Nasdaq Clearing is expanding the currencies in which it clears interest rate swaps as upcoming changes in European Union regulation may shift some volumes from LCH, the London Stock Exchange Group’s clearinghouse.

The European Commission has proposed an active account requirement under EMIR 3.0, the revised central clearing regulation. The proposal would require market participants to have active accounts in EU central counterparties if they clear certain systemic derivatives contracts through those CCPs.

Nasdaq Clearing has existing clearing of interest rate swaps in Swedish krona, and said in a statement that it is expanding into euros, Danish krone and Norwegian kroner.

Patrik Löhr, chief executive of Nasdaq Clearing, told Markets Media that the upcoming changes in Emir will currently impact active accounts in Euros and Polish zloty but could change other currencies in a later stage.

“LCH is the powerhouse in clearing IRS,” he added. “We have always competed with them in Swedish krona but some clearing will move and we want to ensure we are a competitive alternative over time.”

If regulation moves some volume out of LCH, Nasdaq Clearing wants to ensure it can offer clearing to bond issuers and clients in its home market of northern Europe and the Nordics.

“We do not we have not have plans to extend to other currencies,” said Löhr.

In 2023 the market share in clearing euro IRS based on Euribor was 95.4% at LCH, and 4.6% at Deutsche Börse’s Eurex according to a blog from Clarus Financial, the derivatives analytics provider. Clarus said: “The gain in share at Eurex in 2020 and 2021 has reversed in 2022 and 2023.”

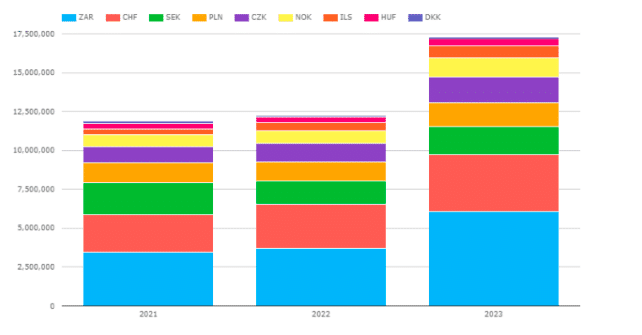

LCH SwapClear had 99% of the overall Europe, Middle East and Africa (EMEA) 2023 volume. Czech koruna, Hungarian forint and Polish Zloty were the only three currencies where LCH had less than 99% share of clearing IRS in 2023, according to Clarus Financial.

“In Swedish Krona we do not currently have any Nasdaq OMX SEK volume after May 2023 or open interest after June 2023,” added Clarus. “For prior months in 2023, Nasdaq volume was 1.2% and LCH 98.8%, which is a change from 2022 when Nasdaq had 3.9% share.”

Löhr said Nasdaq expects to start clearing the new currencies early this year. The technology is ready but the CCP needs to make sure that it has all the necessary signed agreements in place.

Equities

In addition to interest rate swaps, Nasdaq is also expanding clearing in equities.

In October 2023 Nasdaq said in a statement that it was launching a new product, Custom Basket Forwards. The contracts initially cover the European market and allow clients to design their own baskets by creating their own themes.

Custom Basket Forwards enable investors to create a forward contract on a customized equity basket that is defined by return type and currency. Following the definition of the basket, a cash settled forward contract is issued in Nasdaq’s trading and clearing systems with Nasdaq Clearing acting as counterparty in the transactions.

Nikos Georgelis, portfolio manager at Atlant Fonder, said in a statement: “I am really thrilled about the introduction of a very strong alternative to over-the-counter derivatives such as equity swap through the launch of Nasdaq Custom Basket Forwards, we are now offered a great instrument that provides us with a simple, flexible, and cost-efficient way to gain tailored exposures via a standardized derivative contract that is centrally cleared and traded on a regulated market.”

Alessandro Romani, head of European derivatives at Nasdaq, said in a statement at the time that bilateral risk, bilateral dependency in liquidity provision, and costs associated with regulation have all been contributing factors to the vast market demand for a simpler and more cost-efficient way to manage tailored equity exposures.

Löhr added: “By the end of this year we would like to see volumes and in the new IRS currencies and baskets.”

Regulation

In September 2023 a number of trade associations including Finance Denmark, Nordic Securities Association, FIA and ISDA issued a statement recommending that the active account requirement under EMIR 3.0 is removed,

“Among other things the trade associations assert that the AAR would negatively impact EU capital markets by introducing fragmentation and loss of netting benefits and make the EU less resilient to market stresses with no benefit to EU financial stability,” said the statement.

Since leaving the European Union, the UK has been developing its own financial regulations. In December last year ISDA and UK Finance submitted a joint response on the reform of the UK European Market Infrastructure Regulation (EMIR).

“The associations recommend a small number of clearly defined changes, seek certainty and permanence on current temporary exemptions and request an end to the current dependency on equivalence decisions for certain provisions (for instance, the intragroup exemption),” said the response.