Nuveen’s Global Impact strategy has invested more than $1bn (€820m) since launching a decade ago and the asset manager is fundraising as investor interest in impact investing has accelerated.

Rekha Unnithan, co-head of impact investing at Nuveen, the global asset manager owned by TIAA, told Markets Media she thinks of impact investing as a subset of a responsible investment practice.

Rekha Unnithan, Nuveen

“In our view, what differentiates impact investing is an intentional practice of seeking to find companies that can have impact, behaving in a way that can drive that impact further and including that into the investment process alongside returns,” she said.

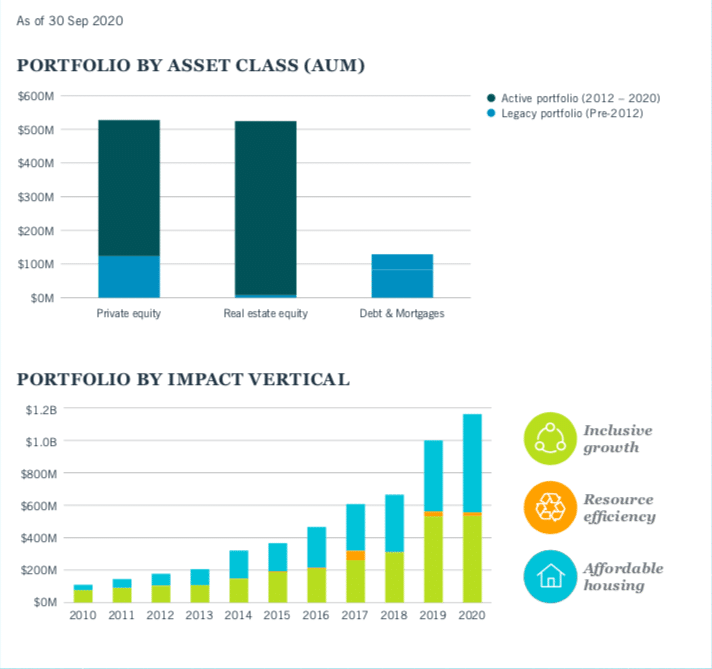

Nuveen’s private markets impact investing team had $1.34bn in committed capital as at the third quarter of 2020. TIAA, which provides financial services in the academic, research, medical, cultural and government fields, made its first private markets impact investment in 1989. Nuveen’s private markets impact investing portfolio has been invested on behalf of the TIAA General Account since 2008 and has been offered to third-party investors through the Nuveen Global Impact Strategy since 2012.

Unnithan explained that she entered the impact investing space a decade ago years ago when people were sceptical that the strategy could work as there were few investable companies.

“Now the story is very different and we have a large pipeline which means we can be super-selective and find the best in breed,” Unnithan added. “The world is changing rapidly because companies see opportunities to solve problems and go after large addressable markets.”

She grew up emerging markets and studied development economics which helped attract her to impact investing in 2012.

“I was a banker and latched on to the idea of aligning these important goals to the private sector with respect to innovation, discipline and new rewarding good behaviour,” Unnithan said.

Prior to joining Nuveen in 2012, Unnithan worked for Bank of America Merrill Lynch as a vice president in the institutional investment group. She has a B.A. in Economics from Yale University and an M.B.A. with a specialization in Financial Instruments and Markets and Social Innovation and Impact from New York University’s Stern School of Business.

“Although impact investing was not as pervasive ten years ago, there were financial models such as micro-finance,” she added. “There were not as many believers, so it was being persistent and taking a really commercial approach which has served us well.”

Fundraising

Nuveen announced the initial close of its Global Impact Strategy fundraising in July 2020 after securing $150m in commitments toward its targeted $400m offering. Danish pension fund Velliv committed $50m in capital.

Nuveen completes initial close of $150 million for its Global Impact Strategy. Open to institutional investors globally, the strategy seeks to provide positive change towards inclusive growth and resource efficiency. https://t.co/Z4njSzTgLe pic.twitter.com/658NISpgHC

— Nuveen (@NuveenInv) August 24, 2020

Anders Stensbøl Christiansen, chief investment officer at Velliv, said in a statement: “Now more than ever, there is a compelling case for impact investing, and we believe this strategy provides us with an appealing market opportunity to achieve competitive returns, whilst ensuring we are also achieving measurable impact goals.”

Unnithan explained that the strategy seeks to drive positive change across three impact verticals – inclusive growth, resource efficiency and affordable housing – by investing in a portfolio that focuses on private equity, private debt and real estate.

Inclusive growth is related to low-income customers in emerging markets being under-served in access to basic products such as financial services, education and healthcare.

“So we look for companies that are serving that customer in a differentiated way,” she added. “In resource efficiency we are investing in companies that do things better, faster, more efficiently while creating less waste in large value chains such as real estate or agriculture.”

Source: Nuveen.

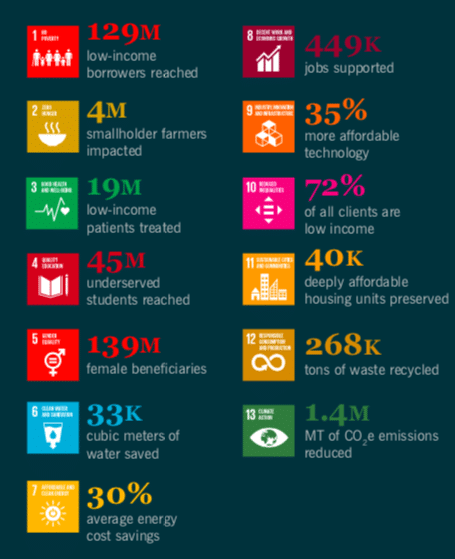

The strategy also relates to six of the United Nations Sustainable Development Goals (SDGs) set out as part of the Paris Agreement: SDG1 (No poverty); SDG 2 (Zero hunger); SDG 3 (Good health and wellbeing); SDG 10 (Reduced inequalities); SDG 12 (Responsible consumption and reduction) and SDG 13 (Climate action).

The team considers both negative and positive impacts using a proprietary ‘Net Impact Score’ which explains and compares investments based on their net effects on people and the planet, aligned with the UN SDGs. The strategy seeks to do well by doing good and targets competitive risk adjusted returns in the range of 17% to 20% for private equity and between 9% and 11% for real estate net internal rate of return for real estate.

For example, in 2019/2020 the impact investing portfolio reduced carbon dioxide emissions by 1.3bn metric tons of in 2019, up from 36,000 in 2013; and recycled 268m tons of waste recycled, up from 1,995 in 2013, according to Nuveen’s Investing in Resilience report.

The strategy targets strong risk-adjusted private equity returns and targets growth stage companies in developed and emerging markets that are at an inflection point where Nuvveen can help them scale.

Unnithan believes that taking a private equity approach, buying significant minority stakes in companies and sitting on their boards means that Nuveen can have an outsized influence. The fund typically invests between $20m to $16m for approximately five years, when the company may go public, attract more capital or get acquired.

“It takes a lot of time and effort as we are very deliberate in our investment,” said Unnithan. “We contractually agree to why we are investing and how we plan on measuring impact and financial progress.”

Source: Nuveen.

Going forward Nuveen will continued focus on its verticals and driving that forward in a deliberate way.

“We want to continue to take socially focused companies and talk to them about climate change,” Unnithan added. “In the other direction we want to take climate-focused companies and talk to them about diversity, equality and inclusion, which we think is a really unique approach.”

She admits that ‘impact-washing’ is a concern, which is why Nuveen published the inaugural disclosure of its impact management practices and their alignment with the Impact Principles in 2020 which was verified by an independent third-party consultant. Nuveen is a founding member of the Global Impact Investing network and a founding signatory and creator of the Impact Principles that was led by the IFC, an arm of the World Bank.

“Third parties come in and examine us and give us pointers around what we are doing well, what we are not doing so well and areas for improvement, which we share with our clients,” said Unnithan.

Nuveen collects self-reported data at the company or property level from impact reports, investor reports and other sources provided by investees. The raw data is converted into common indicators and annualized by measuring the incremental value as of the calendar year-end to enable aggregation and analysis by year and over time.

Covid-19

Unnithan continued that the conversation around impact investing has gone up a notch since the Covid-19 pandemic highlighted the distance between ‘haves’ and ‘have-nots’ from a social, equality and health standpoint, while continuing to push the focus on climate change.

She said: “Signposts are clear around the momentum and excitement. Impact investing as a whole is also growing in the public bond markets, infrastructure and real estate.”

PwC’s Private Equity Responsible Investment Survey 2021 found that more than half, 56%, of respondents stated that ESG features in board meetings more than once a year, compared to 35% in 2019.

How are Private Equity firms taking action on climate risk, inclusivity & governance? PwC’s new report shows how PE firms have reassessed the importance and value of #ESG to their business. Details here. https://t.co/ZXbdnWXfYD pic.twitter.com/IfL3boEMU8

— PwC_sustainability (@PwCclimateready) May 13, 2021

Will Jackson-Moore, global private equity, real assets and sovereign funds leader, PwC UK, said in a statement: “The attitude and approach of private equity firms has matured. ESG factors are reshaping the global economic landscape and will undoubtedly impact the investment success of private equity in the coming years.”

Three quarters, 72%, of survey respondents always screen target companies for ESG risks and opportunities at the pre-acquisition stage, and the majority, 56%, have turned down a potential investment or refused to enter into an agreement on ESG grounds.

Diversity

In Nuveen’s private markets impact investing team 50% of senior management and the investment committee identify as women of color. In addition, 50% of the team identify as women and 64% identify as people of color.

Unnithan said: “We do what we do because of who we are. This team was formed naturally by instinct and people’s desires, passions, investment interests and backgrounds.”

She continued that team attracted talent that was interested impact investing but now that the market is maturing the firm will have to be deliberate about being inclusive in every way.

“We want to keep that integrity, diversity and expression as part of our team as it grows,” she added. “So we are being very intentional about diversity going forward.”