nuam exchange. a consolidation of markets in Colombia, Peru and Chile, has formed a technology partnership with Nasdaq to provide a single market across asset classes that will improve access to the region for international investors.

Juan Pablo Córdoba, chief executive at nuam exchange, told Markets Media: “We have been working for many years to create more efficient capital markets in the region, particularly by building a single market.”

Córdoba was previously chairman of Bolsa de Valores de Colombia (bvc) between 2005 and September 2023, when he took on his current role. He has also worked at institutions including the International Monetary Fund and the Colombian Ministry of Finance and Public Credit and was chairman of the World Federation of Exchanges between 2014 and 2016.

He explained that there is a lot of similarity and complementarity between Chile, Colombia and Peru beyond just their markets. They have been engaging in free trade agreements for many years and there has been a lot of cross-investment between corporations in the three countries.

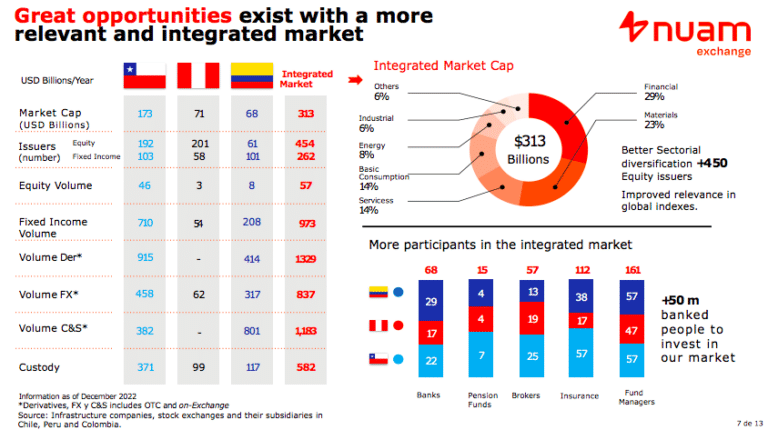

Discussions to investigate ways of combining the three markets began in 2020 and the merger into one holding company was approved last year. nuam believes the merger will position the company as the second most relevant market in Latin America and in the global market infrastructure industry.

“There are tremendous challenges but also a tremendous opportunity if we provide a single experience for both domestic and international investors to trade any security in the three countries with the same user experience,” added Córdoba. “We feel we can have more scalability and ease of access so the region becomes more attractive to both local and international investors.”

For regulatory reasons, each country will retain its individual exchange and central securities depository CSDs in the individual countries. However, nuam will work as a single market operationally for the user.

In December last year nuam announced a strategic technology partnership with Nasdaq.

Córdoba said: “All of technology choices have the focus of making it easy for international participants, and sending the message that we run a very reliable IT infrastructure.”

Access will be standardized through standard industry APIs and risk controls will help ensure quality and trust in the market to help attract larger, global participants, and strengthen liquidity. The platform will operate with the FIX 5.0 SP2 protocol.

Tal Cohen, co-president of Nasdaq, said in a statement: “Global capital markets are increasingly demanding resilient and robust technology, capable of withstanding ever-greater volatility and volume. Well-functioning, trusted markets are critical to inclusive growth and prosperity, and we are pleased to support the ongoing development of nuam exchange in Latin America.”

Nasdaq has also expanded its relationship with Chile’s CSD for capabilities to manage digital securities; with B3 in Brazil to develop a new clearing platform; and with BMV in Mexico to modernize its post-trade technology platform.

Multi-asset class growth

Initially nuam will be launching a combined equity market, which Córdoba has the most to gain in terms of efficiency.

“We feel that we have very valuable corporations in the region that are not sufficiently on the radar of international investors,” he added.

The new stock market is slated to launch in the second quarter of 2025, subject to market participants being ready and a single rulebook being put in place, following the necessary changes in regulation. Connectivity testing is due in the third or fourth of this year, with full market testing following at the beginning of next year. nuam will move to a shorter settlement period of T+1, one day after a trade, for the three markets on the day of launch.

There are more than 400 issuers in the region with a combined market cap of around $350bn according to Córdoba , but they are currently split across three exchanges.

nuam also intends to develop one single index composed of the top 50 to 80 issuers from the three countries to give them visibility and attract more international participants. The index will allow the development of equity derivatives and exchange-traded funds.

“The index can create a virtuous cycle of liquidity between different products such as ETFs and futures,” added Córdoba.

He continued that the region has well developed fixed income markets so nuam will provide an opportunity for corporations to raise funding in any of the three countries’ currencies or the US dollar.

“We feel this market can be two or three times as big as it is today over a five-year horizon,” said Córdoba.

Latin America also has a lot to offer in providing resources for the energy transition and in projects associated with climate compensation according to Córdoba. He explained that nuam can create a green market across the three countries with single processes, validation and taxonomy so that it is easier to access and more visible to the international community.

“We see a tremendous opportunity from Latin America and particularly from Colombia. Peru and Chile, regarding our contribution to climate issues,” Córdoba added. “We want to be an avenue for channelling investment into the energy transition and compensation mechanisms for the globe.”