The net asset (NAV) value for a fund from Fidelity International has been put on a blockchain, which could accelerate fund tokenization and facilitate the automation of fund administration.

On 3 July 2024 Chainlink, which provides infrastructure for the tokenized asset economy across blockchains, announced a collaboration with Sygnum Bank, the digital asset banking group, to bring NAV data on-chain. Sygmun tokenized $50m of treasury reserves from Matter Labs, which builds technology to enable mainstream adoption of public blockchains. The reserves are held in Fidelity International’s $6.9bn money market fund and issued on the ZKsync blockchain.

Fatmire Bekiri, head of tokenization at Sygnum Bank, told Markets Media that the bank began the Fidelity project in March this year and achieved its first goal of having proof of reserves on zkSyncEra.

“The missing piece was having NAV on-chain and we now have all the ingredients to move to the next level,” she added.

Bekiri continued that putting NAV on-chain is crucial because it integrates the quantity and value of the asset in the same infrastructure.

“This will significantly enhance usability on-chain and facilitate various applications, such as using a token as collateral or on-chain portfolios,” she said.

Sergey Nazarov, co-founder of Chainlink, told Markets Media that putting NAV on-chain is just the beginning of transforming fund management. Chainlink creates data standards that allow financial markets to go on-chain, and also provides the ability for value to move between chains over CCIP, the cross-chain interoperability protocol.

“NAV data is critical for funds for purposes such as redemptions,” Nazariv added. “It is just one of the pieces of data that we are now putting on-chain, and part of an evolution where a lot of fund administration will end up becoming a smart contract.”

After NAV, other data that could be put on-chain includes identity, which will allow institutional users to interact with the financial products, and proof of reserves.

In February this year, ETF issuer 21Shares US integrated Chainlink Proof of Reserve on Ethereum mainnet to enhance the transparency of the bitcoin reserves backing the ARK 21Shares Bitcoin ETF. The feed pulls reserves data directly from Coinbase, the crypto firm which has direct access to the account holding the reserve assets as the ETF’s custodian.

Johann Eid, chief business officer at Chainlink Labs, said in a statement: “By providing real-time, tamper-proof data on Bitcoin reserves, Chainlink Proof of Reserve is not just enhancing the security and transparency of the ARK 21Shares Bitcoin ETF, but also empowering institutions and market participants with the confidence to actively engage with onchain finance.”

Nazarov said more granular fund data could also eventually be put on-chain, such as real estate data for a property fund.

“Data will be available to everybody and will be updated much more frequently,” Nazarov added. “The frequency of these updates will have a lot of value.”

Growth

An on-chain financial system requires standardization to bring connectivity and interoperability, which is crucial for scale. Chainlink allows the NAV to be accurately and securely reported and updated on-chain across any public or private blockchain.

“We have now taken the next step in the right direction,” added Bekiri. “I am convinced that tokenizing funds is a large trend and that having NAV on-chain is an accelerator for this movement.”

Nazarov argued that tokenizing real world assets is currently the biggest trend in crypto, and has become more valuable than DeFi (decentralized finance), or peer-to-peer financial services on public blockchains. He said DeFi fluctuates between $90bn and $120bn and tokenization of real world assets fluctuates between $140bn and $180bn.

In addition, Nazarov believes that funds could become the largest subset of real world asset tokenization. He expects to see more tokenized funds launch this year.

In July this year, BlackRock’s tokenized money market fund reached $500m in record time.

ICYMI: @BlackRock's BUIDL crossed $500M, breaking records as the first tokenized fund to do so in under 4 months pic.twitter.com/VodyopA1Rf

— Securitize (@Securitize) July 10, 2024

Carlos Domingo, co-founder and chief executive of Securitize, said :

If the pace accelerates in the second half, which I believe it will, we will certainly go beyond $3B this year, and the target for next year should be $10B combined, which is still less than 10% of the combined market cap of stablecoins https://t.co/imfV5bGdcQ

— Carlos Domingo (@carlosdomingo) July 15, 2024

Bridges to traditional finance

Bekiri highlighted some other challenges that need to be solved for fund tokenization to become the norm, such as harmonizing international regulation and more scalability on the technology side. She said: “Regulation is an enabler and essential to move forward because this is what our clients and our partners are looking for when they partner with us.”

Sygnum holds a banking licence in Switzerland, has licences in Singapore and the group is also regulated in Abu Dhabi and Luxembourg and Bekiri argued that regulatory approval is a differentiator. In addition, Sygnum aimed to be involved in tokenization when it was founded in 2017 and subsequently built its own technology stack.

“We did our first tokenization in 2020 and have experience from a lot of different projects,” Bekiri added. “Our license, expertise and experience puts us in the sweet spot of being a bridge to traditional finance.”

Nazariv argued that a single standard for blockchains will be required, such as TCP/IP, the communication protocols which allow network devices to seamlessly connect on the internet.

“It is inevitable that there will be a standard to allow all the different blockchains, which are really just data structures holding critical information, to interact,” he added. “Our goal is to have an open source global standard that powers what we call the internet of contracts.”

Chainlink also interfaces with traditional finance by synchronizing on-chain data and activity with financial market infrastructures. The firm creates compatibility between on-chain data and the existing regulated infrastructures so they can use the blockchain as a reference point, and blockchain transactions can be legally binding, explained Nazarov.

For example, the traditional Swift messaging system could be used to trigger a stablecoin payment instead of a bank payment; or the tradition FIX messaging standard could be used to trigger an asset transfer on-chain.

In August, 2023 Swift released results from a series of experiments that showed its infrastructure could seamlessly facilitate the transfer of tokenized value across multiple public and private blockchains in co-operation with financial institutions, market infrastructures and Chainlink.

Tom Zschach, chief innovation officer at Swift, said in a statement at the time: “For tokenization to reach its potential, institutions will need to be able to seamlessly connect with the whole financial ecosystem.”

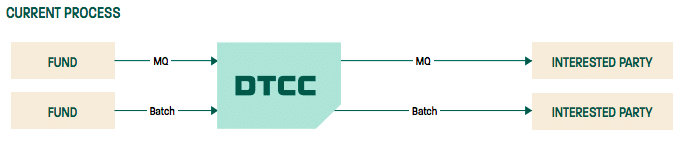

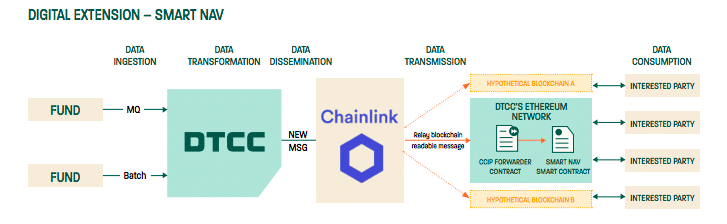

In May this year, DTCC, the US post-trade market infrastructure said it had developed a pilot, Smart NAV, with Chainlink and 10 market participants. The pilot was designed to explore an extension of DTCC’s Mutual Fund Profile Service for transmitting “‘Price and Rate” data.

“The pilot found that by delivering structured data on-chain and creating standard roles and processes, foundational data could be embedded into a multitude of on-chain use cases, such as tokenized funds and “bulk consumer” smart contracts, which are contracts that hold data for multiple funds,” said DTCC. “

Additional benefits include real-time, more automated data dissemination and built-in access to historical data.

In traditional finance, mutual funds generally update their NAVs each working day after markets close, while ETFs can also calculate an intraday NAV every 15 minutes throughout the day. Nazarov highlighted that on-chain NAVs could be updated every minute, allowing investors to redeem every minute, which structurally changes the market.

“You will end up with the better use of funds as collateral, and more reliable and better administered funds that are also cheaper to administer,” he added.

Bekiri said: ”Our ultimate goal is to have an on-chain financial system. We have made a lot of progress the last few years, but we are still at the very beginning of a big movement.”