Adena Friedman, chair and chief executive of Nasdaq, said the group’s Index business had an”exceptional” year in 2024, which helped the Capital Access division reach record full-year revenues.

Nasdaq reported that total net revenues for 2024 were $4.6bn, an increase of 19% over 2023, or 9% on an adjusted basis. Friedman said on the full-year results call on 29 January that 2024 was a “transformative” year for Nasdaq. Capital Access platforms generated 10% revenue growth in 2024, driven by the performance of the Index segment.

Friedman said: “2024 was also an exceptional year for our Index franchise, which delivered 31% revenue growth, ending the year with record assets under management.”

The Index business had $80bn of net inflows in 2024, including $28bn in the fourth quarter. As a result, the business reached its fifth consecutive record quarter for assets under management of exchange-traded products that track Nasdaq indices at $647bn at the end of 2024, which was almost $200bn higher year-over-year.

In 2024 the Index business also launched a record 116 new products. More than half of the new launches were international, 27 were in the institutional insurance annuity segment and 30 were launched in partnership with new index clients.

Friedman said there are potential growth areas in digital assets, options, products and proprietary index options benchmarked to cryptocurrency indexes.

“We expect additional opportunities to arise as new regulatory frameworks provide clearer guidance, and Nasdaq will continue to strategically assess and pursue them in this dynamic space,” she added.

Market Services

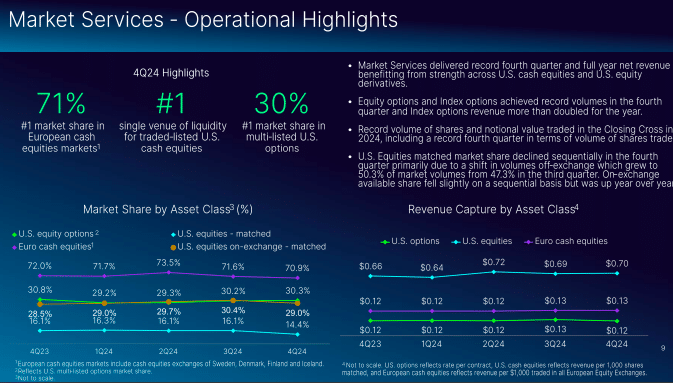

The growth in the Index business helped boost adoption of index options and multi-listed options products, as index options revenue more than doubled year over year. Market Services achieved record fourth quarter and full-year net revenue which Friedman said was driven by higher volumes across US equity derivatives, as well as US and European cash equities.

Friedman said Nasdaq is “very focused” on growing the index options franchise by understanding new ways to build new products, bring more capabilities to clients and grow the ecosystem with both institutional and retail investors. Nasdaq’s proprietary index products are available on retail investing platforms, such as RobinHood. Institutional adoption has increased as products are integrated into different data tools

“As our index business goes more into the institutional audience, such as insurance, this drives demand for options trading and hedging capabilities,” she added. “A virtuous cycle is developing.”

Friedman said Market Services also benefited from momentum in US cash equities, including the Closing Cross setting full year records in both share volume and notional value traded.

In September last year Nasdaq migrated its International Securities Exchange (ISE) to Fusion, its next-generation derivatives platform, which now hosts four out of six of its US options markets and one European equity derivatives market. This year Nasdaq agreed to sell its Nordic power futures business to Euronext, the pan-European capital market infrastructure.

“This transaction will sharpen our focus on our strategic growth areas,” said Friedman. “Moving forward, our European business is an integral part of our strategy as the combination of our US and European footprint is critical to our ability to serve clients globally.”

Financial Technology

The fourth quarter of 2024 marked the one-year anniversary of the completion of acquisitions of Axiom SL and Calypso.

“With the integration of AxiomSL and Calypso largely complete, we’ve made substantial progress as a scalable platform company,” Friedman added.

In November 2023, Nasdaq acquired Adenza from private equity firm Thoma Bravo for $10.5 bn. Adenza consisted of Calypso, which provides capital markets participants with end-to-end treasury, risk, and collateral management workflows, and AxiomSL, which provides regulatory and compliance software.

Friedman said the Financial Technology division emerged as a “vital force” of innovation as more than 3,800 clients see Nasdaq as a partner in helping to solve their most critical challenges across risk, regulation and trade infrastructure,

“The financial system is at a point where transformation is technologically and culturally possible, with greater confidence in the banking and capital markets industry to implement cloud-based solutions,” she added.

The level of comfort among global banks to deploy cloud-based solutions has increased from 57% five years ago to 93% today, according to a recent report from Nasdaq and BCG. In addition, only 22% of banks prefer building in-house solutions for their regulatory and compliance programs.

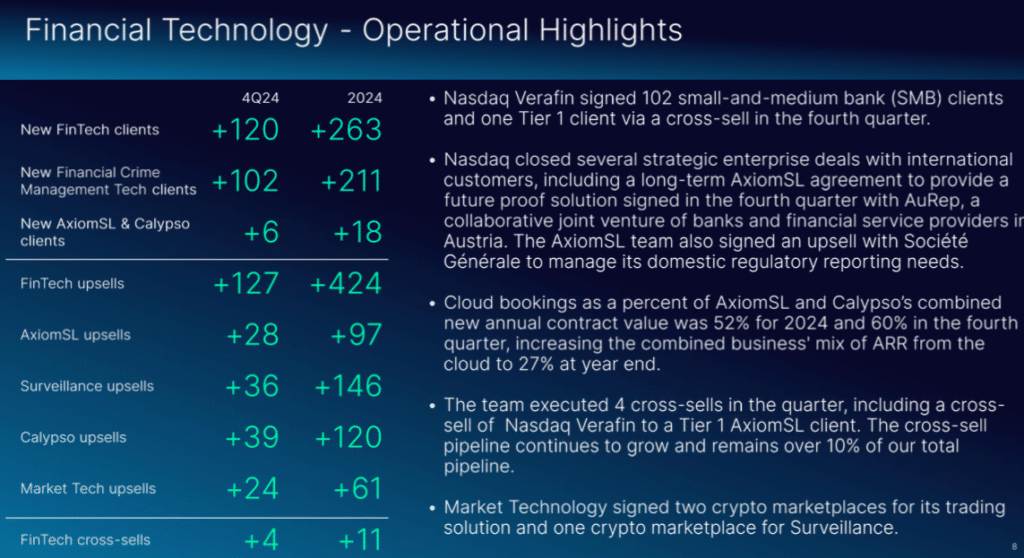

Cloud bookings as a percent of AxiomSL and Calypso’s combined new annual contract value was 52% for 2024 and 60% in the fourth quarter, increasing the combined business’ cloud mix of ARR to 27% at year end. ARR is the current annualized value of subscription contracts.

“The large majority of banks understand that external solutions provide superior capabilities to solve common industry problems, and they are seeking strategic technology partners who provide solutions across multiple disciplines,” said Friedman.

In 2024 Financial Technology signed 263 new clients, achieved 424 upsells and has already completed 11 cross sells in 2025. Friedman said these represent Nasdaq’s continued penetration across global financial institutions and the cross highlight success in Tier 1 and Tier 2 banks.

Financial Technology also continued its international expansion with several strategic enterprise deals. For example, AxiomSL secured an upsell with Société Générale to manage the French bank’s domestic regulatory reporting needs. Capital markets technology expanded in markets including Latin America, and Friedman said notable wins included Brazil, Mexico and Colombia.

The technology business also signed three new crypto clients in the fourth quarter.

“As we look ahead, our digital asset strategy continues to focus on helping the industry mature through infrastructure that enhances market liquidity, transparency and integrity through the integration of the asset class within financial institutions,” said Friedman. “This is evident from the industry’s adoption of our market technology, surveillance and Calypso solutions.”

The Trump administration may loosen regulations for the US banking sector but Friedman highlighted that 69% of the revenues of Calypso and AxiomSL combined comes from non-US banks. She argued that if banks have more capital that they can deploy in global markets, that also drives demand for our Nasdaq technology.

“If banks are in growth mode, they will be going into new asset classes and geographies, and that drives demand for our solutions,” she said. “We have a lot of opportunities for growth across the franchise in different regulatory environments.”

Artificial intelligence

Nasdaq is incorporating new AI-powered solutions and product offerings across each of its departments. Friedman said Nasdaq shifted in 2024 from exploration and experimentation with AI to driving impact.

“Entering 2025 our team is engaged in scaling our use of AI to deliver efficiencies and productivity enhancements across the organization, which is also reflected in the expanded efficiency program,” Friedman added.

Friedman was asked about the impact of DeepSeek, a Chinese open source AI platform, that was recently released and led to a $1 trillion fall in the share prices of US technology companies.

She replied that Nasdaq uses multiple cloud providers so that the firm can use both proprietary and open source models. When Nasdaq thinks about a new capability or product, it will test different models to see which one provides the best solutions, and then which has the most efficient cost structure.

“The cost of generative AI has already come down a lot and has been quite dramatic,” she added. “We are really embedding gen AI capabilities into our product roadmaps.”

For example, Nasdaq’s Verafin business has deployed a gen AI co- pilot the anti-financial crime business, and Friedman said that will be implemented in the surveillance business.