Bank of America has become an investor in Nasdaq Private Market and BlackRock has agreed to acquire Preqin, a private markets data provider, highlighting the expected growth of alternative assets.

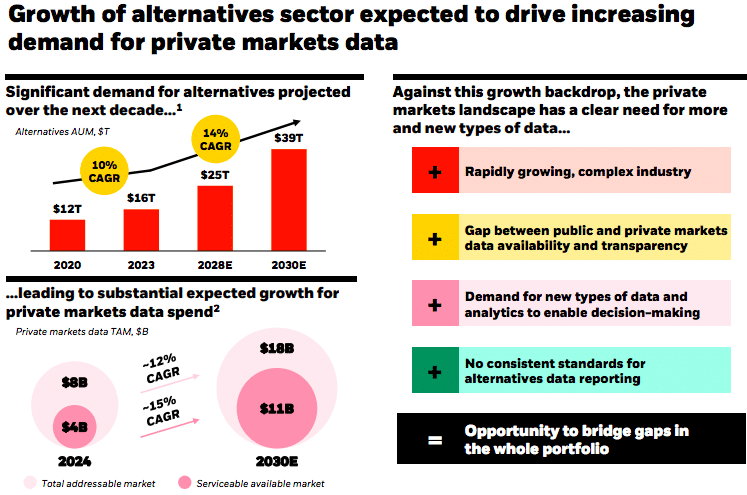

In June this year, BlackRock said in a statement it has agreed to acquire Preqin, for £2.55bn, or approximately $3.2bn in cash. BlackRock said private markets are the fastest growing segment of asset management, with alternative assets expected to reach nearly $40 trillion by the end of the decade.

Tom Callahan, chief executive of Nasdaq Private Market (NPM), also highlighted the “hyper growth” of private markets during the last 15 years. Nasdaq Private Market provides liquidity solutions for private companies, employees and investors through the company’s growth before it goes public.

In the late 2000s there were a small number of unicorns, private companies valued at more than $1bn, according to Callahan. Now, there are approximately 1,000 unicorns just in the US, and about 1,500 globally, with an aggregate value of $3.5 trillion.

Firms are waiting much longer to go public. Callahan said that two decades ago the average company went public after five years, and this has increased to 15 years. In addition, 20 years ago there were around 8,000 publicly traded companies in the US and that number has shrunk to closer to 3,000.

Callahan estimated that the number of private unicorns will double or triple over the next five or 10 years. The asset class could be worth between $7 trillion and $9 trillion, which will have implications for global capital markets and capital raising.

“The private markets have been very much the tail, and the public markets have been very much the dog,” he added. “In a world where the private markets become the dog, access to private investments and liquidity becomes essential because that is where all the wealth will be generated.”

Nasdaq Private Market

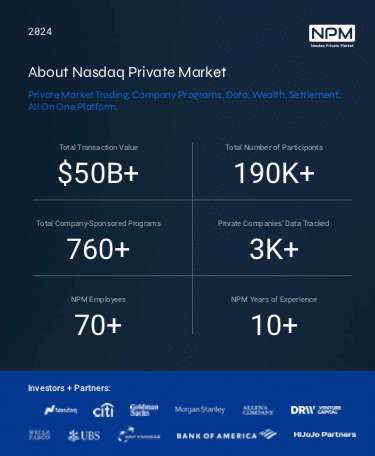

NPM was founded within Nasdaq in 2013. In 2021 NPM was spun out as an independent company with strategic investments from Nasdaq, Allen & Company, Citi, Goldman Sachs, and Morgan Stanley. The company said it has executed more than $50bn in transactional value across 760 company-sponsored liquidity programs and block trades since inception.

In January this year NPM closed its $62.4m Series B financing led by Nasdaq with participation from existing investors. New investors in the Series B included BNP Paribas, DRW Venture Capital, UBS and Wells Fargo. In August this year Bank of America also became an investor in NPM.

Sonali Theisen, head of FICC electronic trading and global markets strategic investments at Bank of America, said in a statement: “With the growth of private markets in recent years, Bank of America has been keenly focused on supporting evolution in this space as an active member of the NPM platform. We look forward to developing further scale and electronic efficiencies in this market segment with our clients and partners.”

Callahan explained that banks have historically found that pulling together as a consortium is the most effective way of trying to change market structure. For example, in private markets it typically takes months to settle a trade.

However, banks want to be able to provide an efficient service to wealthy and ultra high- net worth clients such as entrepreneurs who own private shares, or want to invest in other private companies. Therefore, they need to be able to use a platform where they can transact with integrity, that has real data and provides settlement certainty. “These are all things that are taken for granted in the public markets,” said Callahan.

In August this year Nasdaq Private Market also added its first Japanese and Asian-based financial institution as an investor – HiJoJo Partners. NPM said this will accelerate new product development and its global footprint in Japan and across Asia Pacific.

Spyridon Mentzas, chief executive of HiJoJo Partners, said in a statement: “We also aim to support the creation of a platform for private stock trading, fostering collaboration between Japanese and U.S. startups, multinational companies, shareholders, and investors contributing to the rejuvenation of the Japanese innovation economy and enhancing industrial competitiveness.”

Callahan added that international expansion will be a big part of the use of proceeds from the fundraisings.

“We think our brand and the credibility of our consortium plays incredibly well,” Callahan said. “We have the ability to go into certain markets around the world because private equity is very much a global market.”

In addition, global capital wants to invest in the most innovative companies in the world and Callahan said that presents a “massive” opportunity, as many innovative companies are based in the US.

Company Solutions

NPM’s company solutions segment supports private companies using proprietary technology to facilitate tenders, auctions, and pre-direct listing programs, which Callahan said forms about half of the firm’s business.

Private companies hire NPM to be able to provide partial liquidity to employees, who are having to wait much longer before a potential initial public offering allows them to sell their shares in public markets.

“We have done ten times more tenders for private companies than the rest of the market combined,” said Callahan.

In a report, Private Market Pulse: Mid-Year 2024 Review, NPM said there was a rebound in the secondary market after an 18-months lull. In the first six months of the year, NPM executed 31 structured secondaries for 30 private companies, the largest being a $1.6bn tender offer.

The slowdown in the IPO market since early-2022 has resulted in an increasingly mature population of private companies awaiting their public market debut, added the report. A number of late-stage companies, many within 12 to 18 months of an IPO, looked to NPM to boost their cap tables and allow employees and other shareholders to sell equity prior to a lockup in the public market.

“In tandem with private companies’ employment of secondaries to provide liquidity throughout the first half of 2024, eligible shareholder participation remained at historically elevated levels,” added NPM. “A notable highlight from the first six months of the year was NPM’s penetration of the French market.”

NPM said the platform recorded more trade volume in the first half of the year than all of 2023 with a median discount to the last round of 18%.

SecondMarket ATS

In the second quarter of this year NPM officially launched SecondMarket, a proprietary electronic secondary trading platform which it said will help unlock greater access to private market data, liquidity, and settlement efficiencies.

Callahan said: “We rolled out SecondMarket in recent months and it is starting to scale. Our technology is custom designed for the needs of private markets, which we know about because we’ve been doing it for a decade.”

There are many differences between trading in public and private markets. For example, in public markets trades are bilateral between the seller and the buyer. However, trades in private markets are trilateral because private companies have to approve every share transfer on their cap table, and can decline a transaction.

“This trilateral nature adds complexity, because matching size and price is just 10% of the work involved,” said Callahan.

One of the real pain points in private markets is the long settlement cycle, which can be months. Callahan said NPM’s settlement technology can reduce this time to less than a week and has seen massive growth. However, he noted that in public equity markets it took nearly a decade to move from analog voice-based brokers to the modern age of electronic trading.

“We are seeing encouraging early signs of adoption, because there are so many players in this market that desperately want transparency and efficiency,” he added.

Private market data

Another of the many differences between public and private markets is that regulation enforces mandatory transparency for public companies. However, private companies do not have an obligation to publish financial information.

In the third quarter of this year NPM launched Tape D, its first premium data product.The Tape D pricing suite includes pricing estimates, bid/offer history, reported trade levels and primary round history. Callahan said more capital will be poured into the data and analytics segment as it is expensive to build a world class business.

“Tape D is a cheeky riff on the public markets in the US, where you have tape A, B and C,” added Callahan.

NPM has used artificial intelligence to analyse thousands of certificates of incorporation of private companies, and digitized them so the information is at the fingertips of investors.

Every private company in the US needs to be incorporated in a state and file a certificate of incorporation (COI) that includes information such as shareholder accounts and the cap table.The majority, 90%, of private companies are incorporated in Delaware, but it can take many weeks to receive the document by email in a pdf file, which costs $100, and is cumbersome for investors.

In addition, all US mutual funds that own private shares have to file reports with the Securities and Exchange Commission. NPM downloads these forms so investors can see how mutual funds value their private shares, which is helpful for trading on SecondMarket.

“We present as much publicly-sourced, private market data as we can in this very difficult environment,” said Callahan. “We have a very hard Chinese wall between our tender and settlement businesses.”

The importance of data was shown by BlackRock’s £2.55bn acquisition of Preqin. BlackRock said that unifying Preqin’s data and research tools with Aladdin, the asset manager’s technology platform, will create a preeminent private markets technology and data provider.

Private market data is estimated to be an $8bn total addressable market and grow at 12% per year, reaching $18bn by 2030, according to BlackRock.

Rob Goldstein, chief operating officer of BlackRock, said in a statement: “As clients increasingly evolve their focus from choosing products to constructing portfolios, this shift requires technology, data, and analytics that create a ‘common language’ for investing across both public and private markets. We see data powering the industry across technology, capital formation, investing, and risk management.”

Callahan estimated that the average allocation of private wealth managers to alternatives is 3% and they are trying to increase this to 5% or 6%, which translates into $1 trillion of inflows.

“If the private markets are going to be the dog and the public markets become the tail, then it is hugely important for asset managers to have products in the alternative world,” he added.