as SEC Chairman. pic.twitter.com/Guo2HhOP91

— Cointelegraph (@Cointelegraph) December 4, 2024

Jake Chervinsky, chief legal officer at crypto venture capital firm Variant, said:

It's impossible to express the magnitude of the shift we're likely to see at an SEC run by Paul Atkins.

— Jake Chervinsky (@jchervinsky) December 4, 2024

Crypto has literally never existed without the overhang of uncertainty or hostility from US regulators.

This moment is a regulatory singularity before a new era for crypto 💫

Greg Xethalis, general counsel at Multicoin Capital, a thesis-driven firm that invests in tokens and blockchain companies, said:

Who is Atkins? He’s a former SEC Commissioner nominated by G.W.Bush, serving from 2002-2008. While on the Commission, he had the foresight to hire as counsel to his office the two outstanding now-Commissioners (Hester Peirce and Mark Uyeda), who await his confirmation as Chair.

— Greg Xethalis (@xethalis) December 3, 2024

Atkins' work at Potomak has touched digital assets, and he co-chaired the Token Alliance initiative with former CFTC Commissioner Jim Newsome. That initiative sought to create clear taxonomy and rules for tokens, launches and trading.

— Greg Xethalis (@xethalis) December 3, 2024

The opening of Atkins' Reg NMS dissent show the high level priorities that speak to Trump and a positive reshaping of the SEC. https://t.co/G2azhJ9JI1 pic.twitter.com/cYV39SB7Ay

— Greg Xethalis (@xethalis) December 3, 2024

– Atkins knows and trusts Commissioners Peirce and Uyeda and the work they’ve done. An Atkins nomination unlocks Peirce and Uyeda and their teams to really get a headstart as they wait for his confirmation (hopefully by early Q2 2025). pic.twitter.com/ABk6eqKNHw

— Greg Xethalis (@xethalis) December 3, 2024

For crypto, this likely means a whole lot more of Crypto Mom, as it's expected that Peirce will carry the crypto portfolio with Uyeda at her side and the full support of Chair Atkins. With a mandate from the Oval Office, we can expect:

— Greg Xethalis (@xethalis) December 3, 2024

– Expansion of the assets and activities of public funds investing in crypto (i.e., more ETFs and other variants).

— Greg Xethalis (@xethalis) December 3, 2024

– An end to destructive enforcement policies that harm US consumers and investors, and a return to a clear focus on rooting out fraud and bad actors.

We’re working on just that and will continue to meet and work with the Commission, staff, and elected officials, as well as our esteemed colleagues in the space. If you want to get involved, DMs are open — let’s go!

— Greg Xethalis (@xethalis) December 3, 2024

We have a lot of work to do at the SEC to advance free markets, capital formation, investor choice, and innovation. I'm delighted that Paul Atkins will be returning to lead the effort. Having worked for him during his last stint at the agency, I cannot think of a better person…

— Hester Peirce (@HesterPeirce) December 4, 2024

Paul Atkins' nomination as SEC Chair is a huge win for financial innovation. President Trump promised to have the most pro-digital asset admin in U.S. history, and I am looking forward to working with both of them to promote innovation and make our economy strong again

— Senator Cynthia Lummis (@SenLummis) December 4, 2024

Stuart Alderoty, chief legal officer at Ripple, which builds crypto solutions, said:

The triumvirate of Atkins, Peirce, and Uyeda at the SEC will not only bring common sense back to the agency, but true investor protection as well. https://t.co/dV0f5qDAOy

— Stuart Alderoty (@s_alderoty) December 4, 2024

Atkins is on the advisory board member at Securitize, the tokenization platform which was used by BlackRock to launch the asset manager’s tokenized money market fund. Carlos Domingo, co-founder & chief executive at Securitize, which has reached more than $1bn in tokenized onchain assets, said:

We are very excited about the possibility of former SEC commissioner and @Securitize's member of our advisory board, Paul Atkins, becoming the next SEC chair; he can bring necessary change to the industry! https://t.co/PmV0EQYUxC

— Carlos Domingo (@carlosdomingo) December 4, 2024

Jeremy Hogan, partner at law firm Hogan & Hogan, said: “He won’t be the bull in the china shop many in the crypto space want. He will make measured and deliberate changes. Overall, I give his appointment a B+ for the digital asset industry, and that was good enough to get me a law degree so, yeah!”

Trump picks former SEC head Paul Atkins to chair his SEC.

— Jeremy Hogan (@attorneyjeremy1) December 3, 2024

Pros:

He has advocated for reasonable (and workable) regulation in the digital asset space – especially with the exchanges.

He's a steady hand who was SEC chair for 8 years. It will be hard for the Dems to attack him.… https://t.co/3RgVq0PxRL

Cody Carbone, president of blockchain trade association The Digital Chamber, said:

Thrilled for Paul! Personnel is policy.

— Cody Carbone (@CodyCarboneDC) December 4, 2024

If anything can clean up the SEC's current mess and bring the regulatory clarity that the #digitalasset industry, it's Paul. https://t.co/KaWQitD53G

Hunter Horsley, chief executive of Bitwise Asset Management, the US crypto index fund manager, said:

Great news for crypto.

— Hunter Horsley (@HHorsley) December 4, 2024

2024: After 16 years, regulatory headwinds are becoming tailwinds. https://t.co/X3n875dGNd

Bitcoin reaches $100k

Overnight on 4 December Bitcoin surpassed $100k for the first time ever, which Stocklytics.com said in an email was stoked by a series of appointments by the incoming administration, including Atkins.

Neil Roarty, analyst at Stocklytics.com, said the growth in crypto since the US election has shown that digital assets are very much a Trump trade, and his appointments in the SEC have cemented this.

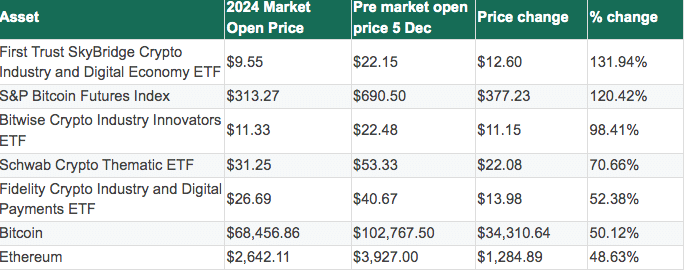

“However, investors can look beyond the raw currency of Bitcoin and take advantage of the huge growth across the whole digital asset industry,” he added. “ETFs can offer a great way to invest in a basket of companies across a specific sector while taking advantage of the market volatility, which has been hugely positive for crypto enthusiasts in 2024 so far.”

Equities markets

Dave Lauer, chief executive at technology company Urvin Finance and advocate for fair markets, said:

It's confirmed that Paul Atkins will be the new SEC Chair. This is quite bullish for crypto, as he was a member of a cryptocurrency advocacy organization.

— Dave Lauer (@dlauer) December 4, 2024

In terms of equity market reforms, Atkins voted against Reg NMS in 2005, and will likely prefer a hands-off approach. https://t.co/9qKtTSZCP3

Richard Johnson, founder and chief executive of Texture Capital, an SEC registered broker-dealer supporting digital securities issuance and trading, said: “The combination of ongoing dissatisfaction with equity market structure, Atkins’ influence within a new administration looking to scale back financial regulations, and the review initiated via the Regulatory Flexibility Act mean that a fundamental review of equity market structure, including the trade through rule, is increasingly likely.”

I wrote this blog in 2016 looking at his dissent against Reg NMS and his predictions that came true.

— Richard Johnson (@_richjohnson) December 4, 2024

Perhaps the end is nigh for rule 611?https://t.co/PzlVv9gNj0

Joe Saluzzi, partner at broker Themis Trading, co-author of the book Broken Markets and CFTC Technology Advisory member, said:

In 2005, Paul Atkins was one of two SEC Commissioners who voted against Reg NMS. This rule helped create the fragmented liquidity landscape that we have today. Below excerpt is from "Broken Markets": pic.twitter.com/8Q6e2SOltC

— Joe Saluzzi (@JoeSaluzzi) December 4, 2024

Better Markets, an independent, nonpartisan, nonprofit organisation objected to Atkins’ nomination and warned : “If the SEC again abdicates its mission as it did when Mr. Atkins was a Commissioner in the years before the 2008 crash, then investors, markets and financial stability will suffer.”

#PaulAtkins, President-elect #Trump’s nominee to lead the @SECGov, is smart, experienced, and capable. Unfortunately, he is also a deregulation zealot and industry cheerleader who, as a Commissioner at the SEC from 2002-2008, supported deregulation that contributed to the…

— Better Markets (@BetterMarkets) December 4, 2024

.