OSTTRA, the post-trade solutions provider, and financial technology provider FIS are collaborating to make post-trade processing for exchange-traded derivatives more efficient, and help market participants meet the new requirements from the FIA’s Derivatives Market Institute for Standards (DMIST).

Joanna Davies, head of trade processing at OSTTRA, told Markets Media that the two firms started talking in a very collaborative way nearly a year ago about the direction of the futures industry. She said: “It felt like there was an interesting opportunity to do something for the greater good of the futures community.”

OSTTRA has wanted to offer buy-side clients complete transparency through the lifecycle of an exchange traded derivatives transaction by connecting to global central counterparty clearing houses. Rather than building out connectivity to each CCP, which is an enormously time-consuming process, it made strategic sense for OSTTRA to connect just once to FIS. The OSTTRA network of asset management clients will then be able to benefit from receiving real-time clearing status from FIS Connections, which has links to more than 70 global CCPs. As a result, market participants will gain increased transparency into the finality of give-ups and improved exception management capabilities.

Davies added that the partnership will allow OSTTRA’s extensive margin network to use the strength of FIS’s margin advisor solution to provide enhanced transparency, validation and reconciliation for exchange-traded derivatives. In the other direction, FIS will provide the broker network with enhanced operational efficiency via straight through processing of allocation instructions enriched with OSTTRA order IDs directly into the FIS cleared derivatives platform, allowing for increased automation of give-up/give-in processing.

She believes the two firms will be able to connect clients and enable them to benefit from this interoperability from the first quarter of 2025.

“There are many more things we can do together, and many more opportunities for both firms strategically,” she added. “This is just the start, and we are moving as quickly as we can so we can interoperate on behalf of our global customers.”

DMIST standards

The collaboration also enables market participants to meet the DMIST’s 30-30-30 standards for the timeliness of allocations and give-ups in the exchange-traded derivatives market through enriched, and more accurate, data.

“There is no point meeting the timeliness standard if the underlying data is inaccurate,” added Davies.

The FIA, the industry body for exchange-traded derivatives, decided to set up DMIST after the Covid pandemic in 2020 resulted in a massive backlog in processing exchange-traded derivatives and CCPs were asked to extend their clearing windows. However, there were long delays in the allocation and give up process and, in some cases, it took many days to correct trades that were in the wrong place.

In addition, the ETD industry has been experiencing record volumes every year, which also puts pressure on workflows. FIA data shows global trading volume of futures and options continues to increase, and the trade body expects 2024 to be another all-time high, marking seven straight years of record activity. DMIST, an industry-governed standards body, was formally launched by the FIA in 2022.

Following a consultation period, DMIST published its first final standard for Improving Timeliness of Trade Give-Ups and Allocations in June 2023. The ’30/30/30’ standard establishes 30-minute timeframes for completing steps in the allocation process and a 30-minute clock from confirming orders to booking trades. Don Byron, FIA’s head of global industry operations and execution, has described the 30/30/30 standard as an important first step in a multiyear journey for DMIST.

DMIST published the Average Pricing Standard in June 2024. DMIST’s second standard calls for CCPs globally to adopt certain minimum standard average pricing functionality as the lack of standardization was cited as one of the issues that prevents transactions being processed on trade date. Average pricing is being used extensively in ETD markets as electronic trading allows firms to break large trades into many smaller orders to minimize market impact.

Davies continued that some banks are already at more than 90% of straight-through processing, which means they are very likely to be a long way down the line of meeting the 30/30/30 standard.

“We are working on proof of concepts (PoC) with a number of those banks in order to reach 100%,” she added.

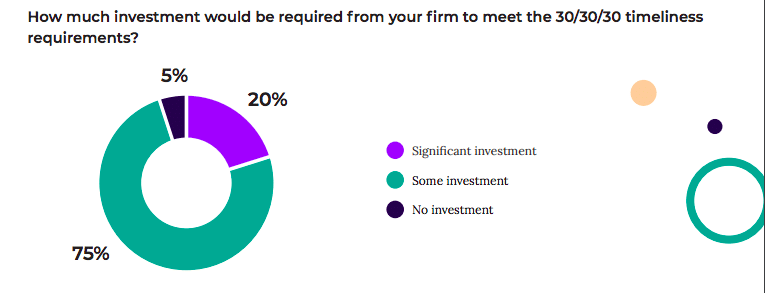

A survey by OSTTRA and Acuiti which was published in April this year found that 95% of respondents were planning to invest to meet the 30/30/30 requirements, with a fifth planning significant investments.

The DMIST standard around position transfers is a really hot topic as it is an operationally heavy and very manual process using email, according to Davies. OSTTRA has built an automated affirmation workflow with extensible technology/

“The technology for use in ETD is in internal user testing and will be ready to be tested with external participants in the first quarter of 2025,” said Davies. “Additionally, what is so helpful is that OSTTRA has credibility in the limit management/limit utilisation and margin analytics space and both are vital in the position transfer process, so we feel we are ideally placed to offer in time a really complete solution for those that need one.”