Cboe Global Markets reported record net revenue in the third quarter of this year, helped by average daily volume of index options growing 49% and multi-listed options increasing 8%.

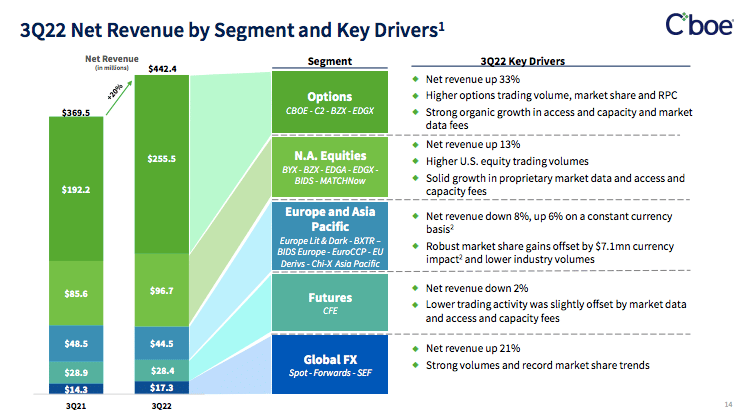

Cboe had net revenue for the quarter of $442.4m, an increase of 20% from a year ago. The group also increased its target for organic total net revenue growth for 2022 to between 14% and 16%, from 9% to 11%.

NEWS: Cboe Global Markets Reports Results for Third Quarter 2022https://t.co/RxCLkdYMR4 pic.twitter.com/EKaj1LGvge

— Cboe (@CBOE) November 4, 2022

Edward Tilly, chairman and chief executive of Cboe Global Markets, said on the results call that the firm will remain focused on significant opportunities in three core areas – derivatives, data and access solutions, and Cboe Digital.

Tilly said: “We fuel these opportunities by executing against our ongoing strategy which remains consistent, leveraging our superior technology, further strengthening our core proprietary products, increasing recurring revenue, and expanding our product line by geography and asset class.”

Net revenues from derivatives markets grew 31% in the third quarter, data and access solutions grew 15%, and cash and spot markets finished 5% higher on a year-over-year basis.

Derivatives

Derivatives initiatives are expected to contribute 2% to 4% of total organic net revenue growth over the medium term.

Brian Schell, chief financial officer and treasurer, said on the call that options were the fastest growing segment. Options net revenue grew 33% to $255.5m from the third quarter of 2021.

Tilly described the derivatives business as delivering another strong quarter, driven by record activity across the SPX complex, which had a 67% year-over-year increase in average daily volume. Third quarter ADV reached 2.4 million contracts, up from 1.4 million contracts a year ago.

Cboe recently added Tuesday and Thursday expirations for SPX and Mini SPX options. Tilly said they continue to reshape trading behavior and expand the overall market as market participants have increased their use of shorter-dated options to navigate rising inflation, interest rates, and geopolitical tensions.

“The strong volume in SPX options activity was driven by trading in our short-dated SPX Weeklys options as investors navigated rapidly changing market conditions,” added Tilly. “We’ve also seen volumes in Mini SPX increase by over 50% since adding Tuesday and Thursday expirations last month.”

There has also been an increase in users opening and trading positions on the same day as contract expiry and zero days-to-expiration contracts have become the fastest-growing segment of the US options business. Adding Tuesday and Thursday expirations for SPX and Mini SPX has enabled market participants to trade zero days-to-expiration contracts any day of the week.

“Volume in zero days-to-expiration options in SPX has increased steadily month-over-month this year, reaching a record ADV of 1.2 million contracts in September, which represented over 44% of total SPX options volume,” said Tilly. “With our diverse index options product suite, we are well positioned as investors of all shapes and sizes continue to embrace shorter-duration trading strategies as they navigate this volatile market environment.”

Trading hours in SPX and VIX options have been extended to 24 hours a day, five days a week, which has led to greater client adoption. ADV in global trading hours for SPX options increased 219% year-over-year in the third quarter and VIX options increased 71%. Those trends have continued in October with global trading hours ADV up 63% in SPX options and 36% in VIX options from the third quarter.

NEWS: Cboe Plans to Launch Trading in Mini S&P 500 Index (XSP) Options during Global Trading Hours (GTH), Beginning December 11

XSP options will be available with $SPX options & $VIX options and futures during GTH which runs from 8:15 pm – 9:15 am ET https://t.co/QOSaFwyr0D pic.twitter.com/902fS3oQq5

— Cboe (@CBOE) November 4, 2022

Cboe has announced plans to launch trading in Mini S&P 500 Index (XSP) options during global trading hours, which will make the product available to customers nearly 24 hours every business day on Cboe Options Exchange from 11 December 2022. The aim is to give market participants globally more product choice to manage risk more efficiently and react to global macroeconomic news at any time.

Overseas business

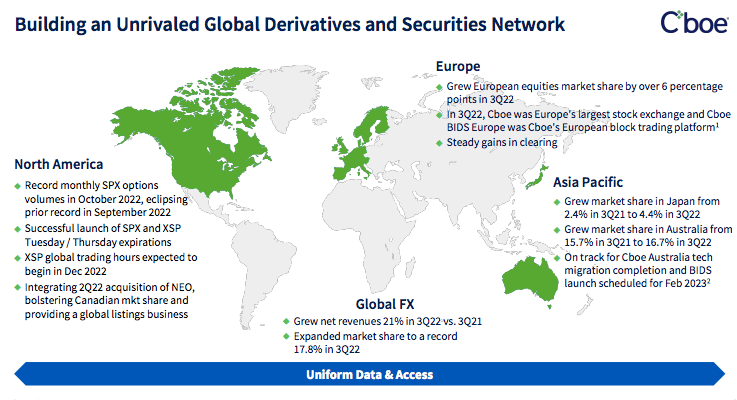

Cboe Europe Equities reported its highest quarterly market share in nearly seven years, reaching 24.6% for the third quarter, which Tilly said made it Europe’s largest stock exchange for the quarter.

“Our analytics-driven campaign in the region continues to encourage additional order flow to our exchange and extend our leadership position, with overall October market share up nearly 200 basis points from third quarter levels to an all-time high of 26.5%,” said Tilly.

He added that Cboe BIDS Europe remained the largest block trading platform during the third quarter, reaching a record 35% market share of the European block trading market.

Dave Howson, president, continued on the call that the real differentiator for Cboe Europe Equities gaining 600 basis points in market share over the past year has been the data driven analytics presented to customers. He said: “This induced changes in behaviour on the realisation that they can get the same, or better outcomes, by choosing a different place to post orders.”

Cboe also has a trade reporting mechanism In Europe, which together with a data feed product, allows the venue to see half of equity trading in the region. In October Cboe launched pan-European equities market data as part of the Cboe Global Cloud service alongside its existing market data suite, providing access to users around the globe.

“The value in that data continues to increase,” added Howson. “We produce indices off the back of those equity prices which then leads to our derivatives capability.”

In Asia Pacific, Cboe Japan market share increased to 4.4%, up from 2.4% in the third quarter of 2021. Tilly said this is an early demonstration of Cboe’s commitment to bringing healthy competition to the Japanese market.

In Australia market share grew to 16.7%, up from 15.7% year-over-year. Cboe is also on track to migrate Cboe Australia to its proprietary technology in February 2023 and to launch Cboe BIDS Australia, subject to final regulatory approval.

Cboe BIDS Canada had a record quarter with 59 million shares traded and overall equities market share in the country grew to 12.2%. During the third quarter, Cboe had its first coordinated listing on both the Canadian and U.S. stock exchanges with Emerge ETFs.

“This dual listing was the first step towards realizing our vision to become an unparalleled global listings network that creates connections across borders and provides new capital formation and investment opportunities for capital-raisers and investors around the world,” said Tilly. “These listings added to the strength of our ETP listings business, where we remained the second-largest ETP listing venue in the U.S. as of quarter end.”

Howson highlighted that Cboe One Canada Feed was launched in September, which is real-time market data for Canadian equities reference quote and trade information.

The feed is Cboe’s first Canadian data offering since the company acquired Neo and MATCHNow, the largest equities alternative trading system (ATS) in the country, which comprise approximately 15% of the total equities market share in Canada.

Howson said 60% of growth in the data and access segment is from outside the United States, but only 20% of the segment’s total revenue are from outside the United States. “So we have a big runway there,” he added .

Cboe Digital

In May 2022 Cboe Global Markets completed its purchase of Eris Digital Holdings (ErisX), an operator of a US-based digital asset spot market, a regulated futures exchange and a regulated clearinghouse, which is the cornerstone of the new Cboe Digital business.

We are officially Cboe Digital! A complementary combination that will accelerate the growth and scale of the ErisX digital asset spot and derivatives marketplaces with the support of @CBOE's global operations, relationships and distribution. https://t.co/Ir1vRyDt7V pic.twitter.com/k8rpZqiCiM

— CboeDigital (@CboeDigital) October 6, 2022

In August Cboe announced the planned equity investors in Cboe Digital, which Tilly said is a diverse range of market participants. Cboe has finalized the material investment terms and anticipates closing the investments very soon.

“We are actively onboarding partners to CBOE Digital,” added Tilly. “We look forward to leveraging the combined expertise of these firms to help accelerate Cboe’s vision of a transparent and well regulated digital asset marketplace for participants across the globe.”

On 24 October Cboe and SBI Holdings, a Japanese internet financial services provider, announced a memorandum of understanding. SBI Holdings is the largest online brokerage in Japan so the two firms will discuss potential collaboration in both traditional and digital finance.

NEWS: Cboe Global Markets and SBI Holdings, Inc. Sign Memorandum of Understanding

Read the press release for more info on what this means for Cboe's efforts in APAC: https://t.co/OuIBQHd1SL pic.twitter.com/za9HUTaU5X

— Cboe (@CBOE) October 24, 2022

Tilly said the MOU creates the opportunity for Cboe and its Japanese equities market, Cboe Japan, to work with SBI to use their respective expertise to extend the reach of products, services and customer bases.

“We see a wide range of potential opportunities to work with SBI on the development of an institutional digital asset infrastructure,” Tilly added. “SBI has established a global leadership position in this area through its affiliate, SBI Digital Asset Holdings.”