Nomura has integrated its public and private credit asset management offerings in the US as the Japanese group aims to grow the business outside its home market by lifting teams and making acquisitions.

In March this year Nomura said in a statement that it had realigned the firm’s collective asset and investment management capabilities in the Americas under a new brand Nomura Capital Management, led by chief executive Robert Stark. He was previously chief executive of Nomura Private Capital, the private credit business which has been aligned with Nomura Corporate Research and Asset Management, the firm’s public credit business which is more than 30 years old. Stark will also continue in his role as head of investment management in the Americas.

Stark told Markets Media: “Investment management business is of utmost importance to Nomura and is considered one of the key growth engines. The firm is fully committed to put more money to work to grow its investment management business, especially outside Japan, and that should result in a meaningful increase of our earnings contribution over time.”

He explained that the group, which will celebrate its 100th anniversary next year, was built on the wealth management business in Japan, which forms 30% of its total business. The wholesale business, which includes investment banking and sales and trading, comprises 60% of the business and the remaining 10% is from fund management, which has approximately $550bn in assets, mostly in Japan.

Given the group’s existing size in Japan, Nomura needs to expand internationally in order to grow asset management and also needs to consider acquisitions.

Yoshihiro Namura, senior managing director of Nomura Holdings and head of investment management, said in a statement: “The Americas represent a very important market for Nomura and the creation of NCM allows us to maximize our efforts to further grow our investment management business and provide our clients with more investment strategies and choices over time.”

Nomura is initially focusing on the US, given its history in the country and the size, relevance and importance of the market, but will not ignore opportunities in Europe, Middle East and Africa (EMEA) or Asia, outside Japan.

“We already have a pretty sizable footprint in public credit and we have been building up our private credit capabilities in the last couple of years,” said Stark. “It made sense for us to consolidate and integrate our various efforts under a single roof.”

For example, when talking to institutional clients in the US Nomura was historically more focused on public credit, especially high yield. However with intermediaries, particularly registered investment advisors, Nomura was focussed on private credit.

Stark described Nomura’s high yield business as one of the largest with an institutional focus on high yield in the US, with clients including some of the largest corporate and public pension plans, insurance companies and endowments. He argued that the new model allows Nomura to start having much broader dialogues with clients across the credit spectrum, both public and private. In addition, the new organisation is integrated from the front to back office including across investment, distribution, compliance, operations and marketing.

“That is the perfect foundation to build and add more capabilities through team lifts or acquisitions,” he added.

Acquisitions are likely to involve private credit managers with less that $10bn in assets as Nomura aims to add to investment, operations and distribution staff.

“Over time we want to add talent across all three areas to handle an increasingly complex environment,” said Stark. “We need to find firms that align with our philosophy and can help grow the entire franchise but the acquired firm also needs to get comfortable that we are the right partner.”

Competition

Nomura faces competition in private credit, where markets have grown at a compound annual growth rate of 13% since 2013, and attracted asset managers. For example, in April this year Petershill at Goldman Sachs Asset Management made a passive, minority investment in Kennedy Lewis Investment Management, an opportunistic credit manager, and in 2023 BlackRock acquired Kreos, which provides growth and venture debt financing to technology and healthcare companies.

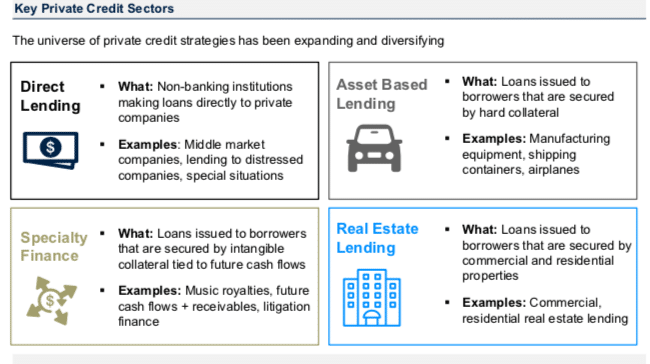

However, Stark said Nomura launched its private credit business in asset-based lending and real estate lending, where the firm has substantial expertise. In addition, Nomura is involved in loans that are smaller than the more established players.

“They are a little bit less crowded, slightly smaller but significantly growing segments where we believe we have an edge and see a significant growth opportunity,” he added. “You won’t see us getting into big leveraged buyouts.”

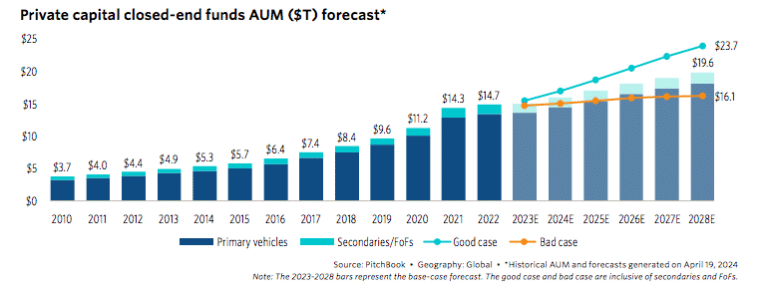

PitchBook said in a report that the growth of private capital has substantially outpaced the expansion of public markets between 2012 to 2022 with a 12.8% annualized growth rate, but that there is still plenty of room for private fund assets to expand beyond $14.7 trillion. The data provider forecast that global private capital will reach nearly $20 trillion by 2028, and could reach almost $24 trillion in the right macro environment.

“However, across direct investing strategies within private capital, we expect wide deviation,” said PitchBook. “Our projections anticipate sustained growth across private equity, private debt, and real assets, while venture capital and real estate face more difficult paths ahead.”

Risks

Regulators including the Federal Reserve and the Bank of England have warned that significant risks may be building up in private credit markets, including maturity and liquidity mismatches. Leverage can help to increase potential returns or hedge those risks, but can also amplify losses and exacerbate liquidity issues in difficult market conditions; and other risks include market concentration, jumps to illiquidity, correlation and interconnectedness.

Stark said Nomura’s efforts in private credit are new and it is deploying fresh capital. As the firm does not have any legacy portfolios, it can be a lot more opportunistic. For example, Nomura provides short-term financing in the form of bridge loans for one to three years, such as when a big renovation project has been completed and is being subleased to a big hotel chain.

Nomura Capital Management has two funds. Stark described Nomura Alternative Income Fund as a private credit interval fund, which is diversified and evergreen, and invests across the private credit spectrum. “That has $100m of seed capital and we are seeing client flows coming in,” he added.

The second fund is an asset-based lending fund. Stark said Nomura Capital Management is opportunistically looking to deploy its $200m of seed capital and will be fundraising towards the end of this year or next year.

Nearly all, 90%, of investors said private debt performance has met or exceeded their expectations according to a survey from data provider Preqin, Asset Allocation: Outlook 2024. Half, 51%, of investors intend to increase commitments, and 40% intend to keep the same amount of capital in play which Preqin said was by far the highest numbers of any asset class. Preqin forecast an average internal rate of return in private debt of 9.8% from 2022 to 2028.

“Given its lower risk profile, this doesn’t look bad alongside venture capital (14.3%), private equity (12.6%), secondaries (11.5%), and infrastructure (10.9%),” added Preqin.

However, Preqin also warned that if the economy slows, some companies will struggle to service debts at higher rates.