Nasdaq, the US exchange group, is aiming for more than 30% of its European data business to come from outside its traditional market data offerings.

James McKeone, head of European data for Nasdaq’s global information services, told Markets Media: “We are building a European data business and our ultimate aim is for upward of 30% of our business to come from outside our traditional exchange market data offerings.”

The move fits in with the strategy that Adena Friedman, president and chief executive of Nasdaq, has articulated for the exchange group. She described Nasdaq as “a technology company that serves the capital markets” with offerings such as market monitoring tools, data and analytics in a webinar with consultancy Greenwich Associates last week.

In June Bjørn Sibbern also took on the new role of president, European markets, to lead markets across the Nordic and Baltic region. He is also responsible for managing trading, clearing, settlement, and data businesses in Sweden, Denmark, Finland, Iceland, and the three Baltic countries. Nasdaq operates 19 offices in 15 countries across Europe.

Friedman said in a statement at the time: “Our European markets are strategically and financially important to our global business. Bjørn will bring his extensive markets experience and strong leadership capabilities to deepen our relationships with clients and regulators and create new opportunities to expand our business.”

Sibbern was previously head of Nasdaq’s global information services business, and led the the acquisitions of investment analytics provider eVestment in 2017, and Quandl, the Canadian alternative data provider, last year.

ESG data

One area of focus for the European business is environmental, social and governance data.

McKeone said: “Our approach to ESG data is unique because we have a team of people who guide companies on reporting, such as how they should report carbon dioxide emissions, and they also validate the data.”

As a result , Nasdaq has a gold source of ESG data which attracts investors and especially pension funds.

“There are 250 companies reporting ESG data since we started with them a year and a half ago,” added McKeone. “The aim is to cover all our listed companies, private companies, and then to expand to the rest of Europe and potentially the US.”

The exchange has also launched Nasdaq ESG Footprint in partnership with Matter, a Danish fintech.

Nasdaq ESG Footprint provides investors & managers with access to the real-life effects of each investment, along with alternatives based upon their sustainability goals. Explore the interface here: https://t.co/tWCSPOjshV #ESG pic.twitter.com/pqtD0E316p

— Nasdaq (@Nasdaq) September 24, 2019

The product is aimed at retail banks and analyses their customers’ portfolios against ESG metrics and the United Nations’ Sustainable Development Goals. It will suggest stocks of similar companies that better meet the investors ESG profile. For example, if the portfolio had weapons manufacturers it suggests companies that are a close match but not in that business line.

“Nasdaq ESG Footprint will first be offered to banks in the Nordics and then expanded in Europe,” said McKeone. “By the end of next year we hope that five or six retail platforms will be using the service.”

The exchange also aims to grow green bond data for investors in Europe and the US, and further expand the alternative data offering to support increased transparency in new markets.

Outside ESG, Nasdaq also launched a partnership in July with the LBMA, the trade association for the wholesale over-the-counter market for gold and silver bullion, to increase transparency in the OTC precious metals market.

“We adapted technology that we acquired through Cinnober to allow for commodities reporting so that members can send us their trade information,” added McKeone. “We aggregate and anonymize this data and create a data product.”

The LBMA-i service was expanded to include daily market information on platinum and palladium, from gold and silver. LBMA-i is an online offering that collates anonymous and aggregated trade volumes reporting data from LBMA members and began as a joint effort between LBMA and Simplitium, a subsidiary of software provider Cinnober, which Nasdaq acquired this year.

Ruth Crowell, chief executive of LBMA, said in a statement: “Our collaboration with Nasdaq ensures that all stakeholders and interested parties have access to high-quality data on precious metals on a daily basis.”

Information services

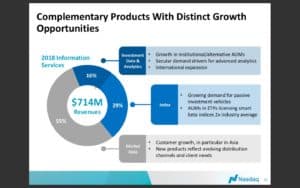

Nasdaq said in an investor presentation last month that the Information Services division earned $714m ($656m) in revenues last year, 38% of group operating income. The presentation continued that key capabilities include being a gold source for data; marquee index brands and analytics that deliver actionable insights.

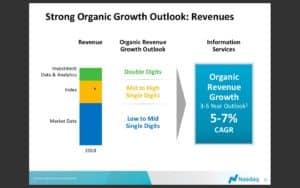

Nasdaq said Information Services revenues from non-exchange source were nearing 50% and the exchange expects organic revenue growth to continue.

In her webcast Friedman answered criticism of exchanges’ market data fees and said sometimes-cited figures of 14% annualized revenue growth are inaccurate. She said: “We try to make data affordable and high value.”

Nasdaq conducted a 10-year review of its equities product and said compound annual growth rate in data revenue was about 6%, with price increases contributing 2.4%. In addition, the Nasdaq Basic data offering is designed as a viable low-cost alternative to more expensive products.