Northern Trust Asset Management expects private investments may provide more attractive returns relative to the public equity and bond markets over the next decade, as the firm assesses its approach to the sector.

Northern Trust Asset Management’s Capital Market Assumptions 2025 Edition expects moderate global equity performance, improving high yield bond returns and strength in private credit over the next 10 years. Three trends likely to affect markets and the global economy over the next 10 years are AI-enabled productivity, navigating the energy transition, and globalization, which the asset manager described as “bent, not broken.”

Anwiti Bahuguna, chief investment officer of global asset allocation at Northern Trust Asset Management, said in a statement: “Private investments may prove to offer even more attractive returns relative to the public equity and bond markets. Declining interest rates will drive demand for private credit to boost M&A activity, while AI and other technology advances will push low double-digit growth in private equity and venture capital.”

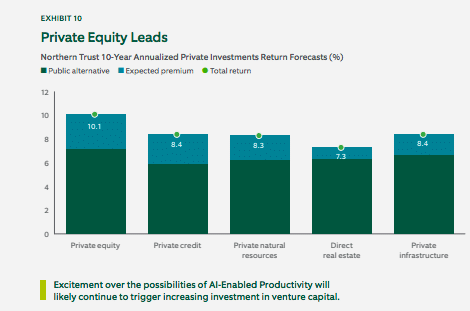

Over the coming decade, Northern Trust forecasts the following long-term average annualized return expectations:

- alternatives: 8.4% annualized return for private credit and 10.1% annualized return for private equity, supported by AI opportunities and potentially more mergers and acquisitions;

- real assets: 6.6% annualized return for global listed infrastructure;

- equities: 7.5% annualized return for U.S. equities and 5.8% annualized return for developed markets ex-U.S. equities;

- fixed income: 4.7% annualized return for U.S. investment grade bonds and 5.6% annualized return for U.S. high yield bonds.

The forecast 8.4% annualized return for private credit, is a 2.5% premium over the high yield bond forecast, which Northern Trust Asset Management said represents a combination of average active manager alpha, an illiquidity premium and the positive growth outlook for the asset class.

The private credit return assumption increased from the 2024 forecast which the asset manager said was mostly because of the removal of the 2% “haircut” on returns. The haircut had been added to reflect private credit’s vulnerability to rising interest rates, but Northern Trust Asset Management said this is no longer expected in the next 10 years.

“Private credit likely will continue to capture market share in the lower middle market as traditional bank lenders’ appetite for smaller businesses wane,” said the report.

The asset manager also expects that falling interest rates will provide a tailwind for M&A, especially for private equity sponsors that continue to sit on record levels of dry powder, so private credit deployment will increase.

Shifts in asset management

John McCareins, head of Northern Trust Asset Management, International said at a media briefing on 5 February that the firm received most inbound queries from clients on private markets and private credit.

McCareins said the firm has a global commitment to alternatives and private markets and is assessing the right approach to the sector. He added: “That could be buy, build, partner or plug in.”

Marc Rowan, co-founder and chief executive of Apollo Global Management, said on the alternatives manager’s results call on 4 February 2025 that asset management is changing due to an entire rethink of public and private markets.

“BlackRock made a number of significant acquisitions in 2024 to lay a foundation for an integration of public and private,” Rowan added. “I continue to believe this convergence will be a very important source of demand for private assets.”

Rowan argued that traditional asset managers will evolve their businesses to include public and private products. Some traditional asset managers will want to launch new products that are co-branded and some will seek to augment their business with managed accounts that can access private assets from a variety of players.

“I see a very good marriage between our industry, our company, and traditional asset managers who I believe are going to reinvent their businesses due to competitive forces,” Rowan added.

McCareins agreed that asset managers are changing their business models and said this presents opportunities. He said: “M&A and consolidation creates opportunities to hire good teams when they become orphans after internal restructuring.”

For example, Northern Trust Asset Management has been expanding its global active quantitative business. In November 2024 the firm named Jan Rohof from Robeco as director of quantitative solutions Asia Pacific to lead these strategies in the region. Rohof’s appointment followed a number of hires from Robeco in 2023 in including Guido Baltussen as head of quantitative strategies, international, followed by the appointments of Milan Vidojevic and Bart van Vliet in January 2024.

In February this year Northern Trust Asset Management announced a further expansion of its global quantitative investment strategies team through hiring 13 investment personnel in Amsterdam from APG Asset Management.

The team includes quantitative researchers, portfolio analysts and quantitative developers which the asset manager said will enhance its existing quantitative factor platform and accelerate innovation into diversifying strategies. They have a successful track record implementing advanced quantitative investing techniques, including deploying machine learning and artificial intelligence, working with alternative data sets, and identifying sustainable investing signals that drive long term shareholder value according to Northern Trust Asset Management.

They join Northern Trust Asset Management’s quantitative strategies team under Mark Sodergren, global head of quantitative strategies and Baltussen.

Michael Hunstad, Northern Trust Asset Management deputy chief investment officer and CIO of global equities, said in a statement: “The growing team has an aligned investment philosophy and complementary expertise to NTAM’s existing investment platform, which will help to drive innovative new strategies, solutions, and technologies for our clients.”

Northern Trust Asset Management managed $43bn in quantitative strategies across equities and fixed income at the end of 2024.