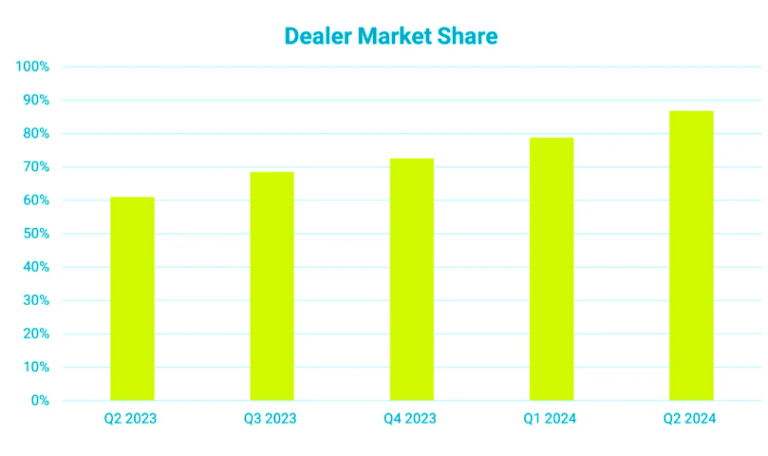

Octaura launched its electronic trading platform for leveraged loans in April last year and chief executive Brian Bejile said the venue had passed the tipping point to accelerate growth.

Bejile told Markets Media that the leveraged loan trading platform launched with three dealers and about 34 institutional buy-side firms. There are now about 17 dealers, with another eight in the process of joining, and 109 asset managers using the venue.

“This represents over 85% of liquidity providers and liquidity takers,” he added. “We have reached a tipping point for growth to snowball.”

Bejile wrote in a blog that Octaura passed an “exciting” milestone in February this year, as the company estimated that nearly 1% of the leveraged loan market was being traded electronically on Octaura. He described reaching 1% of electronic trading in one year as “pretty remarkable.”

“It took nearly 10 years for 2% of high yield market volume to execute electronically,” he wrote. “While the corporate bond market certainly paved the way for other, less liquid asset classes in the fixed income market to adopt electronic trading, we consider this quick adoption to be a clear marker of industry readiness, and we look forward to continuing an accelerated trajectory.”

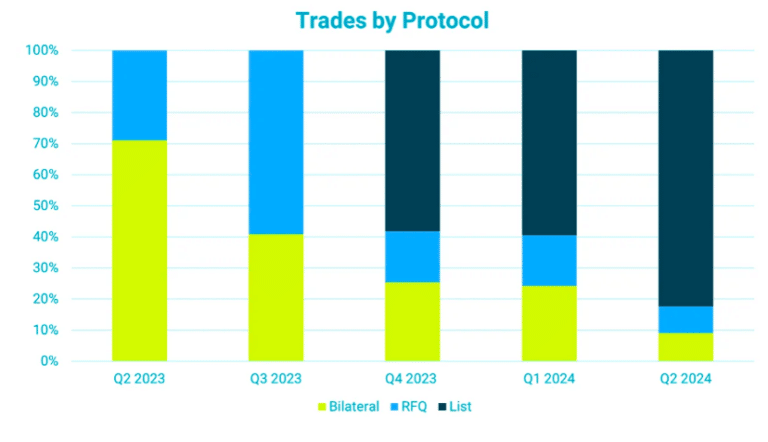

Volumes have been boosted by the introduction of new trading mechanisms alongside bilateral execution – RFQ (request for quote) and the List protocol. In addition, Octaura has introduced features such watchlists and alerts so market participants can monitor specific credits, set alerts, and easily initiate trading activity.

Both the bilateral and RFQ allow trading of one loan at a time, but List allows trading of 500 loans at once. For example, an investor can set up a list of 100 loans that is sent to all the liquidity providers on Octaura, and get prices back in 20 minutes.

Some of the biggest users of the List protocol are exchange-traded fund issuers, due to inflows into CLO ETFs as interest rates have risen. Bejile said the growth of the CLO ETF market can be demonstrated by the increase in assets of the largest AAA CLO ETF, managed by Janus Henderson, to more than $11bn.

Straight through processing

In addition to improving trades execution, Octaura is also focussed on making workflows more efficient via straight through processing (STP) for both the sell side and the buy side. In June this year Charles River Development announced the launch of its two-way interface with Octaura to allow customers to streamline their syndicated loan trading workflows.

Charles River clients can submit orders from within their platform straight through to the Octaura system and receive real-time updates via the Charles River FIX Network, which eliminates cumbersome manual workflows.

Greg Shenkman, head of loan trading at Shenkman Capital Management, said in a statement: “Trading syndicated loans has long been a manual and inefficient process, with the potential for errors and delays. This improved technology allows us to get best execution for our clients in a more effective way.”

Bejile said half of the dealers on Octaura already use STP and the firm working on the rest

“This been very popular in helping people solve real operational challenges and risks,” he added. “We have been integrating order management systems and this is very much a focus for us.”

Consultancy Coalition Greenwich said in its Top Market Structure Trends to Watch in 2024 that there is an increased focus on automating workflows as there is a recognition that operational automation can support profit growth.

“The focus is about building the portfolio, making adjustments based on dealer prices and ensuring the complex basket is executed and booked with no errors,” said Coalition Greenwich. “APIs, middleware and distributed ledger technology have all played a part in operational redesigns. Not only are these ways to reduce people costs, but also ways to better manage risk and improve front-office performance.”

Data and analytics

Bejile said Octaura is also focussed on providing data and analytics as more volume goes through its platform.

For example, the firm is developing embedded execution analytics as part of its trading protocols and liquidity scores for loans where the most liquid loans receive a score of 10. Bejile compared the liquidity score to a torch which market participants can use to navigate in the dark.

“This could help firms to decide to make a market without getting their face ripped off,” he added. “Managers constructing a portfolio want to have a sense of the relative liquidity of their holdings while investors in a strategy could decide to sacrifice some liquidity for more yield.”

Octaura was set up to first automate the trading of syndicated loans this year, then address collateralized loan obligations (CLOs) and then possibly expand into other markets. The firm has been testing electronic trading of CLOs with a limited number of participants.

“This time next year we should be fully launched in ClOs,” said Bejile.