Northern Trust Asset Servicing has launched a data warehouse and is adding functionality and datasets as financial services firms compete to become their clients’ data hub.

Pete Cherecwich, president of Asset Servicing at Northern Trust, told Markets Media that the data warehouse is live with clients.

“We are going to finish our data warehouse, which we believe will be best in class,” he added. “There is a race to see who can be that hub and we have an advantage because we have the context of our clients’ portfolio data and what they need.”

Cherecwich argued that a differentiator for Northern Trust is that other organisations with data businesses take outside data and make it available to clients with portfolios, but in contrast Northern Trust already has data on client portfolios.

“We are the master of our clients’ data and can act as a hub to make sure their data is in a very useful form, and they can pick and choose what they use and what they want to add,” he said.

Technology development

“Technology development is going to be super-fast with cloud, artificial intelligence and machine learning going like gangbusters,” said Cherecwich. “We are known for the high-touch, white glove service, but we need to maintain that level of service while embracing technology and scale so costs can continue to be driven down.”

In addition to investing in the data warehouse, Northern Trust Asset Servicing has invested in using Microsoft Dynamics as its core platform. The firm first started using Microsoft Dynamics internally to dramatically reduce the number of emails.

Cherecwich said in a blog in December last year that Northern Trust Asset Servicing receives about 17 million emails each month so firms need to use automation and AI to streamline this workflow, become more proactive and allow workers to spend time focussing on the things they do best.

“We want to become a productivity machine by eliminating manual work and increasing resilience at the same time,” he said.

Northern Trust Asset Servicing’s digital workplace strategy ensures that each message can be tracked as part of a larger, searchable database and is developing AI capabilities to suggest next-best actions and for requests to be immediately assigned to the regent people to take action.

In 2023 Northern Trust Asset Servicing initially onboarded 1,000 employees and 400 mailboxes to the project. There was a 70% reduction in auto-content and bulk email noise and one team serviced clients in one-third of the time, according to the blog.

Another aspect of technology development is taking core applications into the cloud, which allows faster upgrades.

“The analogy I use is that our staff and clients want the same experiences as on their iPhone with automatic updates, they just want to wake up and hit the button for it to work,” Cherecwich added.

Growth

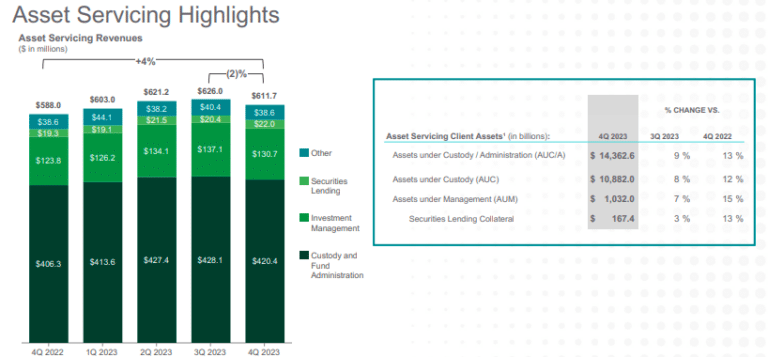

Cherecwich described 2023 as a “tale of two cities” for Asset Servicing.

“The positive side is that demand for our services has never been higher,” he added, “Clients are thinking about cost, capabilities, capital and the number of clients that are looking to outsource and consolidate providers is astonishing.”

However, there are headwinds including inflation, which is still increasing costs. In addition, clients are also re-discovering that cash is an asset class and now actively managing it versus leaving it all on Northern Trust’s balance sheet. There are also increased tail events since as cyber issues, volume spike and market events.

“”If you use outside technology vendors, you have to make sure your systems continue to work even if that vendor goes down,” he added. “It’s a brave new world.”

In the last 15 years Northern Trust’s fund services business has grown exponentially, according to Cherecwich, through expanding horizontally into new countries, buying new companies and launching new products.

The business is now in a phase where Cherecwich wants to continue to build out commitments to clients, but will not go into any new countries.

In terms of new products, Northern Trust is developing a platform to allow institutional buyers to digitally access carbon credits from leading project developers. Last September Northern Trust said in a statement that it had completed fully automated transactions on the initial minimum viable product digital carbon credit platform.

Justin Chapman, global head of digital assets and financial markets, at Northern Trust, said in a statement: “The use of digital technology to manage the lifecycle of carbon credits gives both the buyer and project developers confidence and transparency through the lifecycle of their voluntary carbon credit transactions.”

Northern Trust’s carbon credit platform uses private ledger digital blockchain technology to connect institutional buyers with carbon credit suppliers, and allows purchasers to transact tokenized carbon credits directly with project developers and retire these against their carbon footprint.

Cherecwich highlighted that the firm can use most of the same code as is the carbon credit platform to custody tokens for other assets. Northern Trust is also working with investment banks on providing custody when they issue a bond on DLT.

“Private credit is a big thing,” he added. “Another trend for asset owners is a desire to see all their public and private assets together, so they can manage their entire portfolio across all asset classes, which is really valuable.”

He noted that the overlap between bilateral private credit and tokenization is huge and there will be innovation. There have also been discussions around whether money market funds should be tokenized so that ownership can be transferred with movement of collateral in real time.

Another topic is the reduction in settlement times in the US and Canada in May this year. The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on 28 May 2024 in the US and on the previous day in Canada. The US Securities and Exchange Commission said the aim is to reduce latency, lower risk and promote efficiency and greater liquidity but it requires streamlined and efficient operational processes, presenting an opportunity to increase post-trade automation.

“We are ready for T+1 but I am worried about clients in Asia Pacific as their operating models have to change,” said Cherecwich. “We think the pace of outsourcing is going to pick up as people start to focus on the May 2024 deadline and look at what they have to do.”